Olympic Calm Before Coming Financial Storm

Commodities / Gold and Silver 2012 Aug 13, 2012 - 07:01 AM GMTBy: GoldCore

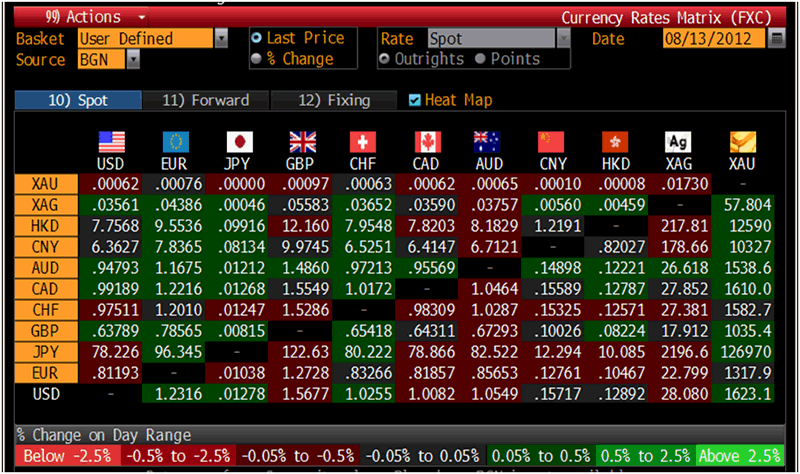

Today's AM fix was USD 1,622.25, EUR 1,317.30, and GBP 1,035.33 per ounce.

Today's AM fix was USD 1,622.25, EUR 1,317.30, and GBP 1,035.33 per ounce.

Friday’s AM fix was USD 1,608.50, EUR 1,310.92 and GBP 1,030.69 per ounce.

Silver is trading at $28.04/oz, €22.81/oz and £17.94/oz. Platinum is trading at $1,405.30/oz, palladium at $580.10/oz and rhodium at $1,060/oz.

Gold rose $2.70 or 0.17% in New York on Friday and closed at $1,620.40/oz. Silver fell and then recovered to $28.32, but finished on Friday in New York with a loss of just 0.4%.

For the week, gold rose 1.1% and silver rose 1.2%.

Cross Currency Table – (Bloomberg)

Gold inched up again on Monday, continuing the climb for its 7th session as world economies falter – increasing the likelihood of further central bank policy action – which may again prove futile.

The yellow metal will become sought out by investors as an inflation hedge when quantitative easing is pursued again and huge amounts of money are again dumped into the financial system in what seems like an increasingly vain attempt to stimulate growth.

In line with China’s poor data on Friday, Japanese data earlier today showed that their economy slowed greater than expected in 2Q.

Gold and silver markets have been extremely subdued of late with Bloomberg terminals abandoned in favour of the marvellous spectacle that was the London Olympics. Many traders, decision makers and institutional participants were off on holidays and or enjoying watching the Olympics.

The precious metals have been strangely becalmed despite significant volatility being seen in stock markets. Economic data has been poor and largely gold positive and this could result in a bout of buying with the return of important market participants.

The distracting spectacle of the Olympics may have led to market complacency and the cocktail of macro risks and geopolitical risks such as the euro zone debt crisis and events in Syria and Iran could lead to the Olympic calm giving way to a volatile and stormy Fall.

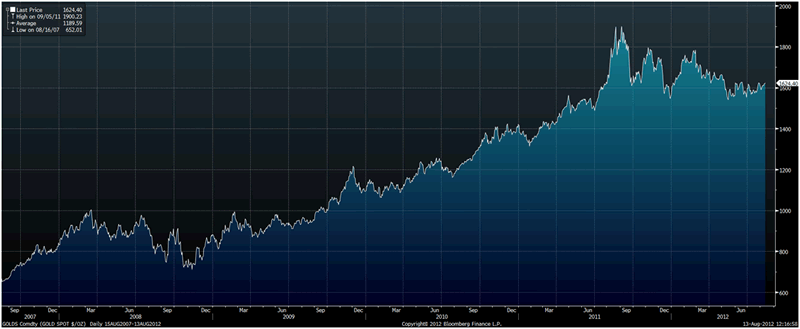

Gold Spot $/oz Daily - (Bloomberg)

It is important to note that markets were also unusually calm during the two weeks of the Chinese Olympics in 2008. The 2008 Summer Olympic Games took place slightly later in August than the London Olympics – starting August 8 and ending August 24.

Only days after the ending of the Chinese Olympics came massive market volatility in September and then seven months of market turmoil.

Similarly to this Olympic year, in Olympic year 2008, gold traded sideways to down in a period of consolidation prior to further gains. Gold bottomed in September 2008 in euro and sterling terms.

Another brief bout of dollar strength saw gold bottom in November 2008 in dollar terms.

Besides the eurozone crisis (and the significant risk of the German Constitutional Court deciding on September 12th to reject the recently cobbled together alphabet soup response to the crisis (ESM etc etc) and significant instability in the Middle East, there is also the not inconsequential risk from the US Presidential campaign and the upcoming ‘fiscal cliff’.

These factors should see gold well supported again in the coming months.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.