Stock Market Bulls Find Their Footing

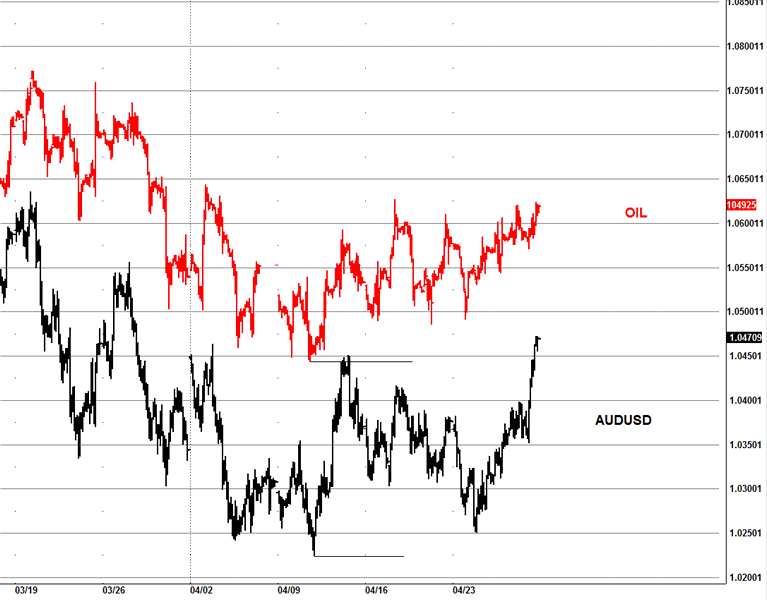

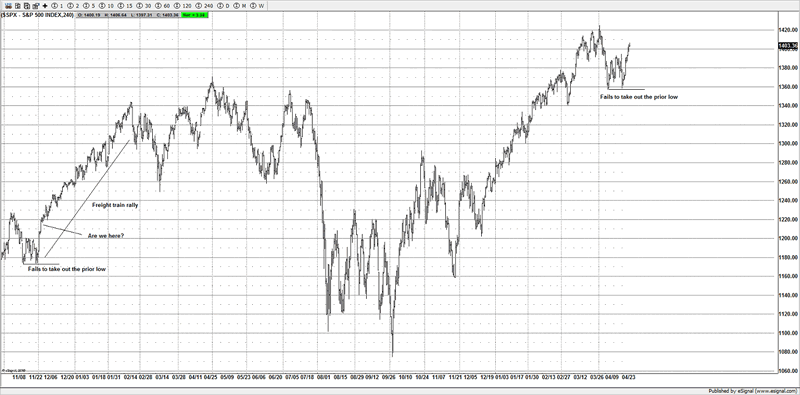

Stock-Markets / Financial Markets 2012 Apr 29, 2012 - 06:14 PM GMT The decline that we have seen over the past few weeks has been very corrective and does not support a strong break lower; the result was a strong reversal higher from our targets as expected. If you noticed the AUDUSD pair failed to take out its previous lows so held key support, as well as oil holding the $102 area. As long as you see other risk markets support US stocks I don't see any evidence to support a bearish stance atm.

The decline that we have seen over the past few weeks has been very corrective and does not support a strong break lower; the result was a strong reversal higher from our targets as expected. If you noticed the AUDUSD pair failed to take out its previous lows so held key support, as well as oil holding the $102 area. As long as you see other risk markets support US stocks I don't see any evidence to support a bearish stance atm.

