Post U.S. Election Market Forecasts for Apple, Gold, Silver, Oil and Stocks

Stock-Markets / Financial Markets 2012 Nov 07, 2012 - 09:02 AM GMTBy: Chris_Vermeulen

Over the past two months shares of gold (NYSE:GLD) and Apple (NASD:AAPL) have had a sizable bite taken out of their share price. Active traders along with the longer term investors have had a wild ride this fall watching these investments slide to multi month lows. The big question is when will gold and apple shares bounce?

Over the past two months shares of gold (NYSE:GLD) and Apple (NASD:AAPL) have had a sizable bite taken out of their share price. Active traders along with the longer term investors have had a wild ride this fall watching these investments slide to multi month lows. The big question is when will gold and apple shares bounce?

Here we are again with another election behind us and Barack Obama in the White House again. Many think this means four years of the same thing… Printing, Inflation and higher stock prices.

Is this good or bad for Americans or the world for that matter? I doubt it, but who really knows and who cares because there is nothing anyone can do about it now. So buckle up your seat belt and focus on trading and investing with major trend both within the United States and abroad using exchange traded funds.

Currently the broad stock market and commodities are in a full blown bull market so the focus should be to buy the dips until proven wrong. Below are some charts showing the important breakout levels for Apple, metals, oil and key indexes like the Russell 2000.

Be aware that during pullbacks which last more than a month which is the market has done, some of the biggest drops in price happen just before prices bottom… Scaling into positions is the key to minimal draw downs.

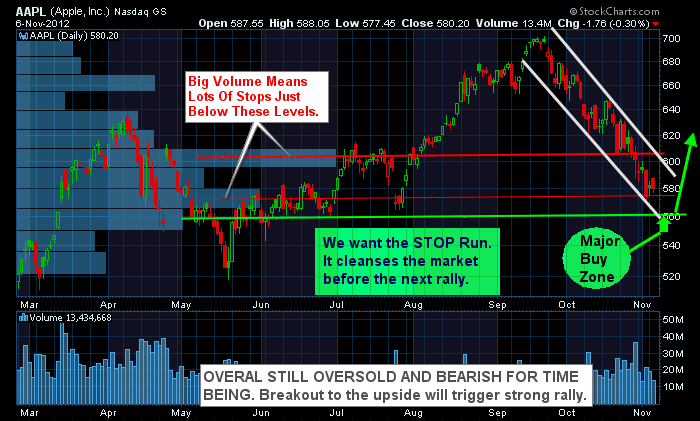

Apple Inc. – AAPL Stock Chart:

Shares of Apple clearly show the down channel which must be broken before investors start buying again. This stock seems to have big potential for $650 to be reached quickly. If Apple shares rise so will the overall stock market… Follow my live charts free here: http://stockcharts.com/public/1992897

Gold Spot – GLD Exchange Traded Fund:

During August and September investors flooded the gold market in anticipation of QE3. Since then gold has been drifting lower with profit taking and because of some slowly strengthening economic numbers in the USA. Gold looks ready for a run to the $1800 but may stabilize here for a few weeks first.

Silver Spot – SLV Exchange Traded Fund:

The price of silver moves similar to that of its big yellow sister (Gold). While the charts look the same silver is highly volatile and can super charge your portfolio when metals rally.

Crude Oil Spot – USO Fund:

Crude oil has been correcting for a couple months also and still has a lot of work to do before a new uptrend to be triggered. Currently oil is trading in the middle of is trading range but once the price breaks above $93 per barrel a good investment fund would be USO.

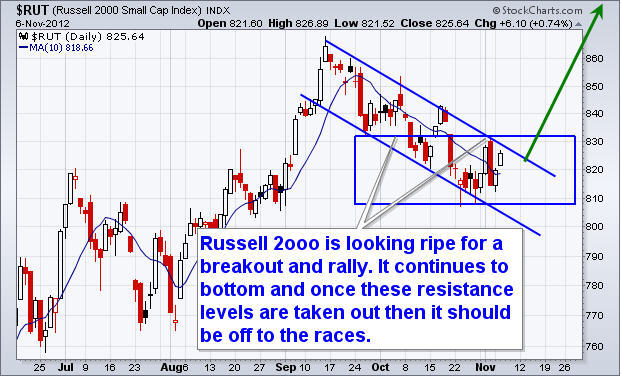

Russell 2000 Small Cap Index – IWM

Small cap stocks typically lead the broad market in both directions. They are the first to rally and the first to rollover and sell off. The major indexes like the DOW, SP500 and NYSE have not formed clean chart patterns which is why my focus is on the Russell 2000. Small cap stocks are now showing a rising relative strength compared to the SP500 large cap stocks and this is very bullish for stocks in general. The best way to trade this index is through the exchange traded funds IWM and TNA.

Post-Election Trading Breakout Summary:

In short, history shows that equities tend to rally after an election. For a detailed outlook of how to trade stocks and indexes during the election cycles be sure to read my report “The Election Cycle – What to Expect in Stocks & Bond Prices”

Get my Daily Trading Analysis & Trade Setups at: www.TheGoldAndOilGuy.com

By Chris Vermeulen

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.