Bitcoin Price Moving Down but What Kind of Move Is It?

Currencies / Bitcoin May 02, 2014 - 06:36 PM GMTBy: Mike_McAra

Briefly: we don't support any short-term positions in the Bitcoin market now.

Briefly: we don't support any short-term positions in the Bitcoin market now.

Bitcoin's popularity has spread in the recent months and this is acknowledged by the number of articles there are out there on cryptocurrencies. Articles also posted by news services and financial websites. Now the popularity of Bitcoin has been confirmed by Bloomberg. The company has recently decided to include Bitcoin in the vast universe of financial instruments reported within Bloomberg's data stream.

On Apr. 30, the firm posted a notice in which it informed that Bitcoin would be available on the Bloomberg terminal:

Regardless of your position, virtual currencies have become increasingly interesting to investors and financial market participants around the world. That's why we are pleased to announce today that Bloomberg is providing Bitcoin pricing to our 320,000+ global subscribers. By typing VCCY<GO> on the Bloomberg Professional service, business and financial professionals can now monitor and chart data from bitcoin exchanges Coinbase and Kraken, while tracking related virtual currency news and social media posts from more than 100,000 sources.

This is a data service only and traders cannot actually trade bitcoins on Bloomberg but it definitely is a step bringing the currency closer to financial professionals the world all over.

We expect Bitcoin data to become increasingly available from major data providers. This is part of the Bitcoin market maturing. Other financial instruments such as Bitcoin derivatives or inverse EFTs (regular ETFs are either already available or in the process of being reviewed by the SEC) might follow.

Let's focus on the charts now.

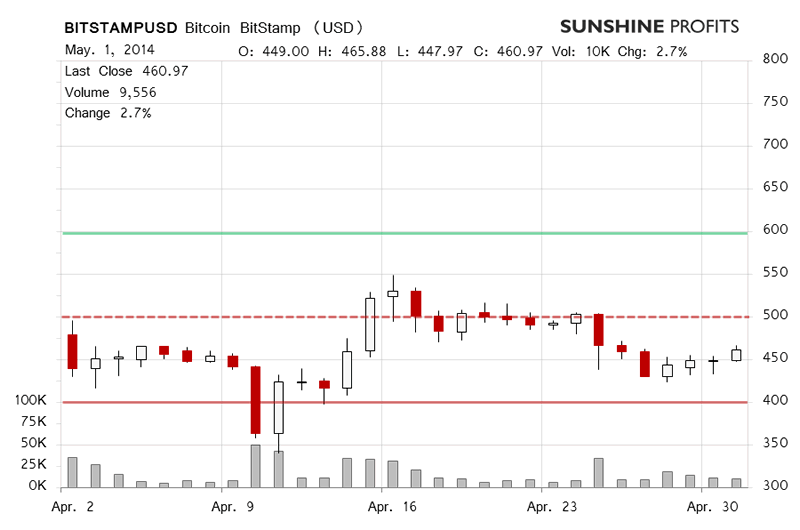

Bitcoin went 2.7% up yesterday on BitStamp. This was a fifth day of gains in a row, but also a fifth day of falling volume. The overall move up from Apr. 27 until May 1 didn't read as strongly bullish even for the short-term. Bitcoin appreciated but didn't really get to close to the $500 level (dashed red line in the chart).

The lack of indication of a stronger move up has been confirmed today (this is written at 10:45 a.m. EDT). We've seen Bitcoin decline 3.0% which is not a bullish development. On the other hand, it doesn't really look like the decisive move down we've been waiting for for a couple of days now. The lack of a visible increase in volume suggests that this move might be part of the back and forth movement we've anticipated recently.

The implications here are not bearish enough to go short.

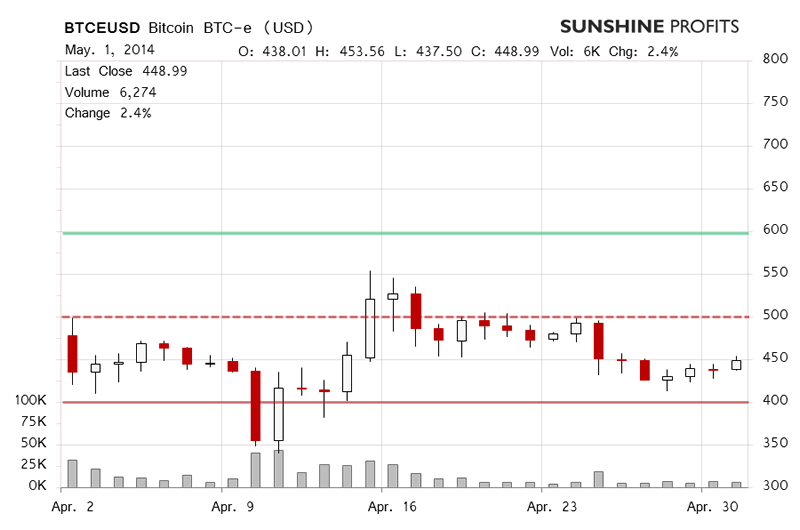

BTC-e saw Bitcoin gain 2.4% yesterday. The volume didn't display such a visible trend as it did on BitStamp but was not strong enough to suggest any kind of meaningful move up. Even though Bitcoin went up, the short-term outlook remained unchanged - bearish.

Today, Bitcoin has lost 3.6%, more than on BitStamp, and is currently around $430. This is not far enough from $450 to consider and immediate move below $400 (solid red line in the chart), particularly that we still haven't seen a confirmation in trading volume. What we're seeing now might still be part of the up-and-down action we wrote about in our Bitcoin Trading Alert on Apr. 26 one alert after we suggested taking your profits off the table because of a possible move up:

We don't view this move up as anything more than a pause after a period of declines and expect to see some wrangling around $450 or a decline to $400 in the near future. The next days will probably help in answering which scenario will exactly happen.

The back-and-forth action has been playing out in the last couple of days. Our bet is that it will be followed by more depreciation but the current move down is not strong enough to go short just yet.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market now.

Trading position (short-term, our opinion): no positions. We're waiting to see more weakness in the market.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.