Pompous Financial Market Prognosticators Revisited

Stock-Markets / Market Manipulation Jul 09, 2009 - 04:32 PM GMTBy: Nick_Barisheff

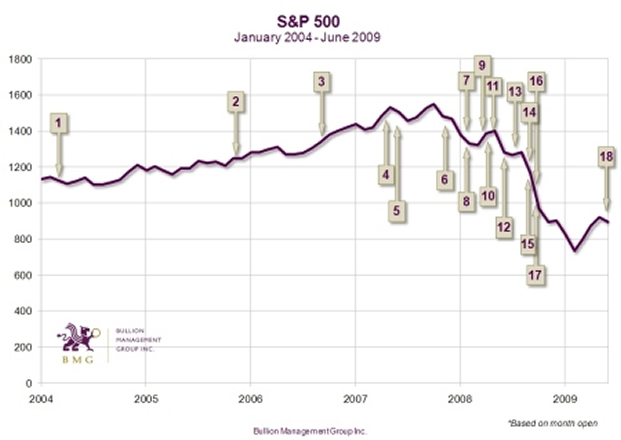

The experts go into denial as the credit crisis unfolds- In 2001, Colin Seymour published an article entitled 1927-1933 Chart of Pompous Prognosticators. In it, he documented the many Depression-era assurances given by politicians, economists, financial experts and the media to the public, protesting that everything was fine and there was nothing to worry about. Meanwhile, the stock market would decline by 92%, the US dollar would be devalued by 40%, real estate would drop 30% and unemployment would soar to 25%.

The experts go into denial as the credit crisis unfolds- In 2001, Colin Seymour published an article entitled 1927-1933 Chart of Pompous Prognosticators. In it, he documented the many Depression-era assurances given by politicians, economists, financial experts and the media to the public, protesting that everything was fine and there was nothing to worry about. Meanwhile, the stock market would decline by 92%, the US dollar would be devalued by 40%, real estate would drop 30% and unemployment would soar to 25%.

Today, we have a similar situation. Politicians, economists and the media are assuring the public that everything is fine. But governments around the world are frantically borrowing trillions of dollars to fund bailout and stimulus plans, the stock markets have lost over 40% of their value, real estate over 50%, and unemployment is approaching 10% in most major countries.

2004

1. “The ability of lending institutions to manage the risks associated with mortgages that have high loan-to-value ratios seems to have improved markedly over the past decade.”

– Alan Greenspan [February 2004]

2005

2. “Home sales are coming down from the mountain peak, but they will level out at a high plateau, a plateau that is higher than previous peaks in the housing cycle.”

– David Lereah, Chief Economist, National Association of Realtors [December 2005]

2006

3. “I don’t know, but I think the worst of this may well be over.”

– Alan Greenspan, [October 2006]

2007

4. “We have a very strong global economy… and I feel very comfortable with the global economy.”

– Treasury Secretary Henry Paulson [March, 2007]

5. “The impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained.”

– Ben Bernanke [March 28, 2007]

6. “In today's environment, it is virtually impossible to violate rules.”

– Bernie Madoff [November 2007]

2008

7. “Over the next few months, existing-home sales are expected to hold fairly steady as indicated by pending sales activity, then rise later in the year and continue to improve in 2009.”

– National Association of Realtors [January 2008]

8. “Although recent data suggest that the probability of a recession in 2008 has increased, CBO does not expect the slowdown in economic growth to be large enough to register as a recession.”

– US Congressional Budget Office [January 2008]

9. “I don't think we're headed to a recession.”

– President George W. Bush [February 2008]

10. “I don't anticipate any serious problems of that sort among the large internationally active banks that make up a very substantial part of our banking system.”

– Ben Bernanke [February 28, 2008]

11. “No! No! No! Bear Stearns is not in trouble.”

–Jim Cramer, CNBC commentator [March 2008]

12. “Later this year, I expect growth will pick up.”

– Henry Paulson, just after Treasury had mailed out 130 million economic stimulus cheques [May 2008]

13. “Fannie Mae and Freddie Mac are fundamentally sound. They're not in danger of going under.... I think they are in good shape going forward.”

– Barney Frank, chairman of the House Financial Services Committee [July 2008]

14. “My own belief is if we were going to have some sort of big crash or recession, we probably would have had it by now.”

– Canadian Prime Minister Stephen Harper [September 2008]

15. “We're probably somewhere pretty close to a bottom.”

– Fund manager Barton Biggs [September 2008]

16. “The fundamentals of our economy are strong.”

– US Senator John McCain [Sept 15, 2008]

17. “We remain committed to examining all strategic alternatives to maximize shareholder value.”

– Lehman Bros. CEO Dick Fuld, shortly before Lehman went bankrupt [Sept 2008]

2009

18. “It’s a huge bull market rally.”

– Jim Cramer, CNBC [June 2009]

Just as Seymour’s Pompous Prognostications proved devastating for those investors who remained complacent due to those false assurances, today’s investors would be wise to educate themselves on the real risks and vulnerabilities they face today. In order to preserve their wealth over the coming years, investors need to make wise, informed decisions, stop being complacent, and avoid following the false assurances of politicians and financial experts. With countless risks and vulnerabilities facing the world, the next 20 years will not be the same as the last 20 years. |

Sources: FederalReserve.gov, BusinessWeek, CNBC.com, Realtor.org, Marketwatch.com, USA Today, Washington Post, Reuters, Associated Press, Bloomberg, BBC.com, TimesOnline. |

By Nick Barisheff

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

© 2009 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.