Fed's Global Pawnshop Hands Out $9 Trillion in Short-term Loans to 18 Financial Institutions

Interest-Rates / Credit Crisis Bailouts Dec 05, 2010 - 05:41 AM GMTBy: Global_Research

mybudget360.com writes: Federal Reserve made $9 trillion in short-term loans to only 18 financial institutions. Since 2000 the US dollar has fallen by 33 percent. The hidden cost of the bailouts.

mybudget360.com writes: Federal Reserve made $9 trillion in short-term loans to only 18 financial institutions. Since 2000 the US dollar has fallen by 33 percent. The hidden cost of the bailouts.

The Federal Reserve released a stunning report showing the details of bailouts that occurred during the peak of the credit crisis. They won’t call it “bailouts” but giving money when others won’t is exactly that. What the report shows is that the Fed operated as a global pawnshop taking in practically anything the banks had for collateral.&

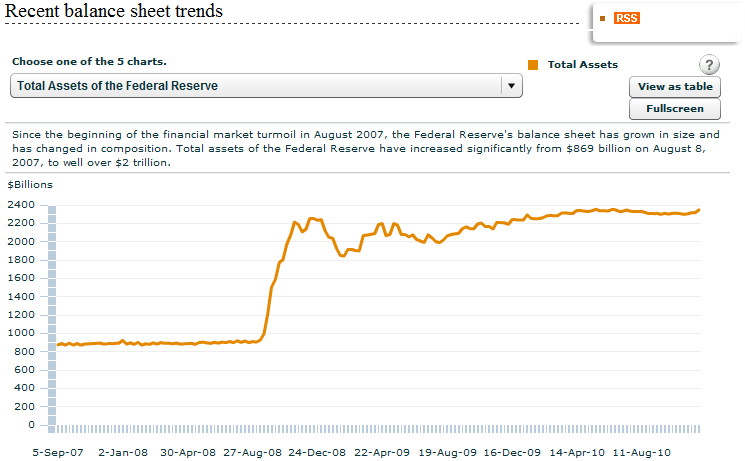

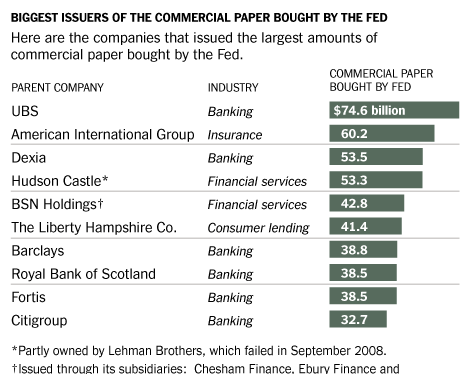

What is even more disturbing is that the Federal Reserve did not enact any punitive charges to these borrowers so you had banks like Goldman Sachs utilizing the crisis to siphon off cheap collateral. The Fed is quick to point out that “taxpayers were fully protected” but mention little of the destruction they have caused to the US dollar. This is a hidden cost to Americans and it also didn’t help that they were the fuel that set off the biggest global housing bubble ever witnessed by humanity. A total of $9 trillion in short-term loans were made to 18 financial institutions. Still think the banking bailout didn’t happen or cost us nothing? Let us first look at the explosion of assets on the Fed balance sheet.

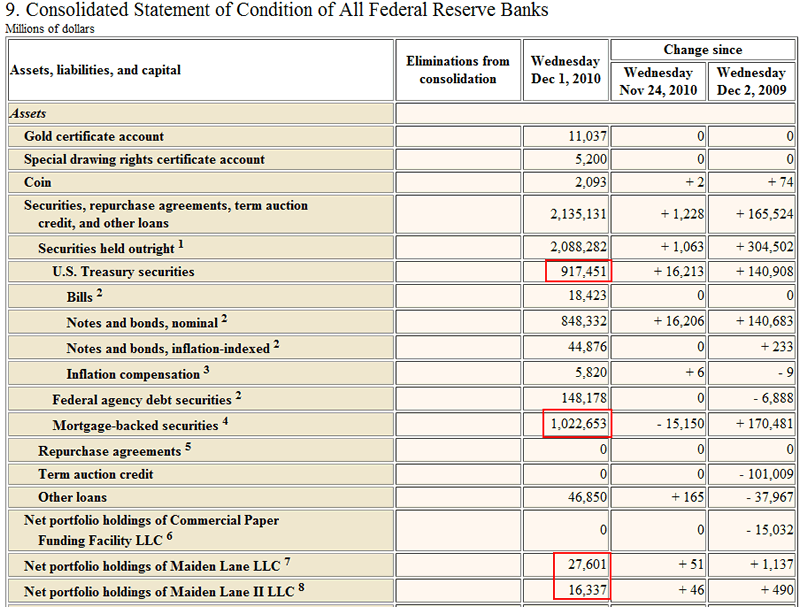

The Fed is still carrying longer term debt on its books that shouldn’t be there:

The Fed typically would carry under $900 billion in high quality government Treasuries on its balance sheet. But today it is carrying roughly $2.4 trillion in “assets” and the biggest part of this is made up of questionable mortgages:

Over $1 trillion of mortgage backed securities sit on the Fed balance sheet and QE2 is only starting.

