Gold is at or Very Near, a Long-Term Bottom

Commodities / Gold and Silver 2012 May 08, 2012 - 05:17 AM GMTBy: Toby_Connor

I am making Monday's premium report available to the public.

I am making Monday's premium report available to the public.

I doubt anyone was surprised by the reversal in the dollar index today.

It’s been made painfully clear that Bernanke is not going to tolerate a rising dollar, at least not for very long. Cycles are still working, and still generating bounces out of daily cycle lows, but they are never allowed to get any traction before the next beat down starts.

I would say there’s a pretty good chance that today’s reversal is signaling that the current daily cycle topped on day four, and the pattern of lower lows and lower highs is still intact.

Presumably the dollar will now start to decline and penetrate the May 1st intraday low before the next significant bounce. The daily cycle timing bands have adhered pretty closely to standard durations in the dollar index. I don’t see any indication that has changed, so we can probably expect the next significant bounce sometime around the last week of May.

Stocks:

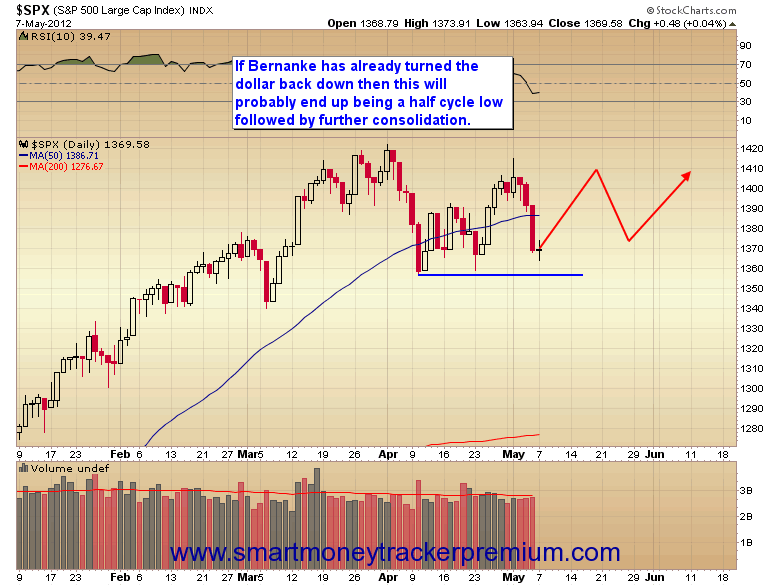

If the dollar cycle has topped then the half cycle low scenario is still on the table.

In this scenario the stock market is on day 19 of its daily cycle and due to form a half cycle low at any time. As most of you probably remember, I’ve been expecting an extended consolidation in the general stock market. A dollar cycle topping on day 4 and a half cycle low on day 19 would be consistent with that theory.

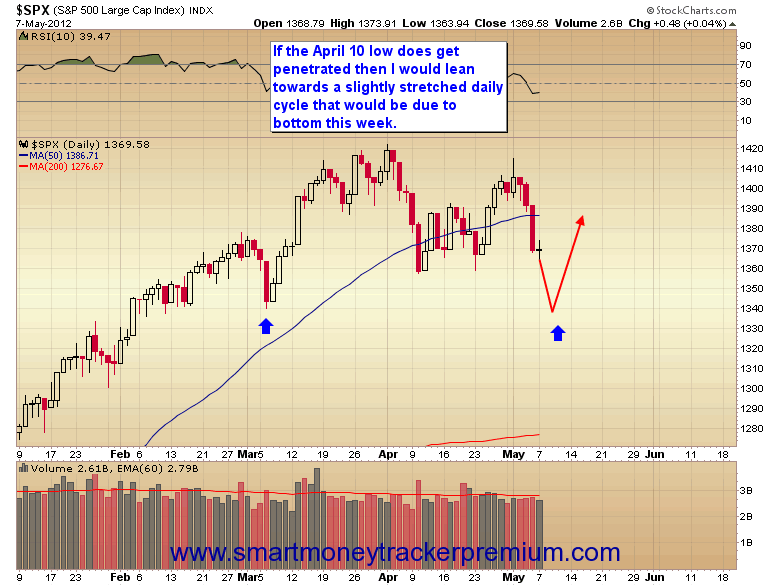

If by some chance the dollar can recover and continue to rally for a few more days it could force stocks to penetrate the April 10th low. In that scenario I would re-phase of the daily and intermediate cycles as shown in the chart below.

At the moment I have no idea which scenario has greater odds of playing out, although I must admit the reversal today does not look good for the dollar.

