The Coming Global Commodities Crisis

Commodities / Commodities Trading Mar 10, 2011 - 04:26 AM GMTBy: Clif_Droke

The last few weeks has seen a startling rise in fuel and food prices. This has been a key contributor to the political and economic instability overseas; it’s also paving the way for an even bigger crisis for the U.S. and the world economy by 2012.

The last few weeks has seen a startling rise in fuel and food prices. This has been a key contributor to the political and economic instability overseas; it’s also paving the way for an even bigger crisis for the U.S. and the world economy by 2012.

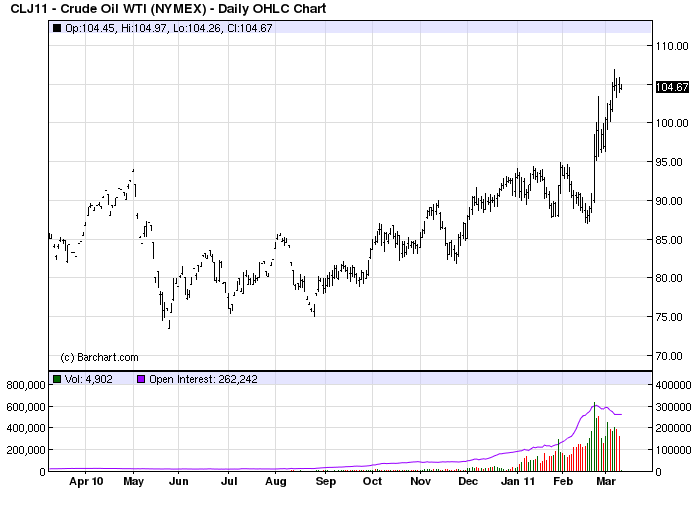

Indeed, the oil price has been on a rip-and-tear largely owing to the Middle East crisis. The fear and uncertainty overhanging North Africa and the Middle East has also benefited the gold price. Our favorite gold proxy for instance, the SPDR Gold Trust ETF (GLD), recently made a new high and is still above its key immediate-term trend line.

The recent fuel price spike was a consequence of the political turmoil in the North African and Middle Eastern region. This in turn was caused by high food prices…which is mainly a consequence of a weak U.S. dollar since commodities are priced in dollars. Ever since the Bernanke’s Fed decided to pursue its second quantitative easing strategy (QE2) beginning last November, the dollar has been weakening while commodities prices have strengthened. This has put tremendous pressure on developing economies, particularly in the Middle East. Thus it could be argued, as some economists have, that the Fed’s QE2 program has been a major contributor to the Middle East revolutions as well as the rising cost of fuel.

The news media is trying to dismiss the high food prices by blaming it on weather related supply shortages. As Steve Forbes recently observed, “Droughts and floods have hurt the food supply, but at best these are only partial explanations and are about as convincing as North Korea’s blaming famines on the weather. Such acts of God were routinely trotted out to excuse food shortages in the old Soviet Union and Ma Zedong’s China.”

The stated reason behind QE2 was to stimulate the U.S. economy and help bring down the unemployment rate. While the Fed’s stimulus program has had a definite impact in terms of improving the financial market and in at least stabilizing the economy, it has done little to improve the structural condition of the economy or to bring down unemployment. What Bernanke & Co. have succeeded in doing with their super aggressive monetary stance is to create something akin to the 2006-2008 commodities bubble. The Fed has succeeded in pushing the oil price to an unsustainably high level and have also made food prices inaccessibly high for hundreds of millions of underprivileged people in the developing worlds.

In his latest Special Edition, entitled “Crisis High,” Samuel J. Kress makes the following pertinent observation: “Since the Great Depression of the ‘30s, the federal government has increasingly intervened in the economy thereby increasing the national debt to astronomical levels with the numerous social entitlement programs. Will the government’s addiction to OPiuM, squanderous spending of Other People’s Money, ever end? Recent QEs defy logic and reason – how can incurring additional debt cure the ills of excessive debt? Is this not equivalent to giving an alcoholic with sclerosis of the liver a case of scotch for the holidays and wishing him a healthy new year?”