Other tens of billions of dollars are sitting in the balance sheet as well that include failed commercial real estate projects and defunct shopping centers around the country. Of course the Fed would like to give the appearance that all is well but no one makes $9 trillion in short-term loans without undergoing serious problems. And doesn’t it bother the public that an institution that represents our banking system essentially bailed out the world at the expense of US taxpayers (without asking by the way) and now taxpayers are having to deal with a toxic banking system and a jobs market that is hammered into the ground?

This concern was raised:

“(NY Times) But Senator Bernard Sanders, independent of Vermont, who wrote a provision in the law requiring the disclosures by Dec. 1, reached a different conclusion.

“After years of stonewalling by the Fed, the American people are finally learning the incredible and jaw-dropping details of the Fed’s multitrillion-dollar bailout of Wall Street and corporate America,” he said. “Perhaps most surprising is the huge sum that went to bail out foreign private banks and corporations.”

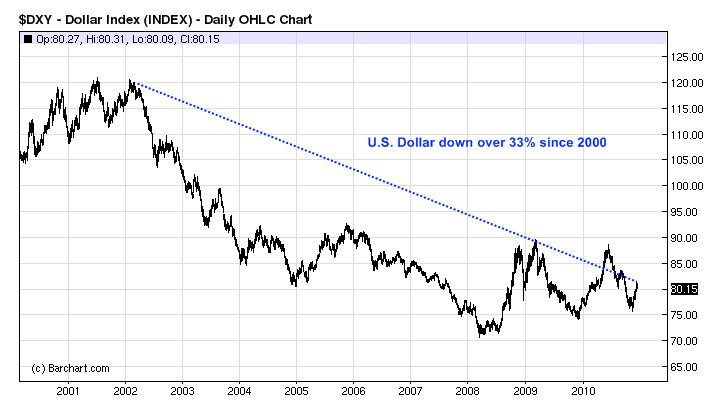

Senator Sanders is absolutely right. Did you also know that billions of dollars went to foreign central banks as well? We all know the issues going on with the European Zone today but the Fed never mentioned this during the bailout frenzy. Don’t be fooled when the Fed says there is no cost associated. 26 million Americans are unemployed or underemployed and 44 million Americans are on food assistance. The US dollar has done the following in the last decade:

Yet this is the response:

“In a statement accompanying the disclosure, the Fed said it had fully protected taxpayers. “The Federal Reserve followed sound risk-management practices in administering all of these programs, incurred no credit losses on programs that have been wound down, and expects to incur no credit losses on the few remaining programs,” it said.”

Sound risk-management? The entire purpose is to destroy the currency in a slow methodical process and inflate away the debt. Yet there is a cost to this born by the many for the few. Over the last decade it has meant the depreciation of the dollar by 33 percent. That is a real cost. It might not be a big deal if you hold money in foreign countries but most Americans only have a paycheck that is issued in US dollars. The actual amount of Fed loans is simply jaw dropping:

“At home, from March 2008 to May 2009, the Fed extended a cumulative total of nearly $9 trillion in short-term loans to 18 financial institutions under a credit program.

Previously, the Fed had only revealed that four financial firms had tapped the special lending program, and did not reveal their identities or the loan amounts.

The data appeared to confirm that Citigroup, Merrill Lynch and Morgan Stanley were under severe strain after the collapse of Lehman Brothers in September 2008. All three tapped the program on more than 100 occasions.”

Keep in mind that unemployment insurance will cost roughly $4 billion per month and most of this money will go back into the economy. Congress is stalling on this yet the media is completely silent on the $9 trillion in Federal Reserve loans? This should be the headline story over and over until people realize how big the bailout was (and how this false dichotomy is being used as propaganda in the media as if $4 billion a month is going to bankrupt the system). The banking elites just want to shift the blame to “poor” people while ignoring the elephant in the room which are the trillions of dollars in Fed loans.

Everyone got in the game:

“Big institutional investors, like Pimco, T. Rowe Price and BlackRock, borrowed from the TALF program. So did the California Public Employees Retirement System, the nation’s largest public pension fund, and several insurers and university endowments.”

Source: New York Times

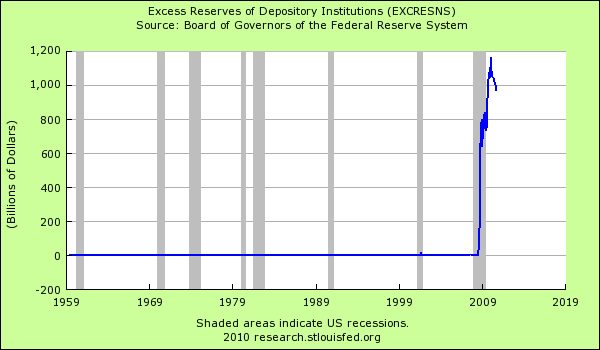

Every big player got into this and you will recall the rhetoric that it was for small businesses and the American consumer. None of that happened. Banks are still sitting on incredibly large excess reserves:

The Fed is operating without any checks and balances from Congress and another trillion dollar exposure has come out with the mainstream media channels like ABC, CBS, and NBC all remaining silent. Can’t interrupt Wheel of Fortune right?

Global Research Articles by mybudget360.com

© Copyright mybudget360.com , Global Research, 2010

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.