Don't Get Shaken Off the Gold Bull Market

Commodities / Gold and Silver 2010 Sep 29, 2010 - 02:42 AM GMTBy: Jordan_Roy_Byrne

The question now is not whether Gold will go higher or not. Most of us know the primary trend is higher and will continue in the years ahead. The real question is three-fold. Are you invested? How much are you invested? Will you hold on? Going forward, as the bull strengthens and as more come on board the last question becomes most pertinent. Let me present you with some quotes that will elucidate my point.

The question now is not whether Gold will go higher or not. Most of us know the primary trend is higher and will continue in the years ahead. The real question is three-fold. Are you invested? How much are you invested? Will you hold on? Going forward, as the bull strengthens and as more come on board the last question becomes most pertinent. Let me present you with some quotes that will elucidate my point.

Jesse Livermore once said: "It was never my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! Men who can both be right and sit tight are uncommon."

I believe Richard Russell said that the job of a bull market is to throw off as many people as possible along the way. After all, if everyone jumped on board all at once, the bull market wouldn't be sustainable.

Finally, consider this wisdom from Dr. Marc Faber. "An investor could have done very well over the last 30 years with just a handful of investment decisions. In 1970, a long-term investor should have bought gold, silver, and oil (commodities); in 1980, he should have sold his gold and oil and bought Japanese stocks; then, in 1989, he should have switched out of Japanese stocks into the S&P 500 or, ideally, into the Nasdaq, which he should have sold at the beginning of 2000."

It is really not all that difficult to make big money in the capital markets. The big money is made in finding major trends in their infancy and riding them out for many years. The major trends are not difficult to find. The difficult part is having an open mind to find the trends and then having the conviction to stay with the trend for many years.

Let me present you with two data points/charts, which confirm that this bull market is still in its infancy insofar as its price appreciation.

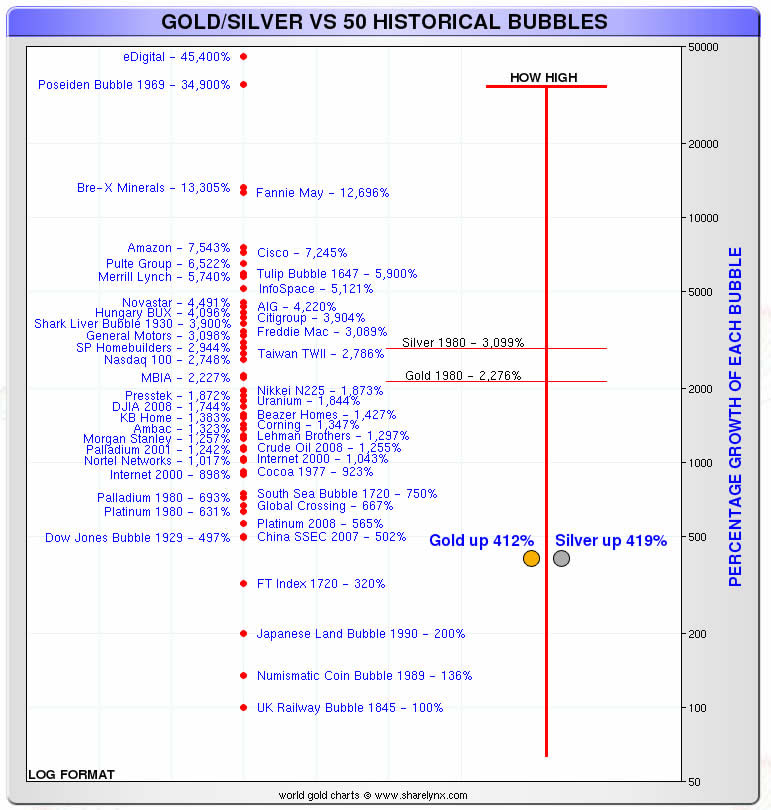

First is this chart from Nick Laird (sharelynx.com), which compares current price appreciation with price appreciation in various bull markets.

Currently, both precious metals are up about 400%. I don't know how anyone can look at that figure and proclaim this to be a bubble top. Moreover, that is after 10 years! This tells us that we've yet to see an acceleration and so one is likely in the next few years.

Secondly, we can't forget the anemic money flows into this market. Even after a 10-year bull market, less than 1% of global managed assets are in this sector. Barrick Gold came up with 0.7%. As of the end of 2009, $400 Billion (of $55 Trillion in global managed assets) was invested in Gold equities and ETF's. According to Goldstocksdaily.com, the total market cap of all public Gold & Silver companies is roughly $300 Billion. What happens if only 3% of global assets ($1.65 Trillion) try to get a foothold in a sector currently worth $300 Billion? And keep in mind; most of those involved in the sector are diehard loyalists. They won't sell easily.

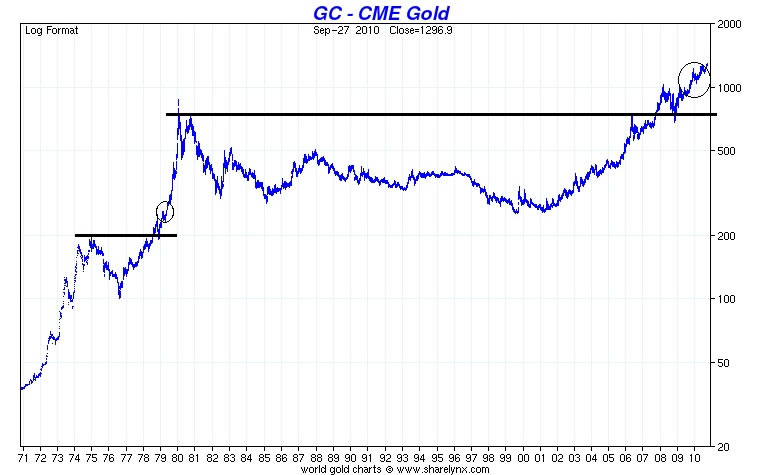

Furthermore, it is increasingly difficult to argue with the market. Please see the chart below.

Look how high Gold went after breaking the 1974-1978 highs. In percentage terms, the 1979 breakout ended up rising 325% greater than the depth of the consolidation. This would project a target of roughly $4,555 for today's bull. We should also note the obvious. The first consolidation spanned only four years while this consolidation spanned 26 years, thus providing a much larger and stronger base that can support a breakout for far more than a year or two.

The question of a major bull market is not in doubt. The answer is obvious. If you are reading this you have made it this far. You are in the bull market before the crowd. If you aren't yet in, you still have time.

Going forward, you need to prepare yourself mentally by developing a plan and following it. First, you need to decide how much of your portfolio should be in the sector. Realize, that this sector can make you fabulously wealthy but that navigating the final stages will be difficult. Hence, you need to formulate a plan beforehand that revolves around trading tactics, which can help reduce risk and volatility.

The primary trend is higher but there will be increasing volatility and major interruptions along the way. That is why we are here. We endeavor to help you find the best stocks and assist you in riding out the bumps along the way. If you’d be interested in professional guidance, we invite you to try a free 14-day trial to our premium service, which provides access to a month’s worth of updates!

Good luck ahead!

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.