Are American's Having Enough Babies to Stop Turning Japanese?

Politics / Demographics Dec 06, 2012 - 10:47 AM GMTBy: Money_Morning

Keith Fitz-Gerald writes:

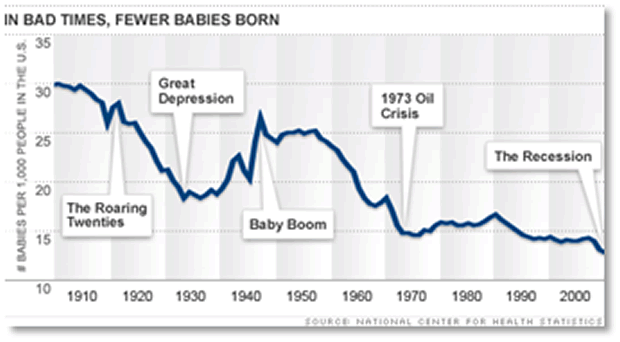

A new study by The Pew Research Center shows that the birth rate in the United States has dropped to the lowest level since 1920, when reliable statistics were first made available.

Keith Fitz-Gerald writes:

A new study by The Pew Research Center shows that the birth rate in the United States has dropped to the lowest level since 1920, when reliable statistics were first made available.

The birth rate dropped precipitously last year to only 63.2 per 1,000 women of childbearing age (which is defined as 15 to 44 years of age). That is half of what it was in 1957 at its peak.

Most people aren't troubled by this -- but they should be. Here's why.

Our low birth rate has tremendous implications at all levels of our society. What's more, it is yet another sign that we are turning Japanese.

Now I know the idea that we are becoming more and more Japanese-like is not without its fair share of criticism.

People question me all the time about it - challenge me is more like it - arguing that the United States is different. That somehow, unlike Japan, we're going to escape the economic mess we've created for ourselves.

Having spent more than 20 years closely involved in Japanese society as a businessman, a husband, a father, and a part-time resident, I think that's wishful thinking.

The truth is any population decline in the United States will have severe implications for our economic way of life exactly the way it has in Japan.

And it's not just the numbers of births that matter, but rather all of the things that stem from low birth rates years down the line.

The Future Pitfalls of the Decline in U.S. Birth Rates

For example, a lower birth rate means fewer job prospects in the future. It also means fewer workers feeding into a system that actually requires more workers to support the greying society we live in.

With declining birth rates, Japan is now expected to drop from 2.8 workers supporting each retiree in 2008 to 1.5 by 2050.

Here in the United States, our trend is headed in the same direction, where a mere 2.6 workers will be expected to support each retiree by 2050. That's a 44.68% decrease from the 4.7 workers in 2008 -- and a whopping 85.65% reduction from the 42 workers who supported each retiree at the end of WWII.

There are implications in terms of health care rationing, too. It will affect home care, assisted living, traffic, mobility, technology, and taxes. Especially taxes...

Of course, with the fiscal cliff approaching, the tax debate is now front and center. But lower birth rates also mean much of the debate is misdirected.

It's not so much a matter of taxing the rich as it is how we deal with declining revenues. No matter how you cut the moral debate about taxing the rich or having more people pay in, fewer workers will mean future tax receipts go down.

And that, in turn, means there will be even less to spend when the rapidly graying population needs it the most.

Our military is also predicated upon national policies that have been developed during times of economic prosperity and are now being carried out at a time of transition. This is a mismatch. Older societies tend to be more survival oriented, so it's entirely possible that the way in which our nation conducts itself in the international community will change.

Perhaps that's not such a bad thing, though, if we are less likely to send our sons to war so easily - but that's a subject for another time.

Our immigration policy, too, merits serious consideration in light of the low birth rate data, especially when we've been building a model based on newly immigrated foreign- born mothers having more children than U.S.- born women. Just because that's worked in the past doesn't mean that the same thing will work in the future.

That's the case, for instance, among Mexican immigrant women who were singled out by the Pew data as having the largest birth rate decline of any group included in the study - 26%. That's a 400% larger decline than U.S.- born women, who saw their overall birthrate fall 6%.

Am I making a mountain out of a molehill here? After all, one data point does not make a trend.

Further, you can counter, as many people do, that modern contraception and better sex education are also factors that could contribute to slowing childbirth.

Both of those things are true; I merely think there's more to this story.

Having spent more than two decades carefully studying both countries, I am convinced that there is a link between economic development and fertility.

Specifically, I believe falling fertility rates here in the U.S. herald some truly world- altering ramifications, not the least of which is that we are making the same damning mistakes Japan has made over the last 30 years.

