Cold Reality of the State of the World Economy

Economics / Global Economy May 19, 2010 - 02:52 AM GMTBy: Brian_Bloom

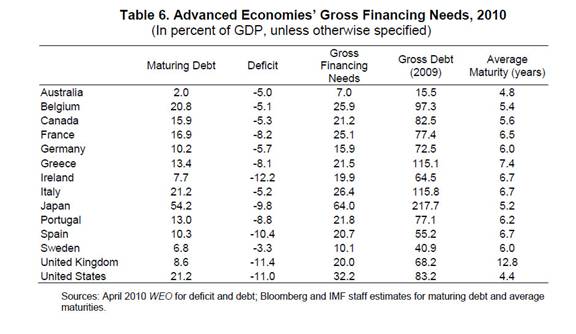

For those who are still in denial regarding the extent of the economic/financial issues we are facing, the table below should put things into perspective.

For those who are still in denial regarding the extent of the economic/financial issues we are facing, the table below should put things into perspective.

Source: http://blogs.telegraph.co.uk/f.. What this table reflects is the percentage of GDP that will need to be applied by the various countries – during the year 2010 – to meet this year’s sovereign debt repayment obligations and to finance this year’s forecast budget deficits.

For those who need more structure in their thought processes, the 2010 Gross Financing Needs of the “ten worst” countries, in descending order, are as follows as a percentage of the relevant country’s forecast 2010 GDP:

- Japan: 64.0%

- USA: 32.2%

- Italy: 26.4%

- Belgium: 25.9%

- France: 25.1%

- Portugal: 21.8%

- Greece: 21.5%

- Canada: 21.2%

- Spain 20.7%

- UK: 20.0%

Note that Greece is only #7 on the list. At face value, their problem is lack of immediate ability to generate the cash flow to service their immediate obligations. That is why that country, in particular, is being cited as “the” problem du jeur.

A reader was kind enough to send me a copy of a very comprehensive analysis of the state of play in the Global Monetary System and which also draws attention to some comments recently made by the Managing Director of the IMF.

In my view, the title of one of the most relevant articles to which the analysis refers, was:

Concluding Remarks by Dominique Strauss-Kahn, Managing Director of the International Monetary Fund, at the High-Level Conference on the International Monetary System

Zurich, May 11, 2010

Source: http://www.imf.org/external/np/speeches/2010/051110.htm

For the sake of efficiency, the salient quote is repeated below:

“A number of steps can be taken to strengthen the IMS, [International Monetary System] including better surveillance of capital flows and analysis of spillovers, an improved global financial safety net, and an enhanced role for the SDR.

This analyst’s interpretation of the true meaning of the above quote based on additional research not quoted here, is that the role of the IMF in the world of finance will very likely change.

The IMF will (has already?) become the world’s central bank. Further, the currency of last resort will be changed from the US Dollar to a Special Drawing Right (SDR) and the 24 nations who are members of the IMF (supervised by no one and accountable to no one) will take over the role of controlling the monetary system of the entire planet.

As part of my additional research I listened to an interview with James G Richards on King World News. Jim made reference to an economic concept called the Triffin Dilemma, which can be better understood by going to http://en.wikipedia.org/wiki/Triffin_dilemma .

In simple terms, if a country with a strong economy acts as the engine of world economic growth by running at a perpetual deficit, then it will eventually go broke. That would have been okay, if some/a group of beneficiaries had taken the baton that was passed to them by the US and, in turn, had assumed responsibility for being the engine of growth for the world economy.

In short, that didn’t happen.

Why didn’t it happen?

As I understand it, the reason was as follows:

The net effects of the US economy running at chronic deficit were:

- Most of the developed world (those countries that are reflected in the above table) got used to the idea that “something for nothing” was a fair deal and the citizens of the developed world kind of liked the idea of living the life of Riley. They sat back and basked in the sunshine.

- The other beneficiaries (those emerging countries that are not reflected in the above table) worked their tails off but did not become sufficiently powerful generators of wealth. i.e. The developing countries did not grow their economies sufficiently to be able to take over this “driver” role from the US.

Because markets in the developed world for fossil fuel dependent technologies had saturated and the energy per capita available to spread the per capita wealth around to the less developed countries was insufficient.

Interim Conclusion

It was a matter of time before the US stock market reflected a dawning understanding on the part of investors that,

- If a world-wide shift to alternative “baseline” energy paradigms was not forthcoming (which were sufficiently powerful to drive global growth in economic value add on a per capita basis), then

- GDP growth rates across the globe would begin to slow, chronically, before contracting.

