Analysis Topic: Commodity Markets - Metals, Softs & Oils

The analysis published under this topic are as follows.Thursday, February 07, 2019

The Battle for Venezuela’s Gold Serves as a Lesson in Counterparty Risk / Commodities / Gold & Silver 2019

By: MoneyMetals

He who controls the gold makes the rules. That old adage applies aptly to the present crisis in Venezuela.

He who controls the gold makes the rules. That old adage applies aptly to the present crisis in Venezuela.

An international battle for control of Venezuela’s gold is currently underway. At stake is the country’s political future – and with it, the global market for its immense oil reserves.

In a desperate effort to cling to power, Venezuelan strongman Nicolas Maduro has been depleting his country’s gold reserves.

The oil-rich nation once had gold reserves of over 160 tons. But in recent months, Venezuela has sold off dozens of tons of gold to allies such as Turkey, United Arab Emirates, and Russia in exchange for euros and other globally recognized currencies.

Read full article... Read full article...

Thursday, February 07, 2019

What Alchemists Think about the Impact of Changes in Automotive Industry on Precious Metals? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

The new Alchemist is out. What can we learn from the latest publication of the LBMA? We invite you to read our today’s article and find out!

Oesterreichische Nationalbank (OenB) and Gold

In the previous edition of the Gold News Monitor, we have already analyzed one article from the newest Alchemist about the gold outlook for 2019. Today, we would like to return to the publication and examine the remaining ones, which are no less interesting.

Read full article... Read full article...

Thursday, February 07, 2019

Gold Price Breaks Lower – What Next? / Commodities / Gold & Silver 2019

By: Chris_Vermeulen

The Technical Traders Ltd. research team has been on top of nearly every move in the metals markets over the past 12+ months. On February 1, we posted this article: Get Ready For The Next Big Upside Leg In Metals/Miners. In this post, we suggested that the recent peak in Gold, near $1330, would likely end and prompt a downside price rotation over the next 45+ days.

The Technical Traders Ltd. research team has been on top of nearly every move in the metals markets over the past 12+ months. On February 1, we posted this article: Get Ready For The Next Big Upside Leg In Metals/Miners. In this post, we suggested that the recent peak in Gold, near $1330, would likely end and prompt a downside price rotation over the next 45+ days.

Subsequently, on January 28, we posted this article: 45 Days Until A Multi-Year Breakout For Precious Metals. In that post, we highlighted our predictive modeling systems support of a sideways price correction in the precious metals markets that would align with US stock market strength and US Dollar strength.

Read full article... Read full article...

Wednesday, February 06, 2019

The New Cold War and Gold / Commodities / Gold & Silver 2019

By: Richard_Mills

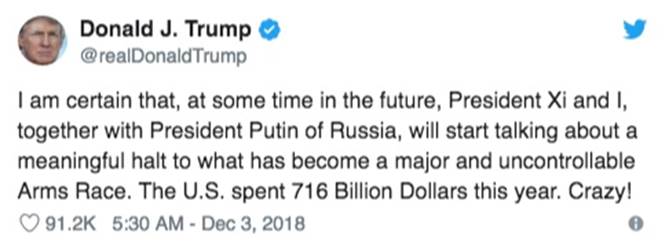

In December President Trump pounded out a tweet that raised a lot of eyebrows in the Twitterverse. It had to do with America’s defense spending, perceived by Trump to be much too high. He wrote:

Didn’t Trump campaign on a stronger military, to crack down on ISIS? To make America safer again? He did, and so the head-scratching began. It was especially odd considering that Trump signed off on a HUGE increase in defense spending in August. The 2019 National Defense Spending Authorization Act has a budget of $717 billion that will raise America’s troop levels to the highest in a decade. The NDSAA allocated $616.9 billion for the Pentagon, $69 billion for overseas operations and $21.9 billion for nuclear weapons programs.

Read full article... Read full article...

Wednesday, February 06, 2019

Crude Oil – The Ground Is Starting to Shake / Commodities / Crude Oil

By: Nadia_Simmons

Yesterday we witnessed a good attempt to move to the downside. The sellers were partially rebutted. How did the big picture stand the test of yesterday and what are we to do about it?

