Why Bitcoin Prices Are Rising Again

Currencies / Bitcoin Mar 07, 2014 - 02:25 PM GMTBy: Money_Morning

The mainstream media has put out a lot of stories detailing the demise of the Mt. Gox exchange, but they haven't had nearly as much to say about why Bitcoin prices are rising again.

The mainstream media has put out a lot of stories detailing the demise of the Mt. Gox exchange, but they haven't had nearly as much to say about why Bitcoin prices are rising again.

Maybe that's because so many of them are rooting for Bitcoin to fail, especially if they're on record having written off the digital currency as a bubble. But reality keeps interrupting that narrative - and rather rudely.

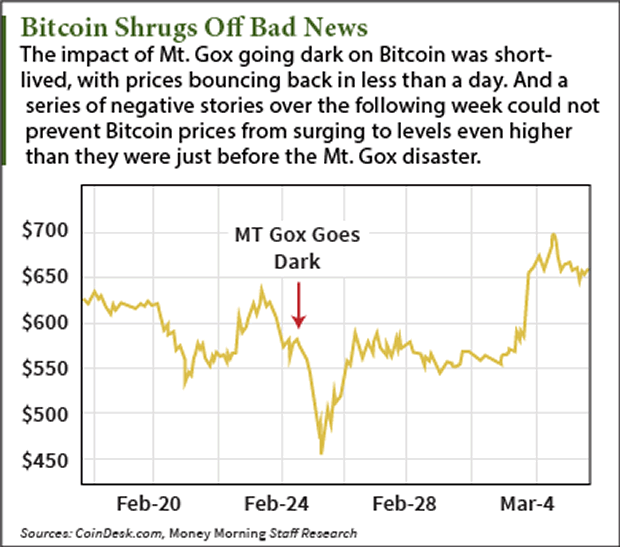

The day that Mt. Gox went dark, Feb. 25, the CoinDesk Bitcoin Price Index (BPI), a composite of the major Bitcoin exchanges, slumped as low as $462.98. That represented a 60% drop from the BPI peak of $1,147.34 hit on Dec. 4, and appeared to confirm that Bitcoin was fast on its way to the dustbin of history.

Except that Bitcoin prices started to quickly recover. The next day Bitcoin prices rose as high as $589.81, a 27.4% increase.

For the next week or so, Bitcoin prices stabilized. Then on Monday Bitcoin prices shot up another 18% to $661.12, and then got within $5 of $700 on Tuesday.

Individually, several of the major Bitcoin exchanges breached the $700 barrier, with BitStamp going as high as $710.

What makes this latest Bitcoin price surge all the more remarkable is the steady drumbeat of bad news about the digital currency over the past month or so.

First there was the Mt. Gox affair. Long plagued by issues in getting fiat currencies from Mt. Gox to user bank accounts, by January customers were complaining of slow Bitcoin transfers. Then, on Feb. 7, Mt. Gox stunned customers by freezing all Bitcoin transfers.

But that was just a prelude to what happened on Feb. 25, when Mt. Gox suspended all trading and went dark. The once-mighty Bitcoin exchange filed for bankruptcy three days later.

And while the Mt. Gox collapse has gotten most of the attention, it hasn't been the only source of pressure on Bitcoin prices...

Bitcoin Prices Hit from Several Directions

For example, just one day after Mt. Gox shut down, Sen. Joe Manchin, D-WV, suggested in a letter to the Treasury Department and the U.S. Federal Reserve that Bitcoin should be banned in the United States because it "has allowed users to participate in illicit activity, while also being highly unstable and disruptive to our economy."

Then, this week Nobel Prize-winning economist Robert Shiller (best known for co-creating the widely cited Case-Shiller home price index) wrote a guest column in The New York Times observing that Bitcoin "has exhibited many of the characteristics of a speculative bubble" and that "Bitcoin's future is very much in doubt."

On Monday, legendary investor Warren Buffett declared on CNBC on Monday that Bitcoin "does not meet the test of a currency," adding "I wouldn't be surprised if it's not around in 10 or 20 years."

And as if that weren't enough, on Tuesday word came that another Bitcoin-based business, a Bitcoin bank called Flexcoin, had closed because hackers had stolen 896 bitcoins, worth about $600,000.

Yet despite it all, and in the wake of the worst crisis yet to strike Bitcoin in the Mt. Gox debacle, Bitcoin prices soared 43% over the past week.

It makes the question of why Bitcoin prices are rising that much more intriguing.

Why Bitcoin Prices Are Rising Again Despite Negative News

Logically, Bitcoin prices should be plummeting, or at least depressed.

So what's up?

One long-shot possibility is that Bitcoin enthusiasts were cheered when Her Majesty's Revenue & Customs (the tax authority in the UK) issued tax guidance on Bitcoin, offering clarity on how the digital currency will be treated there.

But while a positive sign, the UK tax guidance only affects a small slice of the Bitcoin community (a similar announcement from the Internal Revenue Service would be a huge deal, though).

Eric Spano, director of finance at the Bitcoin Embassy in Montreal and a director of the Bitcoin Alliance of Canada, told Kitco News that the surge in Bitcoin prices was the result of buyers recognizing that there's more to the digital currency than one failed exchange.

"Any issues these companies may be having are not necessarily rated to the Bitcoin protocol or the network itself," Spano said.

A story on CoinDesk, a repository of Bitcoin news, suggested a related theory - that all the media attention on Bitcoin over the past 10 days or so has caught the attention of new buyers, who see the lower prices as an opportunity to jump in.

Many Bitcoin enthusiasts are convinced that Bitcoin prices will not only return to the highs of last December, but will keep rising to $2,000, $5,000, and eventually even $10,000 and beyond.

Spano added that collapse of Mt. Gox and other Bitcoin sites, while unfortunate, is just what you'd expect during the maturation of a very young marketplace.

"In Bitcoin, nobody is too big to fail," Spano said. "But overall by weeding out the bad actors, Bitcoin will become stronger. It's all part of the maturity of this industry. The people who can't keep up with the industry or are not prepared... will eventually get kicked out."

Why do you think Bitcoin prices are rising again? Do you think prices will stabilize near current levels, or can they go much higher? Speak your mind on Twitter ;@moneymorning or Facebook.

Most of the tech world sees Bitcoin as the future of money, with many likening it to the Internet in the early 1990s. But investing in Bitcoin isn't quite like investing in other things. Here's a short guide on how to buy Bitcoin...

Source : http://moneymorning.com/2014/03/05/bitcoin-prices-rising/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.