The similarities include:

•The lowest birth rate in history and one that's going in the wrong direction - check.

•A growing number of old people dependent on a smaller number of workers - check.

•Failed stimulus programs - check.

•Outrageous amounts of debt that can never be paid back being spent to make up the leverage gap - check.

And I'm not alone. There is an increasingly vocal group of scientists who believe that higher human development is negatively correlated with lower fertility rates. In other words, the more "advanced" a society becomes, the less fertile it is.

Others, like Mikko Myrskyla of the Max Planck Institute for Demographic Research, believe that there is a "j-curve" of sorts, and that advances in economic development can reverse fertility rate declines.

I think this is like counting leprechauns under the rainbow. The laws of nature are immutable:

1) If you don't have new children, you cannot replace your population.

Japan is literally dying. It's got the worst demographics ever recorded. The number of senior citizens, or "silvers" as they are called because of their silver- colored hair, is growing faster than both the number of new workers needed to support them and the number of children needed to replace them.

So fast, in fact, that the last Japanese will be born in 3011 -- only 1,000 years from now, according to a study from Hiroshi Yoshida of Sendai.

Between the low birth rate and aging population, Japan will lose more than 33% of its population by century's end. The Japanese government estimates that the birth rate will drop so far, so fast, that it will hit a mere 1.35 children per woman in her childbearing years within the next 50 years.

This is made worse by the fact that 36% of men between the ages of 16 and 19 have no interest in sex. More than 60% of unmarried men don't have girlfriends while more than 50% of single women in the same age group are not dating.

So far the United States remains a highly "sexed" society but how much longer will that last? I don't know. But the data, whether you include immigrants or not, seems to suggest that reproduction is the issue.

2) It's becoming too expensive to raise children.

Raising a child from birth to the point where he or she becomes a productive adult can bankrupt even the most productive of families in Japan. My wife and I, for example, know plenty of couples who are perfectly happy not to have children because they don't want the economic stress of raising children in Japan when the economy has been stuck in a rut since they were born.

This has significant implications, particularly when it comes to future employment and the housing recovery everybody seems so fixated on.

You can have the best jobs in the world, but if there's nobody to fill them, the point is moot. Productivity per worker may rise, but barring the massive advances in robotics and other compensatory technologies everybody expects, overall productivity will decline.

As for housing, it's much the same story. People may not think immediately about this, but in Japan where we've seen this play out over 20+ years, the results are extremely evident. Rural housing remains but a fraction of what it cost at the height of Japanese prowess. Many homes are simply empty and decaying.

Banking debt there remains underestimated even today and construction companies are confounded by staggering low levels of new housing formation (the numbers of new families being formed) and the number of young people moving permanently back in with their parents.

It will be the same here in 30 years' time.

3) Technology provides limited compensation.

Many people assume that the use of robotics and other technology will help alleviate the burden associated with aging. I share that opinion but believe it will do nothing to change the societal impact of bad economic conditions on fertility rates.

More than 50% of the world's population now lives in countries with falling and, more specifically, below- replacement fertility numbers. That number was a mere 8% in 1970, according to an older paper by Nobel laureate Professor Gary Becker of the University of Chicago and a deep thinker when it comes to the effects of low birth rates on future economic activity.

4) Immigration might help in the short term but can't solve the problem.

One of the reasons that Japan is in such trouble is the near- complete lack of a workable immigration policy. Migrant workers remain tightly controlled and their children are not recognized as Japanese citizens -- even if they are born on Japanese soil.

Japan has experienced a tremendous shift in education, how young people are employed, and a dramatic polarization of younger versus older members of their society. Have s and have- not s are not the issue. What seems to be at stake is the sentiment that the older generation has had it all, while leaving tremendous burdens to the younger generation that they didn't sign up for.

We've had tremendous immigration into the United States but that appears to be flattening, and our immigration policy remains a wreck despite the fact that it's very different from Japan's.

5) Politicians may not be able to fix this

America, like Japan, is torn on many levels. We are looking to Washington with ba ted breath, hoping our leaders can solve our problems -- but that may be completely futile.

Even if our politicians come to their senses tomorrow, they may not be able to fix this. And, if there is a lesson to be learned from Japan, perhaps that's it.

Demographics is not a policy issue. Declining birth rates are about demographics. They are inescapable.

That's why we must continue to invest in companies that favor the aging population, create technologies we need as oppose to those we simply want, and that pay us for the risks we take.

Source :http://moneymorning.com/2012/12/06/is-america-h...

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.