Gold And Silver - Financial World: House Of Cards Built On Sand

Commodities / Global Debt Crisis 2014 Oct 18, 2014 - 06:02 PM GMTBy: Michael_Noonan

Take heart PM community, your turn is coming. What is happening in the stock market is a harbinger of what is sure to come for gold and silver, at some point in the future. When? Ah, that elusive question the answer to which so many want to know, the same answer to which so many so-called prognosticators have serially gotten wrong over the past few years. The best answer is patience.

Take heart PM community, your turn is coming. What is happening in the stock market is a harbinger of what is sure to come for gold and silver, at some point in the future. When? Ah, that elusive question the answer to which so many want to know, the same answer to which so many so-called prognosticators have serially gotten wrong over the past few years. The best answer is patience.

It is highly unlikely that a single bank, at least in the Western fiat central banking system, is solvent. All, repeat, all banks are insolvent, propped up by the Rothschild system that few can successfully challenge. All banks exist by accounting deceit and every kind of threat, indirect or otherwise, that it is not wise to challenge the international banking cartel [on the verge of collapse]. Russia and China are rising to the occasion rather timely.

What is the result of "printing" trillions upon trillions of fiat currency? While it has not yet played itself out, due to market distortions by "The Powers That Be," history shows that all fiat paper currency systems fail. Is it any different this time around. No! The only thing "different" would be the mechanics of how the Western system will fail. A combination of computers and the internet have given the elites a decided upper hand that has enabled the "disenabling" system they run an extended life, if you will, in their ability to perpetuate fiat deceit.

As an aside, most people are totally unaware of the extent to which the elites have been able to dominate every facet of human life on this planet. Control is not a strong enough word to describe the extent and depth of the evil they wrought in their utterly corrupt ambitions to rule as a one-government New World Order.

We believe we have a degree of insight on some of the ways in which events have been played out on the world's stage, the coup d'etat against the United States by the Rothschild moneychangers, the final nail in the proverbial coffin being the takeover of the United States currency with the passage of the Federal Reserve Act in 1913, and the simultaneous abdication of Congress in its Constitutional duty to Article 1, Section 8: "To coin money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures;

"To provide for the Punishment of counterfeiting of the Securities and current Coin of the United States;" [There has never been any indictment or punishment of anyone from the Federal Reserve Banking System for the counterfeiting Ponzi scheme run by that private banking cartel over the past 101 years. There has, however, been many examples of punishment for those who have opposed the Rothschild central banking system, the assassinations of Presidents Lincoln, Garfield, and Kennedy as the most prominent.]

There have been hundreds of thousands of deaths of lesser known people as a result of opposing the elite's system, almost all of which cannot be directly linked to those in control. Remember the more than a dozen bankers who "suicided" themselves in the past few years, one by several "self-inflicted shots from a nail gun." It is possible that the number of deaths over time may be in the millions. We will never know.

There is so much more that would be shocking to anyone's senses to hear and learn of the degree to which psychological, economical, educational, medical, and biological warfare has been directed against The People, or those not a part of the diabolically corrupt system controlling and running everything, by the moneychangers.

Back to that to which some people can relate. There is one reason and one reason only why the stock market has been going up in "paper value," an oxymoron in itself, and it has been a direct result of pouring in trillions of freshly printed fiat currency from the banking system into the stock market. We gave up on participating in that Ponzi scheme a few years ago, not willing to abet the corruption and greed of the Wall Street scammers, the largest firms that control the markets, and the federal government.

This has been a result of cheap available "money," [available only to bankers to support the corrupt and totally insolvent banking system], [mis]used to perpetuate the myth that unbridled money printing can sustain the economy, when as any reasonably literate person has to know that an infinite supply of money can only destroy the system.

If anything has been learned from the 2008 real estate and stock market bubbles, too many have either forgotten or disregarded recent history. Last week's decline and speed in the stock market is the first shot across the bow that this fantasy called a stock market rally is beginning to end. It often takes several months for a market to top, and one need only look back at the 2008 stock market to see how a top unfolds. The details or the mechanics of the market top may differ, but the net results, a precipitous decline, will not.

The point for buyers and holders of gold and silver is to see how blatant, unless you watch and believe in the elite's mainstream media cartel, the stock market has been manipulated, a word familiar to the PMs markets. The beginning of the end is about to unfold right before your eyes. It is impossible for the central banks to keep printing money to feed a broken system. Almost all markets have been distorted by the Rothschild central planners, and the extent to which distortions have been disrupting the natural order of events, it will result in an equal and opposite effect will eventually ensue.