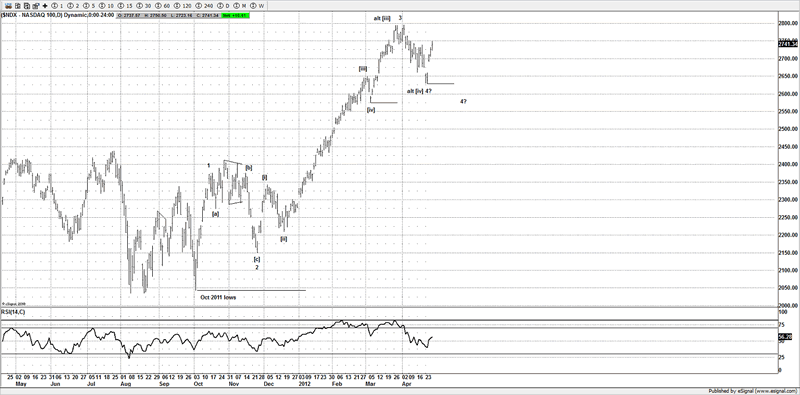

Simply put the bears never stood a chance, the trend remains up since the Oct 2011 lows and we need to respect that, the low is likely in although there is an alternative ideas in the markets to test those lows again we saw in the week, but that will only come on a breakdown of previous support areas.

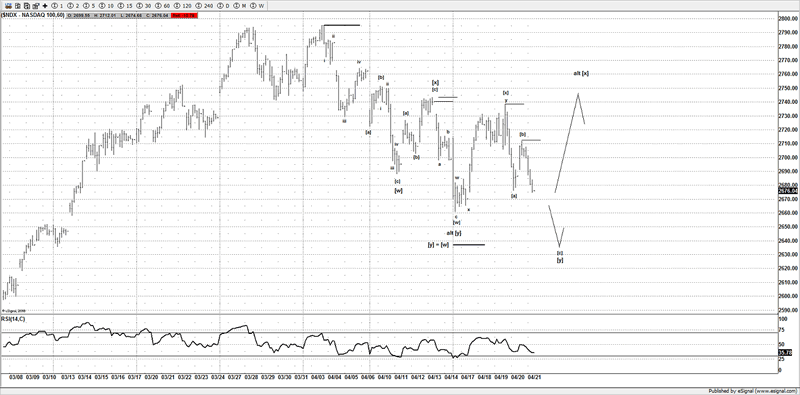

NDX

Following on from last week's report, we indeed got the new low I was expecting and covered our shorts at the lows, the NDX hit my target and reversed, thus confirming the decline likely completed and the bulls take the markets higher.

The target was 2636 as posted from last week's report, it got triggered and the bulls really did make a stand, one would think they got my "special" areas in advance. ![]()