Gold:

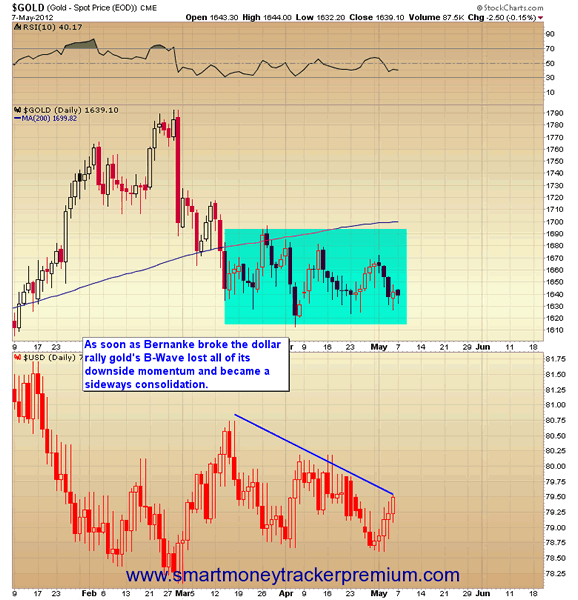

In my opinion gold is trying to move down into one more failed and left translated daily cycle, which I’m pretty confident would mark an intermediate degree bottom. However, as you can see from the chart below, as soon as Bernanke broke the dollar rally gold lost all of its downside momentum.

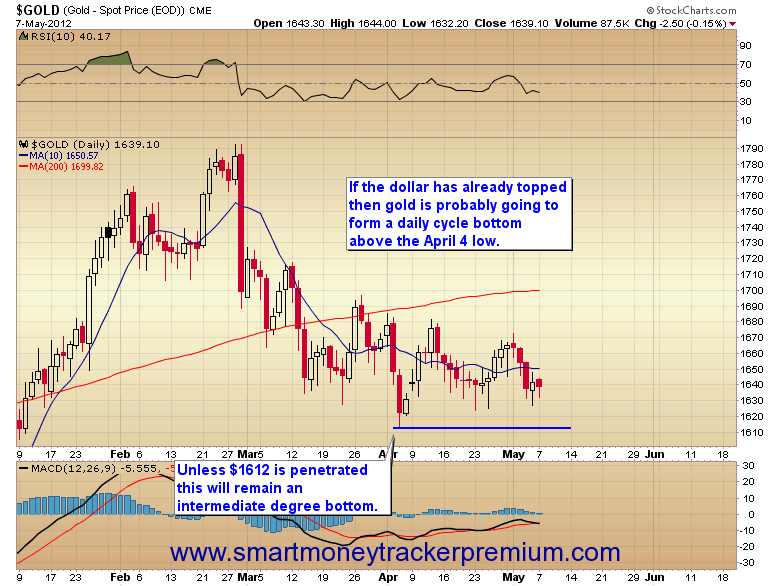

This has turned gold’s B-Wave decline into a mostly sideways consolidation for the last two months. If the dollar has indeed topped then I have my doubts that gold will be able to finish its intermediate decline and penetrate the April 4 low. The fact that the current daily cycle is running out of time may indicate that we are going to have to leave the April 4 low as an early intermediate bottom.

I would prefer to see gold drop down and penetrate $1612 as it would make the intermediate cycle count “fit” better. I know that’s not what most of you would like to see. Most of you probably just want the draw down to end as quickly as possible. I on the other hand understand that this is a secular bull market and that this is going to be a winning trade (well unless the bull market has ended). So I’m not overly worried about a draw down. In a bull market timing mistakes get corrected.

To me a move below $1612 means that we didn’t waste an entire daily cycle on a sideways consolidation and that we have all of a new intermediate cycle still ahead of us. That’s why I would prefer to see gold poke through the April 4 low. It would signal that we have more time to rally, an entire daily cycle more.

So even though we weren’t able to time a perfect bottom, I’m confident that we have entered “close enough” and when the regression to the mean occurs, and it always eventually does, our mining positions are going to deliver a very hefty profit.

Heck, if one was willing to just turn their computer off and wait for the bubble phase of the bull market, our current positions are probably set up to deliver a 500-1000 percent gain. Of course the cost is that you have to ignore the market and go on with your life for the next several years.

When you think about it, that’s a pretty good bargain. Do absolutely nothing, and get rich doing it.

I think we are at, or very close to what is likely to be a once or twice a decade opportunity in the metals sector, especially the mining stocks. If you like today’s report the $10 one week trial is still available. That includes the archives, cycle counts, COT reports, and model portfolio. I strongly suggest one read the last several weeks of reports so they understand how we got here and what is unfolding.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2012 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.