By persisting in its loose monetary policy, which should have been slowed down last year when the recovery had achieved a sustainable momentum level, the Fed is also sowing the seeds of the next major financial crisis. The next crisis will likely be global and could rival the credit crisis in terms of its severity. The fact that the 6-year cycle is up until later this year should help stave off this crisis until perhaps 2012, but the path toward another crisis has been paved and the Fed isn’t likely to reverse course at this juncture. If Bernanke is true to his word in continuing QE2 until spring, the Fed will very likely have gone too far in its loose money policy, just as it went too far in its tight money policy heading into the credit crisis. By the time the Fed recognizes its mistake the damage will have been done and the consequences will have to be paid.

History, it seems, always repeats when it comes to the Fed.

Turning our attention to the metals and mining stock market, the fear and uncertainty concerning North Africa and the Middle East has definitely benefited oil but has also been of some benefit to the gold price. Our favorite gold proxy, the SPDR Gold Trust ETF (GLD), recently made a new high and is still above its key immediate-term trend line.

Gold stocks are in a less strong position than the metal itself, however. As we examined in last week’s commentary, many of the larger cap gold stocks have badly lagged the high-flying silver stocks and smaller cap gold shares in recent weeks. High profile examples of this relative weakness include Newmont Mining (NEM), Freeport Copper & Gold (FCX), Kinross Gold (KGC) and Agnico-Eagle Mines (AEM), all of which are closer to new lows for the year-to-date than new highs.

For a gold stock bull market to be considered strong and healthy, it should be joined by all segments of the market: small-cap, mid-cap and large-cap. When the bigger capitalized mining companies are badly lagging the rest of the group it means the market isn’t firing on all cylinders. If the large cap gold stocks don’t soon reverse their declines it will eventually compromise the broader market’s uptrend. For this reason we’ll need to watch our remaining long positions closely for signs of potential weakness in the near term and hold off on making new purchases until these negative internal divergences have been reversed. As of Mar. 9, both the XAU and HUI indices are below their dominant immediate-term moving averages as we await an improvement in the gold stock internals.

Gold & Gold Stock Trading Simplified

With the long-term bull market in gold and mining stocks in full swing, there exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. It doesn’t matter when so many pundits dispense conflicting advice in the financial media. This amounts to “analysis into paralysis” and results in the typical investor being unable to “pull the trigger” on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

In my latest book, “Gold & Gold Stock Trading Simplified,” I remove the mystique behind gold and gold stock trading and reveal a completely simple and reliable system that allows the small-to-mid-size trader to profit from both up and down moves in the mining stock market. It’s the same system that I use each day in the Gold & Silver Stock Report – the same system which has consistently generated profits for my subscribers and has kept them on the correct side of the gold and mining stock market for years. You won’t find a more straight forward and easy-to-follow system that actually works than the one explained in “Gold & Gold Stock Trading Simplified.”

The technical trading system revealed in “Gold & Gold Stock Trading Simplified” by itself is worth its weight in gold. Additionally, the book reveals several useful indicators that will increase your chances of scoring big profits in the mining stock sector. You’ll learn when to use reliable leading indicators for predicting when the mining stocks are about o break out. After all, nothing beats being on the right side of a market move before the move gets underway.

The methods revealed in “Gold & Gold Stock Trading Simplified” are the product of several year’s worth of writing, research and real time market trading/testing. It also contains the benefit of my 14 years worth of experience as a professional in the precious metals and PM mining share sector. The trading techniques discussed in the book have been carefully calibrated to match today’s fast moving and volatile market environment. You won’t find a more timely and useful book than this for capturing profits in today’s gold and gold stock market.

The book is now available for sale at: http://www.clifdroke.com/books/trading_simplified.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold Strategies Review newsletter. Published each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.