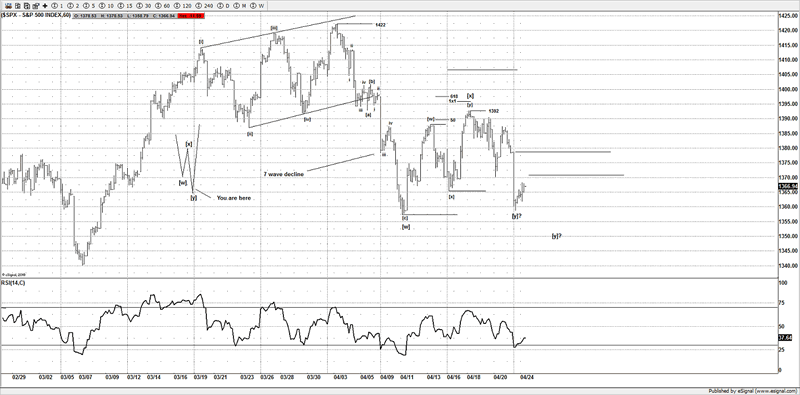

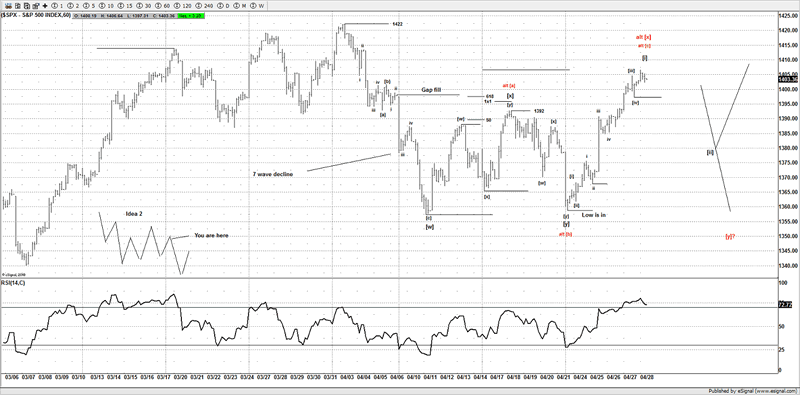

Before

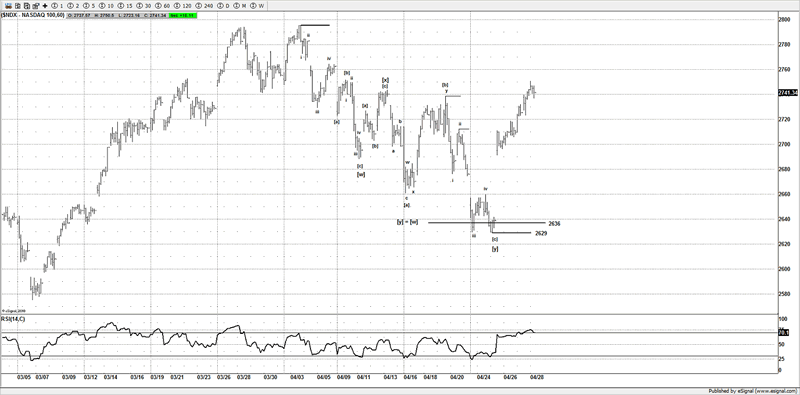

After

The decline was simply part, if not all of a corrective decline, I saw no reason to get bearish expecting some sort of crash as many traders were looking for, just by looking at the price structure gave you high odds to suggest the decline was a corrective move and the odds favor a reversal higher and back to test the March 2012 high potentially onwards to see above 2800, maybe even near 3000.

If we go on the basis of a 5 wave advance from the Oct 2011 lows, then this is still short of some waves and a potential target could be towards 3000, it suggests a new high above the high made in March 2012.

Like any 4th wave they have a nasty habit of fooling many traders, but you have a base marker at last week lows to use for risk control, as long as you see a choppy decline (should we see a pullback) then look to buy those dips against the lows made at 2629.

2629 would be your stop.

SPX

The same idea is seen on the SPX, I thought we would see 1350-1355 and a new low, but it was not to be, I was cautious about the market reversing as the NDX hit its target and the DOW simply refused to join in lower, the RUT was back to prior lows as well, all in all it made us get out of shorts.

Although we had to really wait on the AAPL and FOMC news, so rather than take the risk, being flat was a safer option, but it sure beats being on the wrong side as I suspect many bears were this past week.

Most of the rally came after the AAPL results, then you had to wait on the FOMC, so not exactly great odds to put in our favor, but still we have some strong ideas going into this coming week.

Before

After

Short term this looks like a 5 wave advance finished, so we want to see a pullback to at least confirm if a 3 wave decline towards 1370-80SPX and then we can look to buy it, only a strong break under 1370SPX would suggest the alternative ideas of seeing below 1358SPX etc.

If wave 4 is in as shown on the red wave count then we should see a pullback and then mount a strong move higher, so the low is in at 1358SPX then it's ready to take out the 1422SPX high and onwards to above 1450-1500SPX maybe even towards new ATHs.

But we can watch other markets and the actual structure to help confirm targets.

So if we see a pullback it has to hold above 1358SPX for the bull idea for wave 4 and now started wave. 5 so wave [i] of 5 in place then pull back in wave [ii] and then rally higher in waves [iii], [iv] and [v] of 5 thus completing the move from the Oct 2011 lows and potentially a move from the March 2009 lows.

Seeing the US markets push higher, should see the European markets such as the DAX, CAC and EURSTOXX 50 to correct the 5 wave decline from March 2012.

