Stock Market Oversold Rally will Soon be Dead

Stock-Markets / Stocks Bear Market Jul 08, 2010 - 01:31 AM GMTBy: Mike_Shedlock

Everyone is looking for signs of a continued recovery. Unfortunately there are many misleading signs that trap all but those willing to look beneath the surface to see what is really happening.

Everyone is looking for signs of a continued recovery. Unfortunately there are many misleading signs that trap all but those willing to look beneath the surface to see what is really happening.

For example, please consider the Bloomberg headline U.S. Retailers’ Sales Rise at Fastest Pace in 4 Years

U.S. retailers’ sales are growing at the fastest pace in four years, a sign consumers may be overcoming concern about unemployment and depressed home values.

Sales probably expanded at an average monthly rate of 4 percent in the first five months of the retail fiscal year that began Jan. 31, the biggest gain since 2006, the International Council of Shopping Centers trade group said in advance of its June report tomorrow. Nordstrom Inc. and Kohl’s Corp. are among chains that will report June sales increases at stores open at least a year, according to analysts’ estimates.

Retailers may have bucked last month’s drop in consumer confidence that threatens to temper the rebound. The year-to- date growth in sales shows that spending, a key driver of the U.S. economy, is faring better than many investors are betting, said Michael Niemira, the New York-based ICSC’s chief economist.

“The sales results have been uneven, which makes people worry about the recovery,” Niemira said in a telephone interview. “If you look at the underlying growth rate, it suggests a relatively healthy, moderate pace of spending for the remainder of the year.”

“Investors seem to have given up on the consumers,” Bill Dreher, an analyst with Deutsche Bank AG in New York, said on a July 1 conference call with clients. “Most of our retail operators are very bullish.”

June sales reports will meet or beat analysts’ estimates, and the positive comparable-sales trend will continue, Dreher predicted. Retailers are well-positioned for profitability, with inventories and operating expenses tightly controlled, he said.

“These growth rates are the best we’ve seen in several years, after a multiyear slump,” Craig Johnson, president of Customer Growth Partners LLC, a consulting firm in New Canaan, Connecticut, said in a July 2 telephone interview. “Some of the analysts get caught up in the month-to-month comparable sales, and they can be misleading.”Sign, Sign, Everywhere a Sign

All of these pundits are barking about same store sales, an extremely misleading sign given retail stores are closing like mad.

Month in and month out we hear the same nonsense about retail sales. I will believe it when I see state sales tax collections support the claims.

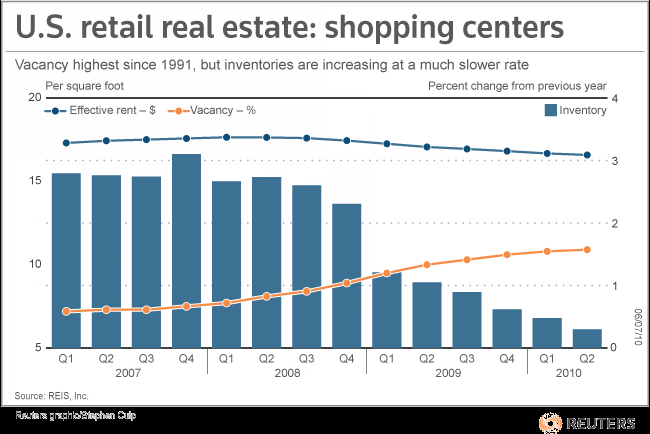

Strip Mall Vacancy Hits 10.9 Percent, Approaches 1991 Peak

Amidst all the fanfare of purportedly rising retail sales, those digging a little deeper note US shopping center vacancy rates rose in 2nd quarter.

Retailers shuttered more stores in U.S. shopping centers during the second quarter, further delaying a rebound in the struggling retail real estate market, according to research firm Reis Inc.

Shopping centers and strip malls have been pounded harder than other types of real estate, hurt by weak consumer spending, anemic job growth and an oversupply built to serve new housing that never materialized.

