Gold & Silver Surge on Perfect Storm, Chavez Gold Action Leads to Backwardation, Short Squeeze

Commodities / Gold and Silver 2011 Aug 19, 2011 - 10:28 AM GMTBy: GoldCore

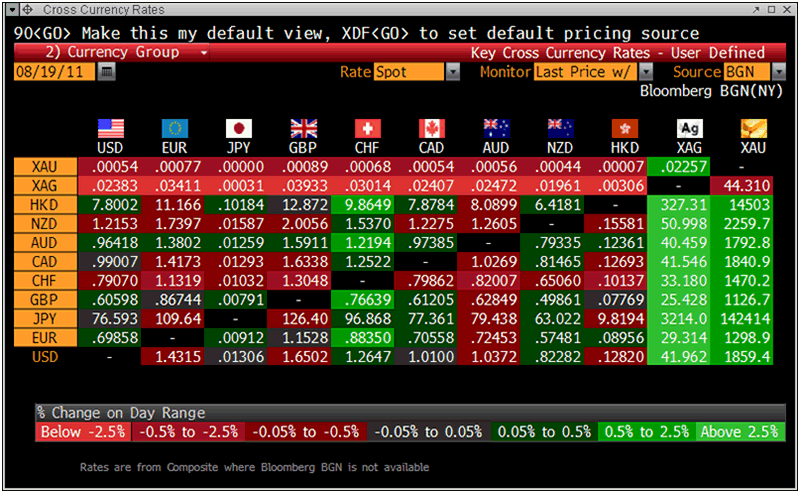

All major currencies have fallen sharply against gold and silver again today with gold reaching new record nominal highs in Canadian and New Zealand dollars, in sterling, in euros and of course in dollars as turmoil continues in global markets.

All major currencies have fallen sharply against gold and silver again today with gold reaching new record nominal highs in Canadian and New Zealand dollars, in sterling, in euros and of course in dollars as turmoil continues in global markets.

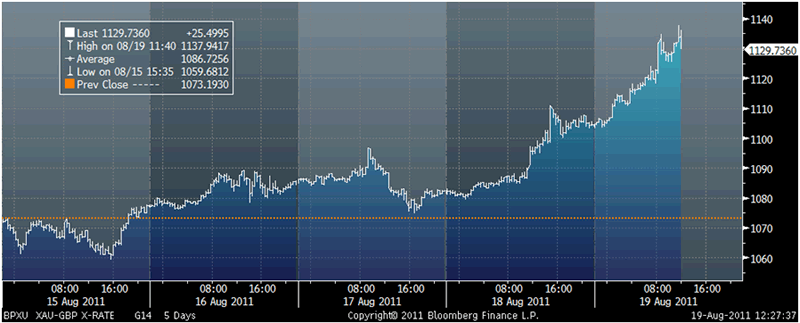

In volatile trade, gold is down 1% from new record highs and is trading at USD 1,860.10, EUR 1,300.40, GBP 1,126.40, CHF 1,470.90, and JPY 142,414 per ounce and has risen some 2% in all currencies. Silver has surged by nearly 3% in all major currencies.

Cross Currency Table

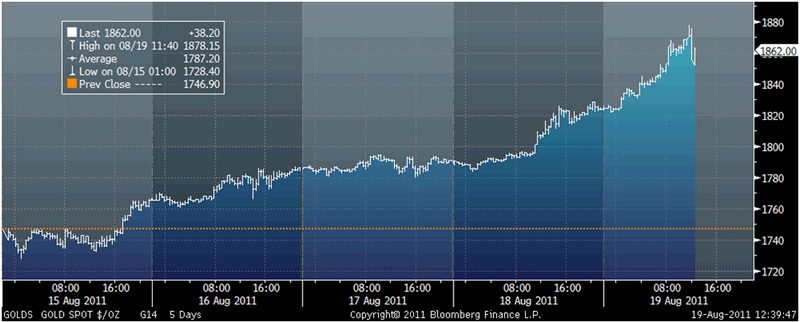

The London AM fix was a third consecutive record nominal high in US dollars. Gold’s London AM fix this morning was USD 1,862, EUR 1,299.28, GBP 1,126.91 per ounce (from yesterday’s USD 1,794.50, EUR 1,246.44, GBP 1,087.12 per ounce).

