End of the Gold Bull Market?

Commodities / Gold and Silver 2011 Feb 24, 2011 - 01:21 PM GMTBy: Ronald_Rosen

Is time running out for the mighty gold bull?

Is time running out for the mighty gold bull?

Has a favorite son been brought to his knees?

Take a close look at the following evidence.

We may have seen the end of this gold cycle.

The evidence presented in this report is not conducive to an ongoing gold bull market. However, the evidence is rather convincing that the gold bull market that began in 1999 has run out of steam in a less than explosive grand finale. Yes, a grand finale that may have wilted in spite of all the glowingly bullish reports dominating the internet and the nightly television news. The advertisements to buy gold and gold coins are a constant presence in most media forms. Conservative talk show hosts consistently talk up the importance of owning gold for survival purposes. The death of fiat currencies and most importantly the U. S. Dollar is a foregone conclusion according to many die hard gold bulls and gold bugs. They may be correct but they also may have to wait another 30 years before the final curtain falls on this less than glorious episode in American history. One by one the clues fall in place.

CLUE # 1

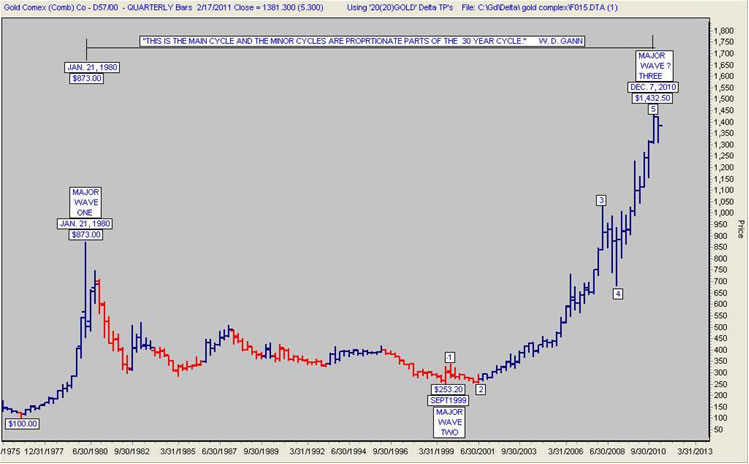

“Time is the most important factor in determining market movements because the future is a repetition of the past and each market movement is working out time in relation to some previous time cycle.”

“In order to be accurate we must know the major cycles.”

30-Year Cycle

-------------------

“This is the main cycle and the minor cycles are proportionate parts of the 30-year cycle or circle.

QUARTERLY CHART 30-YEAR CYCLE

CLUE # 2

“The Commodity Super Cycles I have written about in past reports have been in existence for about 100 years. The peaks have occurred approximately 30 years apart. These cycles began after the Federal Reserve System and the Internal Revenue System were created in 1913. Since the Feds are still here and larger than ever, it is highly probable that the current Commodity Super Cycle is in the process of completing its fourth dynamic phase.” Ron R.

CLUE # 3

The HUI has provided us with a warning notice on two occasions. The first warning told us of a disastrous collapse to follow. The warning came before the exact top but indeed the collapse was a disaster. The HUI, once again, in the month of November 2010 provided us with a similar warning. A decline below a previous peak was and is the warning.

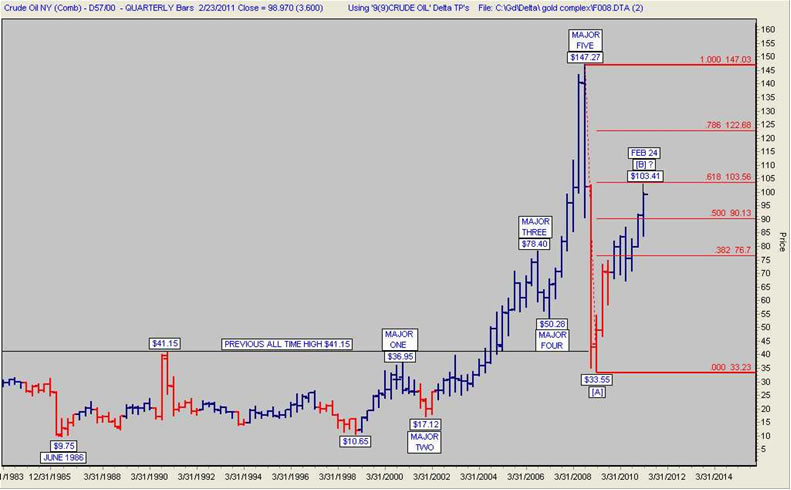

Crude oil traded at $103.41 a barrel on February 24, 2011. This is a critical level and may represent a recovery or corrective top. The quarterly crude oil chart shows that crude oil has recovered 61.8 % of the decline from the $147.27 high to the $33.55 low when it reached the $103.41 level.

CRUDE OIL QUARTERLY CHART

The big question now is; are there any clues that provide us with information about the future path of the stock indexes?

The answer is yes.

They are available to subscribers.

If you are interested in knowing what these clues are and what Welles Wilder’s Delta Turning Points are telling us, the ROSEN MARKET TIMING LETTER is available through Welles Wilder’s Delta Society International. Once there, click on Products and Services. The cost is modest. www.deltasociety.com

Stay well,

Ron Rosen

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.