"Until we see stabilization and recovery take root in both consumer spending and business spending and employment, we do not foresee a recovery in the retail sector until late 2012 at the earliest," said Victor Calanog, Reis director of research.

For U.S. strip centers, the vacancy rate in the second quarter rose 0.10 percentage point from the first quarter to 10.9 percent, slightly below the 11 percent in 1991 during the prior real estate bust, according to the Reis quarterly report, released on Wednesday.

Retailers gave up 1.85 million square feet of occupied space in the second quarter at neighborhood shopping centers, while developers opened less than 400,000 square feet of new strip mall space.

That compares with an average of about 7 million to 8 million square feet of shopping centers built each year from about 2001, according to Reis.Retail Mall Vacancies

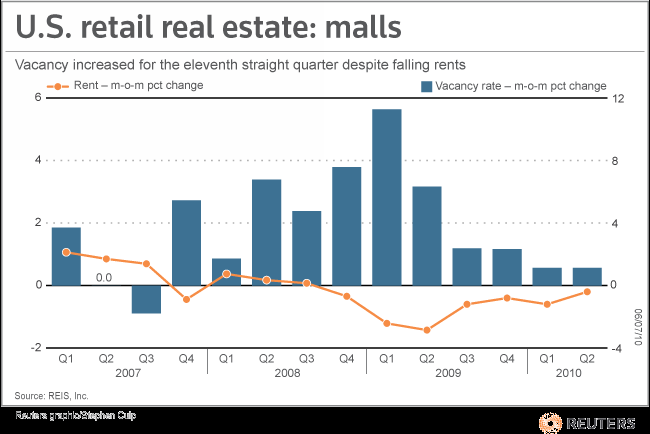

Mall vacancies have risen for 11 straight quarters and rents have fallen 7 consecutive quarters! Inflation? Hardly.

Same Store Sales - Misleading Sign

Reis has it correct and so do I. Not only is it easy to beat record low comparisons of a year ago, same store sales are rising in part because stores are closing like mad.

Circuit City closed its entire chain in bankruptcy, thus some of those sales went to Best Buy, some other places, and some sales simply vanished.

More importantly, states have been reporting declining sales tax collections for the entire year.

Admittedly state tax collection numbers are frequently delayed by a couple months, but that still does not jibe with overly bullish comments about sales over the first five months of the year from the International Council of Shopping Centers.

Assuming you believe the fantasy sales reports, a more important question is "where to next?"

Where Next Signpost

- Home tax credits are dead along with housing starts.

- New home sales cratered a record 33% in May, to a record low annual rate of 300,000 units. See Inane Thoughts of the Day: CNNMoney Article says "Housing Shortage is Coming" for thoughts and details

- Massive numbers of state layoffs are coming even if Congress throws the states a small bone

- Global growth is slowing led by Europe and Asia (that will affect hiring plans)

- Anemic consumer sentiment numbers took a turn for the worse

- The ECRI's Leading Economic Indicator has fallen like a rock. See ECRI Weekly Leading Indicators at Negative 6.9; How Likely is a Double Dip?

By the way, the WLI is now at -7.7 falling again last week.

Yet, amazingly nearly everyone thinks some sort of sustainable recovery is underway. However, the treasury market begs to differ, so do the vast majority of economic signs, and so do I.

2-Year treasuries are close to record lows at .62%, 5-Year treasuries are at 1.78% and 10-Year treasuries are at 2.98% and except for today, falling like a rock. Treasury yields are arguably the most valuable sign.

Nonetheless, the stock market is throwing a party over retail sales that cannot be sustained even if by some sense of the imagination those sales are happening.

Signs suggests this is an "oversold" bounce that will die just as the rest of the bounces this year have died.

A tip of the hat to the Five Man Electrical Band for "Signs"

Signs

Sign Sign everywhere a sign

Blocking out the scenery breaking my mind

Do this, don't do that, can't you read the sign?

Can you read the signs? Most can't.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.