Commercials Gold Short Covering of Massive Short Positions, COT Report

Commodities / Gold and Silver 2012 May 13, 2012 - 01:59 AM GMTBy: Marshall_Swing

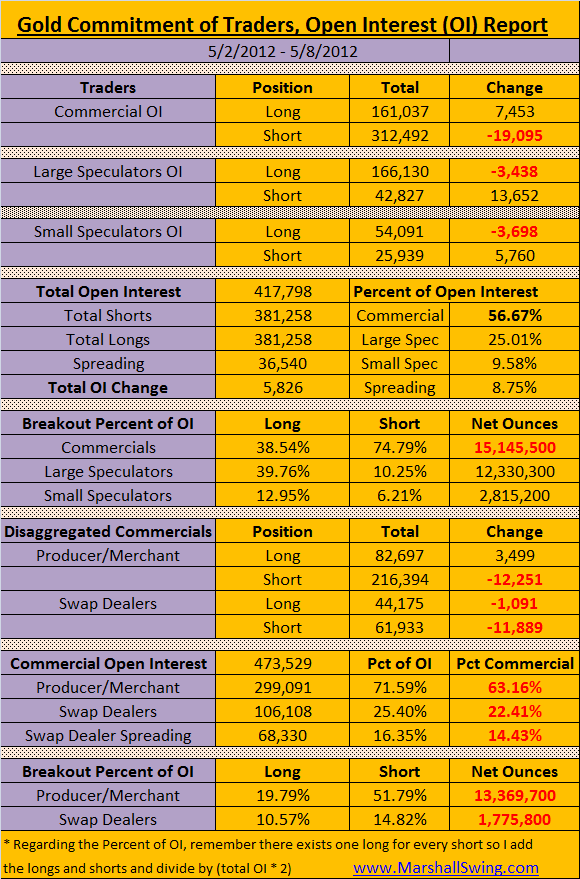

Commercials bought a huge 7,453 longs and covered a humongous -19,095 shorts to end the week with 56.67% of all open interest and now stand as a group at -15,145,500 ounces net short, a mammoth decrease of almost 1,500,000 ounces net short from the previous week. I hope you understand what they are doing here. They intend to go net long at some point in the near future as they know exactly what the future holds. They will maximize their profit to the fullest. They will take the price of gold down until they are either net long or fully long and have bought up every speculator long that they can. It is very important that you review last week's COT because in it, plus this last Wed - Fri trading days are the key to where the gold price is going and how it is going to get there.

Commercials bought a huge 7,453 longs and covered a humongous -19,095 shorts to end the week with 56.67% of all open interest and now stand as a group at -15,145,500 ounces net short, a mammoth decrease of almost 1,500,000 ounces net short from the previous week. I hope you understand what they are doing here. They intend to go net long at some point in the near future as they know exactly what the future holds. They will maximize their profit to the fullest. They will take the price of gold down until they are either net long or fully long and have bought up every speculator long that they can. It is very important that you review last week's COT because in it, plus this last Wed - Fri trading days are the key to where the gold price is going and how it is going to get there.

Large speculators coughed up -3.438 longs and picked up an out of this world 13,652 shorts for a net long position of 12,330,300 ounces, a decrease of just less than 2,000,000 ounces from the prior week. Somebody needs to manage these long speculators. They should contact me immediately for advice at mswing@MarshallSwing.com and a much needed (for them) consulting opportunity for me. They are so misguided and I am quite sure it is because of following the ILL advice of so many positive writers/commentators in the silver and gold industry. Those writers/commentators do not understand what is happening right before their very eyes! What in the world are they thinking buying that many shorts. The commercial producer/merchants will have a field day with them unless they are reading my analysis.

Small speculators were just as wayward and lost -3,698 longs and oh my goodness purchased a huge 5,760 shorts for a net long position of 2,815,200 ounces a tremendous decrease of almost 1,000,000 ounces net long from the prior week.

The commercials are working their way out of their massive short positions they have accumulated, over the years, and those positions are not there for window dressing. They patently manipulate the silver and gold markets at the benevolence of the CFTC's full board of commissioners. The CFTC knows exactly what these producer/merchants are doing to these speculators, right now, killing them, and these commissioners have placed their full blessing upon this rampant destruction of speculator long positions. I remained absolutely convinced that Bart Chilton is not honest in his wanting to see position limits placed. None of the other commissioners are honest as well and are pawns of the producer/merchants and the swap dealers. It must feel really good to be in the same bedroom with them to the rape, pillage, and sack of billions of dollars of speculator's hard earned cash. Blythe Master's is the harlot of Revelation, I believe. This is as disgusting as it gets. She was just on CNBC recently and poo pooed JPMorgan's mammoth short positions as being "hedging". She is a rapist par excellante. Without a peer in her own bank.

For your convenience, if you would like to contact the CFTC and express your views to them, I have provided you their phone numbers and I hope earnestly that you fill up their phone libnes: http://www.cftc.gov/Contact/index.htm and email addresses as well:

ggensler@cftc.gov Chairman Gensler

bchilton@cftc.gov Commissioner Chilton

jsommers@cftc.gov Commissioner Sommers

Somalia@cftc.gov Commissioner O'Malia

mwetjen@cftc.gov Commissioner Wetjen

dmeister@cftc.gov Director Meister

How long must the there exist no free market for speculators in the COMEX metals? How much ill-gotten gain from speculators, at the hands of these producer/merchants, is enough for these commissioners to act and do their jobs to ensure a free market can counter their massive open interest monopolies?

The only way to beat the producer/merchants at their game is to go long and stay long. Easier said than done when you watch price drop significantly below your buy price, I know.

See you next week!

Marshall Swing

The Got Phyzz? Report

© 2012 Copyright Marshall Swing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.