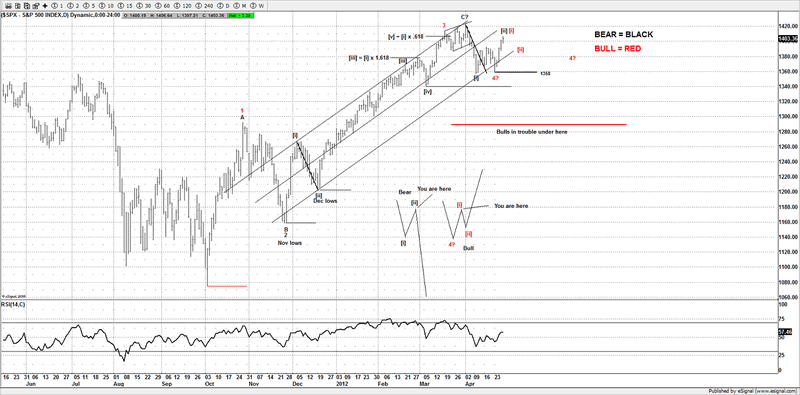

SPX Fractal

One scary chart I think the bears want to watch is if this fractal plays out, it sure does look similar.

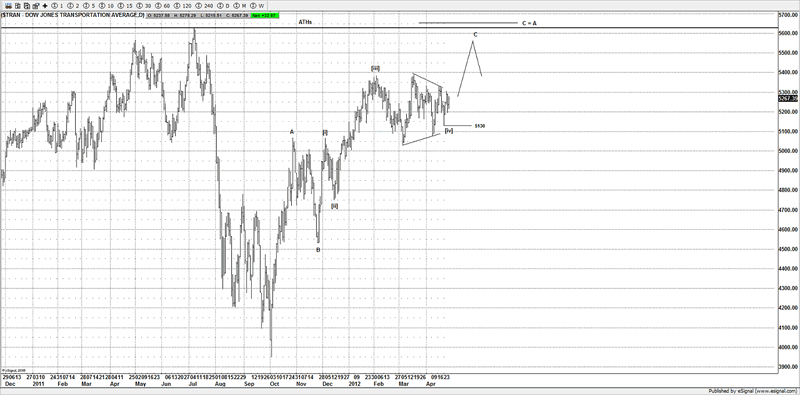

Dow Transports

If there is one market that suggests higher as well, it's the Dow Transports; this coiling we are seeing suggests that of a triangle and ready to thrust higher.

This whole mess appears as a triangle which when its ready would suggest a thrust higher, so above 5130 needed for a move higher.

Conclusion

Currently the US markets suggests a setup to push higher, although if they are still involved in wave 4 from the Oct 2011 lows, then it's possible to morph into a sideways pattern and cause havoc with traders, but the character of previous corrections has been short and sweet and then continue higher, so I have no reason not to think the bulls won't come roaring back now.

Last week lows are key support in the markets to maintain the near term bullish view.

If you're looking for analysis such as seen on these pages, then I encourage you check out our services, I am sure there is something for every trader, whether you are a full time professional or investor or a part time trader who is looking after his/her retirement funds, I am sure the analysis you will find, will help make the right trading decision.

Until next time.

Have a profitable week ahead.

Click here to become a member

You can also follow us on twitter

What do we offer?

Short and long term analysis on US and European markets, various major FX pairs, commodities from Gold and silver to markets like natural gas.

Daily analysis on where I think the market is going with key support and resistance areas, we move and adjust as the market adjusts.

A chat room where members can discuss ideas with me or other members.

Members get to know who is moving the markets in the S&P pits*

*I have permission to post comments from the audio I hear from the S&P pits.

If you looking for quality analysis from someone that actually looks at multiple charts and works hard at providing members information to stay on the right side of the trends and making $$$, why not give the site a trial.

If any of the readers want to see this article in a PDF format.

Please send an e-mail to Enquires@wavepatterntraders.com

Please put in the header PDF, or make it known that you want to be added to the mailing list for any future articles.

Or if you have any questions about becoming a member, please use the email address above.

If you like what you see, or want to see more of my work, then please sign up for the 4 week trial.

This article is just a small portion of the markets I follow.

I cover many markets, from FX to US equities, right the way through to commodities.

If I have the data I am more than willing to offer requests to members.

Currently new members can sign up for a 4 week free trial to test drive the site, and see if my work can help in your trading and if it meets your requirements.

If you don't like what you see, then drop me an email within the 1st 4 weeks from when you join, and ask for a no questions refund.

You simply have nothing to lose.

By Jason Soni AKA Nouf

© 2012 Copyright Jason Soni AKA Nouf - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.