Bitcoin Price Trading Range Narrows

Currencies / Bitcoin Feb 04, 2014 - 10:18 AM GMTBy: Mike_McAra

Key take away from this alert: in our opinion, closing long positions is not the way to go.

Key take away from this alert: in our opinion, closing long positions is not the way to go.

On Jan. 30, the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of Treasury released two additional guidelines on Bitcoin. The first takes a stance on whether Bitcoin miners are to be considered money transmitters:

To the extent that a user mines Bitcoin and uses the Bitcoin solely for the user's own purposes and not for the benefit of another, the user is not an MSB under FinCEN's regulations, because these activities involve neither "acceptance" nor "transmission" of the convertible virtual currency and are not the transmission of funds within the meaning of the Rule.

In other words, if you mine Bitcoins for your own account, you're not under regulations for money transmitters. The second ruling offers some insight as to whether companies investing in Bitcoin are considered money transmitters:

(...) to the extent that the Company limits its activities strictly to investing in virtual currency for its own account, it is not acting as a money transmitter and is not an MSB under FinCEN's regulations.

Which means that companies investing in or speculating with Bitcoin are not considered money transmitters. Why is this important? Because being a money transmitter adds restrictive responsibilities to your business operations.

These rulings seem to recognize that entities might want to mine bitcoins for other money and they might want to invest in Bitcoin without necessarily wanting to transfer money to other parties. This piece of regulation will most likely be welcome by Bitcoin enthusiasts. It is also another proof that government agencies are hard at work trying to figure out rules for Bitcoin.

Now back to the market itself.

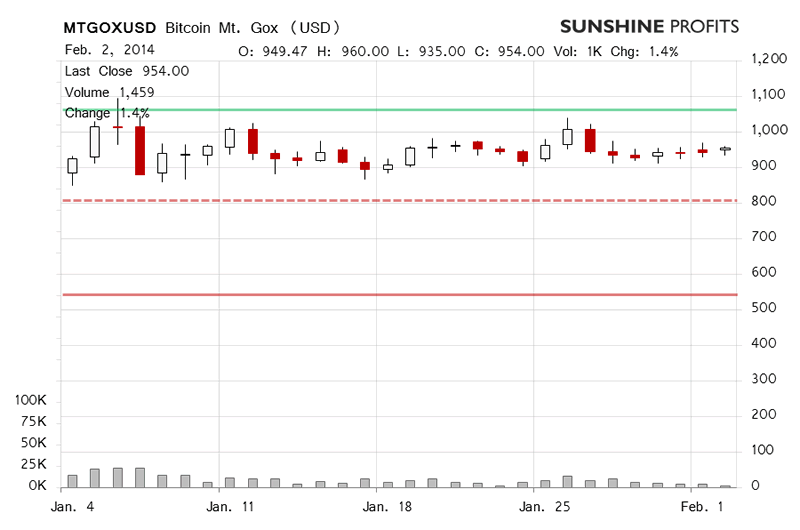

On Mt. Gox, Bitcoin went 1.4% up yesterday to end the day at $954.00. The volume was real tiny, B1,458.55. Stagnant is the word for what we saw then. No moves, no action and Bitcoin still seemed stuck at around $950.

Today, the action has been down, Bitcoin has lost 0.7% so far (this is written past 7:20 a.m. EST). The volume at B619.63 is almost non-existent, might turn out to be lower than yesterday. In combination with the barely moving price, not much has been going on today.

We've been writing about the lack of action in the Bitcoin market for some time now. But it seems that if we thought there had been no moves in Bitcoin earlier, the market is testing our patience now. Even compared with most of January, what's been happening since last Tuesday looks jarringly calm.

Since Jan. 28 Bitcoin has, in fact, barely moved. That day saw relatively high volume (compared with the recent levels) of B10,017.57 but in the following days the trading subsided. These developments might be read as a situation in which the price-setting mechanism was tested on Jan. 28 and investors were seeking a new price level following the more volatile period of Jan. 25-27. There was no pronounced move and the price settled around $950 and has been trading there ever since. But there is no certainty that this is what actually happened.

Anyway, we've been experiencing a period of tiny ticks within a period of calm. We don't see the price as truly stabilized at $950. Neither do we think that there's no possibility of Bitcoin taking a sudden turn anytime. The amount of bitcoins exchanged today up to the moment we write this is below $600,000. This might be a whole awful lot of money if you're an individual investor, but might be barely noticeable to spend for companies or even wealthy individuals. No, this is not about manipulation. The fact that the volume is so small warns us that it might be easy to swing the price one way or another but our point is that at such times even medium-size orders can visibly move the market without speculation in mind.

The current environment suggests that most of the appreciation/depreciation might take place in very short periods of time. On the other hand, these moves might be short-lived if they are not followed by more capital.

So far, nothing has changed. Bitcoin is still between $800 (dashed red line on the chart, our stop-loss level) and $1,000-1,100 (which is marked by the solid green line on the chart). The short-term outlook remains unchanged. If there is anything worrying, it might be the volume. A couple of bigger orders might start a new trend here.

It is unclear how long the current cooling-down period in the Bitcoin market might last. As we've written before, we would like to see at least one more swing at $1,000 before reconsidering our opinion on positions in the market. We're not seeing such a move at the moment, so there's no change in our take on the market just now.

Summing up, there's been almost no action in the market. This means that Bitcoin might be prone to sudden moves in case big orders are placed now but the short-term outlook remains unchanged, in our opinion.

Trading position: it is our opinion that being long might be more profitable just now than being short or being out of the market, and that the appropriate stop-loss level might be $800. We are looking for more orders coming in and for an immediate trend to crystalize.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.