Which Way Will Silver Pop?

Commodities / Gold and Silver 2010 Nov 19, 2010 - 02:53 AM GMTBy: Bob_Kirtley

Team, We know it has been a rough couple of days, however, silver prices showed its true strength today as it bounced back to close in New York City at $26.93/oz, registering a gain of $1.30/oz or 5.07%. The recovery began in Sydney, three cheers for the Aussie gold bugs, carried through in Hong Kong and Singapore, three cheers there too, then onto London where they also managed to push silver prices higher. Well done to all the buyers out there.

The stage is set for some fireworks either way you slice it. The shorters may give it one last thumping in the hope of getting their positions covered before silver rockets and also to satisfy their end of year bonus aspirations. The thirst of the Longs has not yet been slaked and appears to be building. The next few days could be electric as the possibility exists that that the shorters could capitulate and be forced to buy silver at the very same time as the Longs are buying. In a tiny market place where the physical supply is said to be rather tight, this could push prices to new record levels. And that is just what we will think will happen. Be warned though, we have been wrong before.

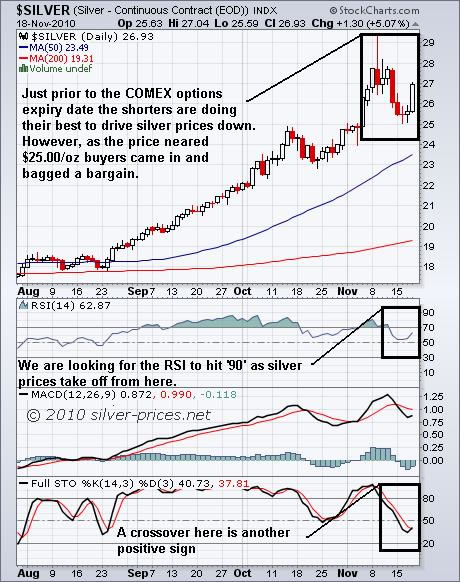

Taking a quick peek at the above chart we can see that just prior to the COMEX options expiry date, 23rd November 2010, the shorters are doing their best to drive silver prices down. However, as the price neared $25.00/oz buyers came in and bagged a bargain. We are looking for the RSI to hit ‘90′ as silver prices take off from here. The STO is forming a nice crossover here which we interpret as another positive sign.

Our old favourite Silver Wheaton (SLW) is also playing a good game and doing wonders for our trading account.

Over in the options trading pit the team have just updated the progress chart to includes yesterdays closed trades, now 51 winners out of 53 trades, the latest two trades will be written up on gold-prices later today.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.