We discussed this in July 2013. [See article about Newton's Third Law, {7th par.}] We stated even then that we did not know when the market decline would end but was more optimistic that the end would be sooner than the now later time frame. It may be changing to the sooner-now-rather-than-later situation, but no one knows, and our point continues to be that knowing does not matter...preparation does.

The damage being done to the world economy has no precedent. The extent to which the world is being manipulated has no precedent. The degree of endless "wars" engaged in and provoked by the United States in has no precedent. The amount of worthless "currency" being used by the moneychangers to fleece the world of its wealth does have a precedent in the Rothschild formula, but the degree to which it has been utilized has no precedent.

One day, and it is a certainty, the value of gold and silver will double, triple, or some unknown multiple of current suppressed values, and those who have been bemoaning the current prices will be equally rewarded as those who have kept the faith and knew that it was just a matter of time.

In the world of fundamentals, timing is never an absolute or a factor. In the world of charts that track developing market activity, which is actually a more accurate way of reading all of the known and yet to be known fundamental considerations, timing is everything. So far, the moneychanger manipulators still have the upper [dirty] hand.

The gold/silver ratio has recently risen above 71:1, after staying in the 68:1 area for a while. It should be more closely watched for those considering a switch from gold into silver, or some portion of their gold holdings into silver. For our reasoning on why, see Magic Of Gold/Silver Ratio article from July. Yes, there is a "give-up" cost in the number of ounces exchanged in the process, but do the numbers to determine if it is worthwhile.

If the ratio were at 73:1, for example, maybe you will get a 68:1 exchange from a dealer. 10 oz of gold = 680 oz of silver. At some point the ratio goes under 40:1, and you get an exchange at 45:1. Your 680 oz of silver is exchanged into 15 oz of gold, or 50% more in gold had you opted not to do an exchange because there was a "cost" involved. Who knows, the ratio could get back to the 20:1 area, and an exchange at 25:1 from a dealer would yield almost 28 oz of gold, almost tripling the 10 oz when started. One thing about the future, Anything Can Happen! A pre-set mind can be limiting.

Consider the above when considering the below. Just a thought.

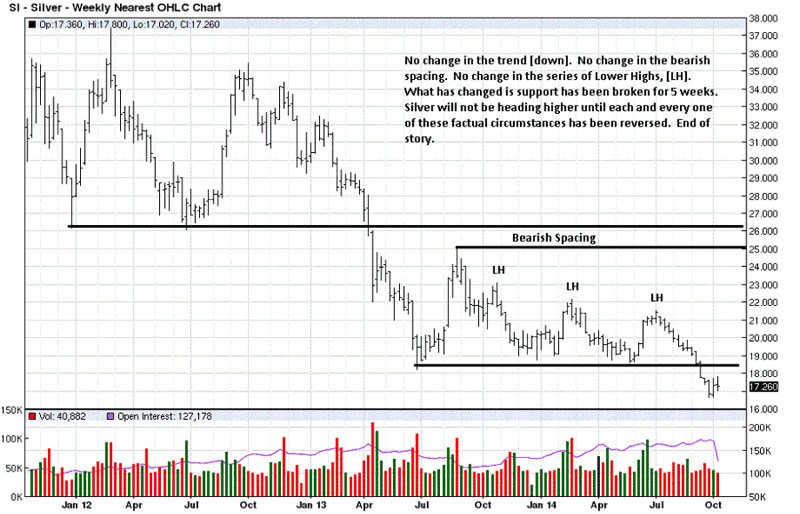

Silver Weekly Chart

What can be said about the decline under broken support is that there is no acceleration to it. When price broke the important 26 support level, it immediately [almost] went to 18+. Breaking 18.50, the decline, so far, has "only" been to 17, where it has been consolidating, as opposed to being driven lower. Price may continue lower, or not, but at a much lower pace, and that is a positive.

Regardless of the final level of decline for silver, keep in mind the bigger picture of reality as it temporarily remains distorted by fiat fiction, but a fiction that has lasted longer in it temporary phase than most have expected. It is what it is, and that is what we must all deal with, for now.