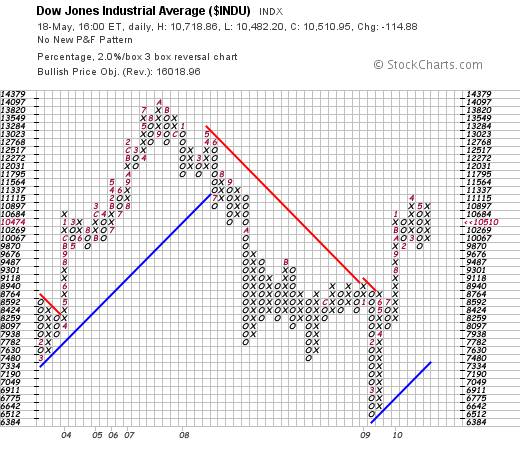

The 2% X 3 point reversal chart below – of the Standard & Poor 500 industrial index in the USA shows that the US stock market has been consolidating, pending a “final” decision by investors: (Chart courtesy stockcharts.com)

11,115 represents the “upside resistance” level to a further rise in the index.

9,870 represents the “downside support” which needs to hold if the US stock market is to avoid entering a Primary Bear Trend. Technically, the jury is still out. Fundamentally, the facts suggest that the jury is in. But let’s focus on the technicals for the moment.

In the short term, whether the index rises above the resistance level or falls below the support level will be a function of what the committee does.

What committee is that?

It is the committee formed as a result of Executive Order 12631, issued by President Ronald Reagan on March 18th 1988 the objective of which was to do whatever it took to maintain investor confidence. Some know this committee as the “Plunge Protection Team”

Source: http://www.reagan.utexas.edu/archives/speeches/1988/031888d.htm

In the past few years, the hole in the world’s financial dyke has been plugged by a group of four United States based individuals, namely:

(1) the Secretary of the Treasury, or his designee; (2) the Chairman of the Board of Governors of the Federal Reserve System, or his designee; (3) the Chairman of the Securities and Exchange Commission, or his designee; and (4) the Chairman of the Commodity Futures Trading Commission, or her designee.

As evidenced by the 1,000 point fall in the Dow Jones Industrial Index a few days ago (probably caused by a cascade of computer algorithm generated sell orders being spat out automatically) the fingers of these four individuals are now losing their effectiveness.

Unfortunately, it took a crisis in Europe to bring a dose of cold reality to the owners of those four fingers that what they are attempting to do is impossible. As a consequence, the role of hole plugging in the world’s financial dyke will be now assumed by the individuals who represent the 24 members of the IMF.

With all the above in mind, I am reminded of something my late father once told me when I was growing up.

“A specialist is someone who knows more and more about less and less until he knows everything about nothing.”

In simple terms, the causes of the world’s economic problems are not financial in nature. It follows, therefore, that these problems cannot be solved by applying specialist financial measures. It follows that the IMF will turn out to be just as impotent as the Plunge Protection Team. However, the shift to the IMF might buy us some more time as it muddies the waters even further.

Let us not mince words. It is a matter of common sense that

- “Energy” is the ultimate input to all economic activity.

- Energy input less losses through inefficiencies translates to economic value-add

- If energy input per capita falls and efficiencies have been maximized as a consequence of intellectual input having been maximized, then economic value-add will fall

It is a matter of common sense that the ultimate causes of the economic problems are related to the fact that energy output per capita has been shrinking on a global basis.

Overall conclusion

In the absence of a replacement set of “baseline” alternative energies to replace fossil fuels, the world economy has nowhere to go but down. The only question – until the core energy issue has been addressed – relates to the rate of deterioration.

By Brian Bloom

Once in a while a book comes along that ‘nails’ the issues of our times. Brian Bloom has demonstrated an uncanny ability to predict world events, sometimes even before they are on the media radar. First he predicted the world financial crisis and its timing, then the increasing controversies regarding the causes of climate change. Next will be a dawning understanding that humanity must embrace radically new thought paradigms with regard to energy, or face extinction.

Via the medium of its lighthearted and entertaining storyline, Beyond Neanderthal highlights the common links between Christianity, Judaism, Islam, Hinduism and Taoism and draws attention to an alternative energy source known to the Ancients. How was this common knowledge lost? Have ego and testosterone befuddled our thought processes? The Muslim population is now approaching 1.6 billion across the planet. The clash of civilizations between Judeo-Christians and Muslims is heightening. Is there a peaceful way to diffuse this situation or will ego and testosterone get in the way of that too? Beyond Neanderthal makes the case for a possible way forward on both the energy and the clash of civilizations fronts.

Copies of Beyond Neanderthal may be ordered via www.beyondneanderthal.com or from Amazon

Copyright © 2010 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.