Markets continue to assess the ramifications of Venezuela deciding to repatriate their large gold reserves from London to Caracas. Their reserves are large in gold tonnage terms but small in dollar terms.

Venezuela’s central bank is the world’s 15th largest holder of gold, with 365.8 tonnes, of which some 211 tonnes, worth $12.3bn are held in London with the Bank of England and JP Morgan, Barclays, and Bank Of Nova Scotia.

Many analysts and the Gold Anti-Trust Action Committee (GATA) have long contended that much of the central bank gold reserves have been leased out by bullion banks and that in the event of central banks choosing to repatriate their bullion, significant supply issues could develop which would lead to a short squeeze and a parabolic increases in prices.

The concern is that other central banks concerned about dollar and currency debasement and expropriation of their gold reserves by embattled large debtor sovereign nations may follow suit.

A short squeeze is quite likely given the scale of global investor and central bank demand.

GOLD SPOT $/OZ

Already, there is a small degree of backwardation developing in the gold market with certain near term futures contracts now trading at higher prices than longer term contracts. The near term August ’11 contract was trading at $1,871.40/oz while June ’12 contract is trading at $1,870/oz (12:16 GMT). The spread between spot and longer term contracts has fallen suggesting that gold may soon join silver in backwardation.

Silver has been in backwardation for seven months now and backwardation appears to be deepening again. This morning the September ‘11 contract is trading at $41.41 while December ‘12 is trading at $40.65.

The possibility of backwardation in gold suggests that major investors are concerned about the supply of physical gold. Buyers are concerned about securing supply in the future and are willing to pay a premium for spot or immediate delivery.

It could indicate that the short squeeze anticipated by many is taking place and we could see a sharp upward move in gold prices.

XAU-GBP EXCHANGE RATE

This would not be surprising considering the very small size of the physical bullion markets versus the size of the overall financial and currency markets and considering the high demand coming from investors and central banks globally.

It is worth remembering what happened when silver went into backwardation some months ago. It led to a price surge from $30/oz to over $50/oz in 10 weeks.

Backwardation rarely happens in the gold and silver bullion markets. Since gold futures first started to be traded in 1972 (on the Winnipeg Commodity Exchange), there have only been momentary backwardations of a few hours.

It suggests that larger gold bars are difficult to acquire in volume and that the physical market is becoming stressed and less liquid.

Backwardation can end in default, failure to make delivery and in sharply higher prices. A default on the COMEX would have important ramifications for the dollar and could see sharp selling of the dollar and sharp falls on global markets.

Gold backwardation has been warned of by newsletter writer Denis Gartman overnight. He said that if Chavez “does push” for repatriation of $11 billion of gold reserves held in developed nations’ institutions it could lead to backwardation which would wreak ‘havoc’.

Investors should buy “nearer gold” and sell deferred bullion futures, he wrote. October and December futures will trade to premium over February and beyond in this case, Gartman wrote.

Meanwhile, in another sign of gold experiencing a near perfect storm, UBS have said that macro hedge funds were noted buyers and may also have dominated demand during yesterday's Comex sweeps. They said that the funds may have been waiting for a correction to buy but due to concerns of the market moving away from them decided to buy yesterday.

“If participation from the macro hedge fund community has only just started to accelerate, this adds a new dynamic to the gold market.”

In normal financial and economic times, gold would be considered overvalued but we are far from that today and gold is experiencing a near perfect storm which could propel prices higher.

JP Morgan’s call for $2,500 gold by year end does not sound that outlandish given the fraught financial, economic and monetary conditions today.

A correction remains a real possibility but buying and holding bullion remains the best strategy in today’s volatile markets.

Cost averaging (dollar, euro, pound) is worth considering after the recent price move.

For the latest news and commentary on gold and financial markets please follow us on Twitter.

SILVER

Silver is trading at $41.79/oz, €29.03/oz and £25.26/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,124.27/oz, palladium at $747/oz and rhodium at $1,775/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.