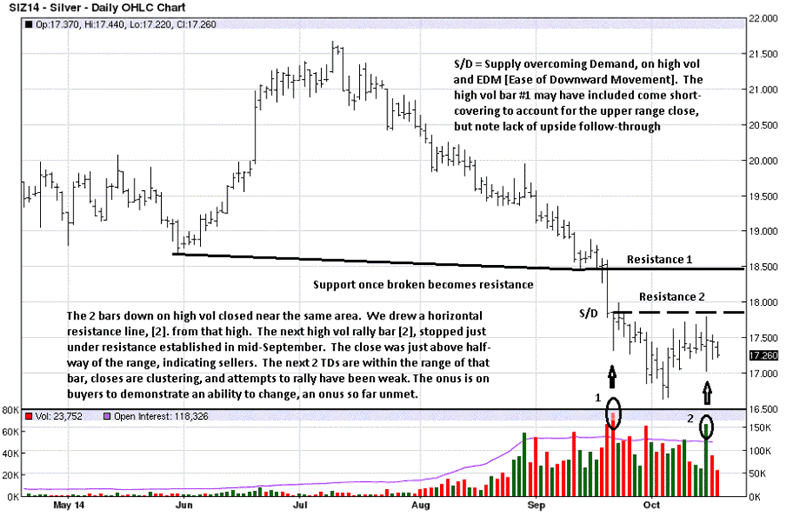

Silver Daily Chart

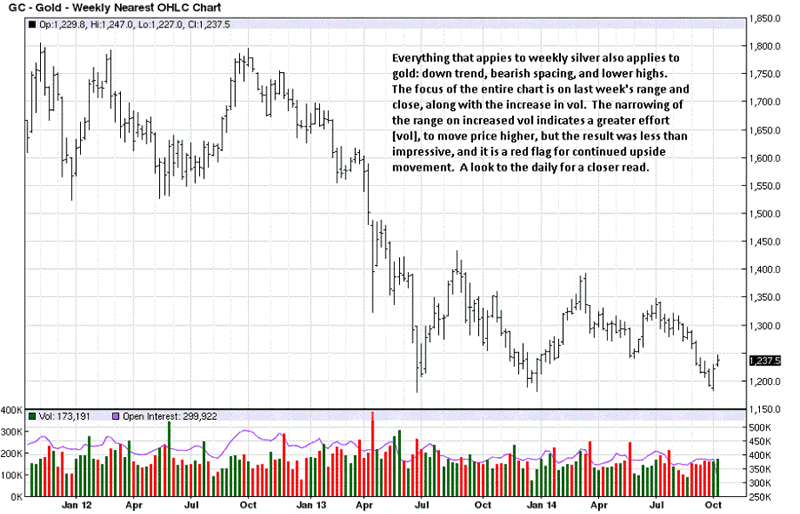

Weekly gold, second verse same as the first.

Gold Weekly Chart

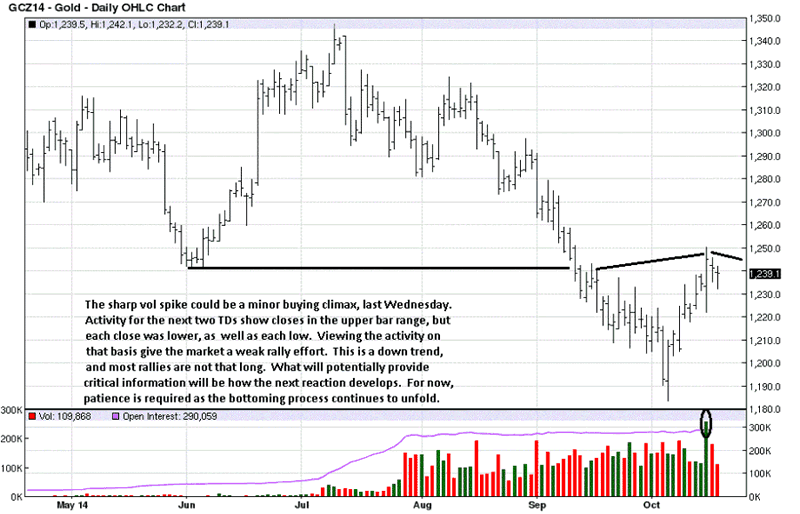

1240 was an area of resistance, for us. Price rallied to 1250. Does this mean the beginning of a change in pattern behavior? Possibly, but it does not matter because there is not enough information to declare a change in trend is under way. Will the rally extend higher into next week? Possibly, but the probability is low. What will be of keener interest is how the next reaction lower develops. If the ranges narrow and volume declines, it will indicate a lessening of selling pressure. If ranges widen and volume increases, there is no promise that support will hold, as it failed in silver.

We have no clue how the next reaction will develop, and we do not need to know ahead of time. All we need do is be prepared for the information the market provides and then be in a position to respond and not have to guess.

Patience is not a common trait for futures traders. [It is for holders of the physical]. The best on can do for now is to be patient, grasshopper.

Gold Daily Chart

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.