Bitcoin Price Strong Appreciation to Be Followed by Declines?

Currencies / Bitcoin Apr 14, 2014 - 02:10 PM GMTBy: Mike_McAra

In not too many words: we don’t support any short-term positions just now.

In not too many words: we don’t support any short-term positions just now.

First of all, a security update coming from Bitcointalk, a forum for Bitcoin aficionados. The following message was posted on the site:

A bug in OpenSSL, used by Bitcoin-Qt/Bitcoin Core, could allow your bitcoins to be stolen. Immediately updating Bitcoin Core to 0.9.1 is required in some cases, especially if you're using 0.9.0.

The full announcement:

If you are using the graphical version of 0.9.0 on any platform, you must update immediately. Download here. If you can't update immediately, shut down Bitcoin until you can. If you ever used the payment protocol (you clicked a bitcoin: link and saw a green box in Bitcoin Core's send dialog), then you should consider your wallet to be compromised. Carefully generate an entirely new wallet (not just a new address) and send all of your bitcoins there. Do not delete your old wallet.

If you are using any other version of Bitcoin-Qt/Bitcoin Core, including bitcoind 0.9.0, you are vulnerable only if the rpcssl command-line option is set. If it is not, then no immediate action is required. If it is, and if an attacker could have possibly communicated with the RPC port, then you should consider your wallet to be compromised.

This vulnerability is caused by a critical bug in the OpenSSL library used by Bitcoin Core. Successfully attacking Bitcoin Core by means of this bug seems to be difficult in most cases, and it seems at this point that even successful attacks may be limited, but I recommend taking the above actions just in case.

If you are using a binary version of Bitcoin Core obtained from bitcoin.org or SourceForge, then updating your system's version of OpenSSL will not help. OpenSSL is packaged with the binary on all platforms.

A lot of technicalities here, but the gist of it is – if you’re using the 0.9.0 graphical version of the Bitcoin Core (Bitcoin-Qt) wallet, you must update the software version to 0.9.1 as soon as possible. You can do it here.

Even if you use other software as your wallet, you might have to either update to a new bug-free version or go offline with your wallet and wait for such version to become available. Wallet software using the OpenSSL library is affected. Best check with your software provider if you need to upgrade.

This is not the first bug in Bitcoin wallets, probably not the last one and it has been reported that stealing funds by exploiting this bug might be relatively difficult and of limited impact but it is better to be safe than sorry.

Now, let’s move on to the charts.

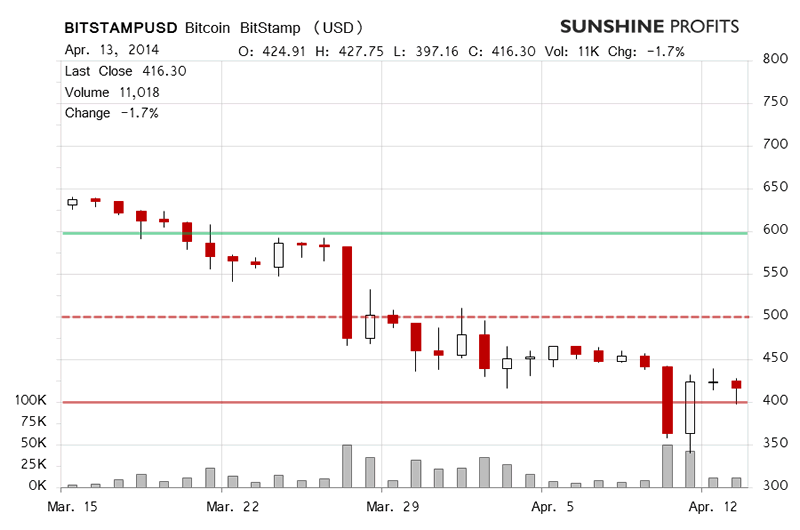

On BitStamp, Bitcoin “calmed down” over the weekend with trading subsiding on Saturday and staying relatively peaceful on Sunday. It looked like traders took a weekend break and Bitcoin stayed between $400-450 for the most part of the weekend.

Today, trading has once again picked up but hasn’t been as heavy as on Friday (this is written just before 11:00 a.m. EDT). The price has gone 10.7% up, to just over $460. This comes as no surprise to our readers, since we outlined such a possible scenario in our Bitcoin commentary on Friday:

We are prepared to see more appreciation in the next couple of days but our guess is that Bitcoin will move lower afterwards. It is also possible that the decline will resume tomorrow. Tomorrow’s close will most probably tell us whether further appreciation is to be expected.

Either way, going long seems particularly risky at this time. If we see more weakness tomorrow or a move higher on declining volume, we might consider going short based on the possible move down. A move below $400 could be such an indication.

Bitcoin hasn’t gone above $500, which doesn’t really change the short-term outlook. It still seems that going long now is very risky.

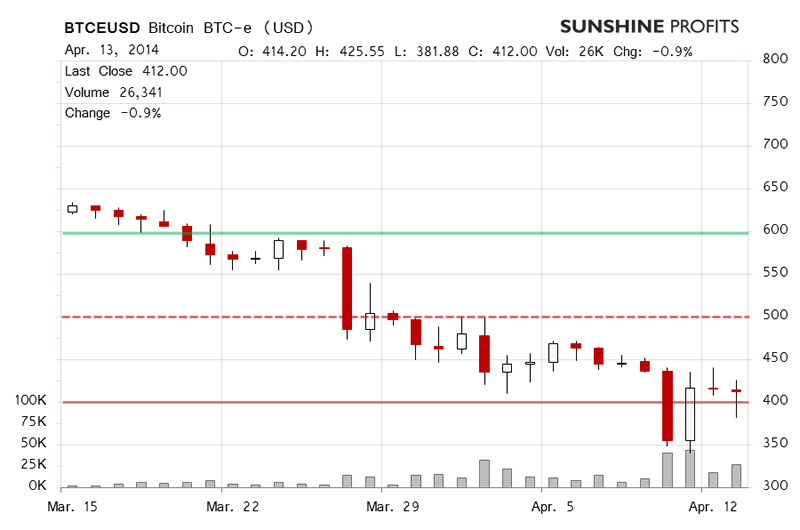

On BTC-e, the events developed pretty much in line with what happened on BitStamp. The action over Saturday and Sunday was less intense than on Friday and Bitcoin stayed between $400-450 most of the time.

Today, the move has been up, 9.6% but the trading isn’t as heavy as we see it on BitStamp. It’s not clear where the volume will end up being but we haven’t really seen a surge in volume so far. This doesn’t support a strong move up.

The short-term outlook remains bearish, although we might still see some appreciation. We expect it to be followed by either strong declines or a period of stagnation and, afterwards, depreciation.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market at this moment. Going long seems particularly risky at this time.

Trading position (short-term, our opinion): no positions. If we see the appreciation stop, we will be on the lookout for shorting opportunities.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.