Read full article... Read full article...

Tuesday, February 05, 2019

LBMA’s Forecasters Are Modestly Bullish on Gold. And You? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

The LBMA published its annual forecast survey for precious metals prices in 2019. Gold prices range from $1,150 to $1,475. Who is right?

Gold Prices Will Modestly Increase

As one year ago, the views of 30 precious market analysts in this year’s forecasts are strongly divergent. The average price of gold is projected to be $1,311.71 , so it is expected to be around the current level (when we write this Gold News Monitor, the price of gold amounts to $1,320.70). It implies a modest increase of 1.8 percent compared to the average price in the first half of January 2019 (when the forecasts have been done), and higher jump of 3.4 percent from the average price in 2018. However, the projected trading range for gold is between $1,150 and $1,475, or $325. So, prepare yourself for a really interesting year for the gold market!

Read full article... Read full article...

Tuesday, February 05, 2019

This Will Confirm The Gold Bull Market / Commodities / Gold & Silver 2019

By: Hubert_Moolman

Gold is moving closer to confirming a multi-year bull market per my long-term comparison. A decisive mover higher than the $1375 area would be confirmation of the bull.

Below, is the updated long-term comparison:

Read full article... Read full article...

Monday, February 04, 2019

Two Winning Gold Trade Setups – GDXJ and ROKU / Commodities / Gold & Silver 2019

By: Chris_Vermeulen

We are not always correct in our calls about the market. Professional researchers and analysts must understand that attempting to accurately predict the future outcome of any commodity, stock, index or ETF is impossible to be 100% accurate. Yet, we are pleased that our proprietary price modeling and analysis tools continue to provide us with very clear triggers and alert us to price moves before they happen.

Today, we are sharing two recent trades we executed with our members that resulted in some decent profits. The first example is our GDXJ trade. We had been in a Long position since before the beginning of 2019 expecting Gold and Miners to rally. Our price modeling systems suggested that after price reached $1300, we may experience a brief price pause over the next 45 days or so. Thus, we pulled the profits in this trade recently to lock in 10.5% profit and to allow us to re-enter when our modeling systems suggest the price pullback has ended.

Read full article... Read full article...

Monday, February 04, 2019

Time for a Breakout in Gold? / Commodities / Gold & Silver 2019

By: Jordan_Roy_Byrne

First we need to define what a breakout actually is. Its when the price breaks a pattern or a range and a new trend is therefore established.

First we need to define what a breakout actually is. Its when the price breaks a pattern or a range and a new trend is therefore established.

Today, people are all too quick to refer to almost every move higher as a breakout. Just google “Gold Breakout” and you’ll see what I mean.

Sure, closing above $1300 was a breakout for Gold. But that’s hardly significant. If and when Gold surpasses the wall (resistance at $1350-$1375), it will mark a real breakout.

The good news is Gold is currently in a much better position both fundamentally and technically than it was in 2016, 2017 and 2018.

Read full article... Read full article...

Sunday, February 03, 2019

Some Optimistic Precious Metals Charts / Commodities / Gold & Silver 2019

By: Rambus_Chartology

Below is a weekly chart for the GDX we’ve been following for a long time watching the two and a half year falling wedge completing about 8 weeks ago when we finally got the breakout. The backtest to the top rail took about seven weeks to complete with this weeks price action possibly beginning the impulse move higher. To be honest I still can’t rule out another backtest to the top rail and the 30 week ema, but at this point it appears the breaking out and backtesting process looks to be complete.

Below is a weekly chart for the GDX we’ve been following for a long time watching the two and a half year falling wedge completing about 8 weeks ago when we finally got the breakout. The backtest to the top rail took about seven weeks to complete with this weeks price action possibly beginning the impulse move higher. To be honest I still can’t rule out another backtest to the top rail and the 30 week ema, but at this point it appears the breaking out and backtesting process looks to be complete.

