The New World Order of Global Sovereigns

Interest-Rates / Global Debt Crisis Aug 03, 2011 - 06:21 AM GMTBy: EconMatters

The U.S. debt ceiling political soap has finally come to an end. With the debt deal done, the U.S. has dodged a major bullet of a debt default, but may not be out of the woods yet for a sovereign credit downgrade. Nevertheless, regardless whether one or more of the Big 3 agencies (S&P, Moody's and Fitch) would really deal a downgrade to the U.S., it is the markets that holds the key to a sovereign's credit worthiness based on its ability to manage a balanced budget, implementing proper monetary and fiscal policies. From that perspective, the markets probably have already spoken.

The U.S. debt ceiling political soap has finally come to an end. With the debt deal done, the U.S. has dodged a major bullet of a debt default, but may not be out of the woods yet for a sovereign credit downgrade. Nevertheless, regardless whether one or more of the Big 3 agencies (S&P, Moody's and Fitch) would really deal a downgrade to the U.S., it is the markets that holds the key to a sovereign's credit worthiness based on its ability to manage a balanced budget, implementing proper monetary and fiscal policies. From that perspective, the markets probably have already spoken.

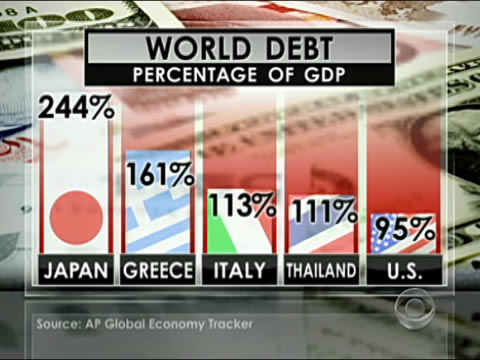

A Reuters analysis discusses that typically the sovereign -- the government -- is seen as the most solvent entity in the country, but with a number of governments face bigger risks of downgrades or defaults, some multinational corporations are enjoying higher cash flows, and set to benefit from higher ratings than their sovereigns.

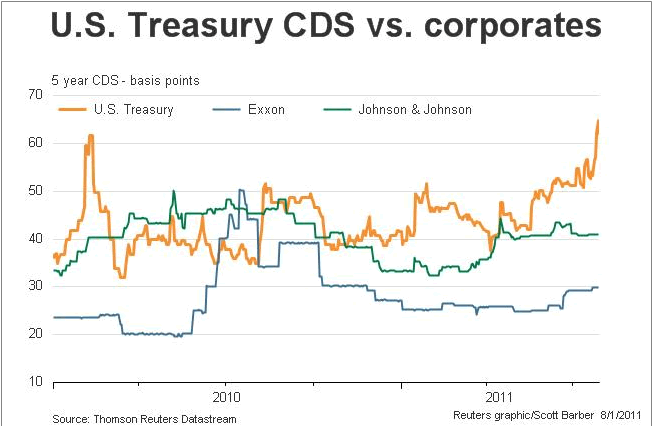

According to Reuters, in the United States, the cost of insuring the debt (i.e. CDS or credit default swap) of Automatic Data Processing (ADP), Exxon Mobile (XOM), Johnson & Johnson (JNJ) and Microsoft (MSFT) against default on a five-year horizon is at least 20 basis points lower than that of the U.S. government (See Chart) All four U.S. companies boast triple-A ratings, the same as the U.S. government, but S&P has said that a change in the U.S. sovereign credit rating or outlook will not affect these four corporations.

Moreover, a New World Order has emerged for the global sovereigns, as Reuters reports,

"Globally, 107 corporate and local governments have higher ratings than those of the sovereign in their country of domicile on a foreign currency basis, Standard & Poor's says. That means these entities are seen as likely to be able to cover their debt obligations even when the central government of the country they are based in cannot."

"Balance sheets of OECD countries will continue to deteriorate. You're looking at a medium to long-term credit downgrade cycle over the next five years," said [Ashok] Shah [chief investment officer of London & Capital.]

Indeed, with a whopping $76.2 billion in cash and marketable securities, Apple (AAPL) now has more cash than the U.S. government. Some jokingly said the U.S. government could ask Steve Jobs for a loan and that Uncle Sam should start selling iPads. These might seem like jokes for the time being, but they also might have foretold things to come in the relationship between corporations and their respective domiciles, and the changes in government entity structure where sovereign may operate more like a business

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.