Friday, February 01, 2019

Crude Oil – How Many Minutes to Midnight Before We Act? / Commodities / Crude Oil

By: Nadia_Simmons

Yesterday, some might have wondered where is the limit to the upswing in oil. It would be natural to expect it to catch up to e.g. gold and silver upswings. Would be, could be. We just saw something that made us act. Diligently, with foresight and confidence – when the odds are with us. It’s time to share it with you.

Read full article... Read full article...

Friday, February 01, 2019

Get Ready For The Next Big Upside Leg In Precious Metals and Miners / Commodities / Gold & Silver 2019

By: Chris_Vermeulen

We recently closed our GDXJ trade for a 10.5% total profit with our members. We are preparing for a lower price rotation over the next 45+ days that will allow us to plan for new long. Our research indicates the metals/miners should enter a downside price rotation over the next 45+ days as the US stock markets continue to rally. Give this expectation, it is important to understand how we are timing this move for our members and attempting to take advantage of strategic trade deployment.

We recently closed our GDXJ trade for a 10.5% total profit with our members. We are preparing for a lower price rotation over the next 45+ days that will allow us to plan for new long. Our research indicates the metals/miners should enter a downside price rotation over the next 45+ days as the US stock markets continue to rally. Give this expectation, it is important to understand how we are timing this move for our members and attempting to take advantage of strategic trade deployment.

With Gold recently breaking above $1300, many analysts have been calling for a continued breakout move to the upside as well as a massive market correction in the US stock market. We’ve been calling for just the opposite to happen – a pause in the metals/miners near this $1300~1320 level.

Read full article... Read full article...

Friday, February 01, 2019

40 Years of Chinese Economic Reforms and Gold / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

The economic development of China is one of the most important events in the history of the world. In an unprecedentedly short time, millions of people have been taken out from poverty. But, as no country has ever developed so fast, that great story raises important worries.

The economic development of China is one of the most important events in the history of the world. In an unprecedentedly short time, millions of people have been taken out from poverty. But, as no country has ever developed so fast, that great story raises important worries.

We invite you to read our today’s article about the great progress China made in the last forty years and find out whether it’s too good to be true and it must end with some catastrophe, triggering rally in the gold prices.

One of the biggest risks for the global economy which can materialize this year is the slowdown of China’s economic growth. So, it is wise to analyze the current state of the Chinese economy – its implications for the gold market and what will happen next. As December 2018 marked the forty years of market reforms in China, we will adopt a long-term perspective, explaining how China transformed itself from a poor, backward and isolated country to the world’s economic power. We will examine what the global economy and the precious metals market can expect in China’s fifth decade of reform and development.

Read full article... Read full article...

Thursday, January 31, 2019

Peak Gold and the Coming Supply Crunch / Commodities / Gold & Silver 2019

By: MoneyMetals

During the lackluster and otherwise unremarkable trading of 2018, a hugely important development took place in the precious metals markets. Gold production, in the estimation of some top industry insiders, peaked.

During the lackluster and otherwise unremarkable trading of 2018, a hugely important development took place in the precious metals markets. Gold production, in the estimation of some top industry insiders, peaked.

Peak gold represents the point at which the total number of ounces being pulled out of the ground by miners reaches a maximum.

It doesn’t necessarily mean gold production will suffer a precipitous fall. But it does mean the mining industry lacks the capacity to ramp up production in order to meet rising global demand and even higher prices would not make it happen.

Thursday, January 31, 2019

Counter Cyclical Market Winds Blow, Gold Miners Front and Center / Commodities / Gold & Silver 2019

By: Gary_Tanashian

As the stock market cracked on October 10th we noted…

As the stock market cracked on October 10th we noted…

Looks Who’s Holding Firm Amid the Carnage; the Gold Miners

And sure enough the GDX bottoming pattern noted in that post (and before that in an NFTRH subscriber update) played out perfectly amid the stock market carnage going on all around it.

Was I trying to predict something? Of course not. I was just following general rules we’ve had in place through all of NFTRH’s 10-plus year history and privately for myself since early in the bull market that began in 2001. Very simply, the counter-cyclical winds must blow and the Macrocosm must come front and center for a constructive fundamental view of the gold stock sector. That first crack in the stock market was a good start.

Read full article... Read full article...

Thursday, January 31, 2019

Will Fed’s Dovish Shift Support Gold? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

Big win for the doves! And for gold, as it jumped above $1,320 amid the soft FOMC statement. What’s next?

Big win for the doves! And for gold, as it jumped above $1,320 amid the soft FOMC statement. What’s next?

Committee Will Be Patient

Yesterday, the FOMC published the monetary policy statement from its latest meeting that took place on January 29-30th. In line with the expectations, the US central bank unanimously kept the federal funds rate unchanged at the target range of 2.25 to 2.50 percent (the Fed also kept other interest rates unchanged and reaffirmed its “Statement of Longer-Run Goals and Monetary Policy Strategy”):

In support of these goals [maximum unemployment and price stability], the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.

Read full article... Read full article...

Thursday, January 31, 2019

A Major Silver Breakout Ahead? / Commodities / Gold & Silver 2019

By: Hubert_Moolman

Silver is currently going for a major breakout.

Here is a chart I featured months ago:

Read full article... Read full article...

Thursday, January 31, 2019

ECB and Fed Dance With Gold at $1,300 / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

ECB’s meeting is behind us, while the gathering of the Fed officials is ahead of us. In the meantime, the price of gold jumped above $1,300. Will it stay for longer?

ECB’s meeting is behind us, while the gathering of the Fed officials is ahead of us. In the meantime, the price of gold jumped above $1,300. Will it stay for longer?

Slowdown in the Eurozone, but not Recession

On Thursday, the ECB held its monetary policy meeting. It left the policy on hold. The bank also maintained its forward guidance about the future path of interest rates unchanged (they are expected to “remain at their present levels at least through the summer of 2019”). However, in his introductory statement, Draghi acknowledged the weaker momentum, caused mainly by an increase in general uncertainty:

Read full article... Read full article...

Wednesday, January 30, 2019

Oil Majors Near Inflection Point As Spending Rises / Commodities / Crude Oil

By: OilPrice_Com

Oil prices are still down sharply from the highs of October 2018, but the industry may still increase spending this year. The cost of developing new projects might rise along with higher spending levels.

Oil prices are still down sharply from the highs of October 2018, but the industry may still increase spending this year. The cost of developing new projects might rise along with higher spending levels.

A survey of top industry executives by DNV GL suggests that capital spending on oil and gas could rise in 2019. Of the 791 senior professionals in the energy industry surveyed by DNV GL, 70 percent said they plan on either maintaining or increasing capex this year. That is up significantly from the 39 percent who said the same in 2017.

“Despite greater oil price volatility in recent months, our research shows that the sector appears confident in its ability to better cope with market instability and long-term lower oil and gas prices,” said Liv Hovem, the head of DNV’s oil and gas division, according to Reuters. “For the most part, industry leaders now appear to be positive that growth can be achieved after several difficult years.”

Read full article... Read full article...

Wednesday, January 30, 2019

Gold & Silver Awaken from Eight-Year Slumber / Commodities / Gold & Silver 2019

By: MoneyMetals

Two years ago at a conference during which I both presented and attended, a Keynote speaker, "Rich Dad" Robert Kiyosaki, introduced me to a different way of looking at things. He posed the question, "How many sides does a coin have?"

Two years ago at a conference during which I both presented and attended, a Keynote speaker, "Rich Dad" Robert Kiyosaki, introduced me to a different way of looking at things. He posed the question, "How many sides does a coin have?"

The correct answer is "three." The front (obverse), back (reverse) and… the edge!

When you think about it, this makes sense. From this angle – uncommon to most observers – a person can begin to look more deeply at a given subject. From the edge, you are able by definition, to see "both sides" of the story.

Using Rich Dad's perspective as a research tool helps define and validate the premise of this essay… that the price action right now of gold – and soon silver – are giving us important clues about the direction, strength, and durability of the next price trend.