Five Reasons For Some FED Action

Interest-Rates / Quantitative Easing Jun 19, 2014 - 07:59 AM GMTBy: Submissions

Sant Manukyan writes:

QE-1? Have to admit it did work pretty well. Unlocked the credit markets, gave a boost to the asset prices and more importantly pushed the rates even lower. QE-2? Depends, but if the intention was to keep the long rates down yes it did work. QE-3? I don’t think it really did work. Not only QE is not “printing money” and “reserves can not be lend” it is not intended to create inflation as well. And before the next recession strikes, been 5 years since the end of the Great Recession, the FED better lock some of it’s tools up into the tool box so that it can them out later. Any reason for tightening? Sure, here they are:

Sant Manukyan writes:

QE-1? Have to admit it did work pretty well. Unlocked the credit markets, gave a boost to the asset prices and more importantly pushed the rates even lower. QE-2? Depends, but if the intention was to keep the long rates down yes it did work. QE-3? I don’t think it really did work. Not only QE is not “printing money” and “reserves can not be lend” it is not intended to create inflation as well. And before the next recession strikes, been 5 years since the end of the Great Recession, the FED better lock some of it’s tools up into the tool box so that it can them out later. Any reason for tightening? Sure, here they are:

- Even though Yellen and some FOMC members believe the unemployment rate is “extremely or insanely high” comparing the rate with the post WW2 average does not say so. To be fair it is high but nothing extreme to see here.

2. Inflation is low. PCE wise it is even lower. But take a look at the numbers below. I am not talking about the headline CPI. Core Services CPI for the past 3 months is trending significantly higher and stands at 2.8% annualized. Something to keep an eye on.

3-Washington we have a problem! I will not argue if Jeremy Stein is right or wrong regarding his concerns on financial stability. But there is obviously something odd. VIX is at the lowest since 2007, bond volatility index Move is at a record low, hi-yield –investment gread spread ; again very low. Almost 400 days have passed since the S&P touched it’s 200 day moving average (a rare trend indeed) and as Bloomberg has mentioned the index has not moved (up or down) more than 1% for 41 days. Longest streak since 1995.

Participation rate is surprisingly low. Or is it? Take a look at this http://www.bls.gov/opub/mlr/2002/09/art3full.pdf and this http://www.chicagofed.org/digital_assets/publications/chicago_fed_letter/2012/cflmarch2012_296.pdf . Way back in 2002 analysts knew what was coming. No denial, some of the decline is due to the economy. However it’s share is not more than 50%. The World is changing, demographics are changing, educational habits are changing , male and female behaviour is changing.Hey, FED has a female president!! The sooner FED gets it the better.

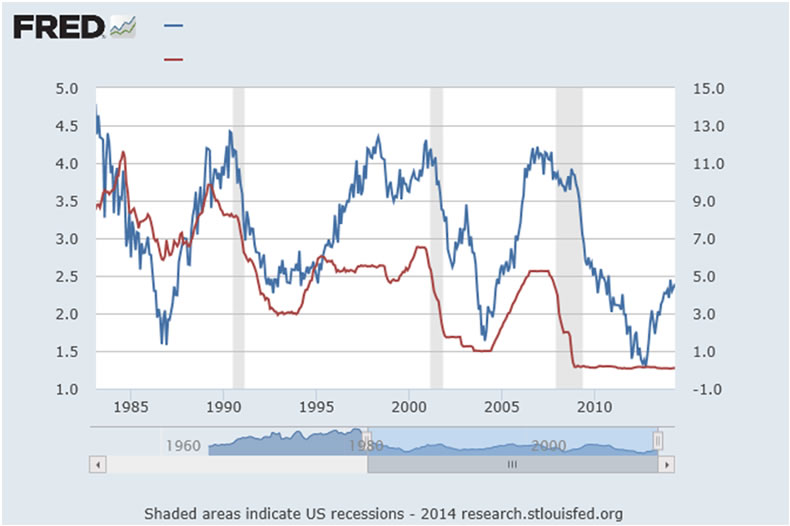

4-Wage gains are not phenomenal that’s right. But history tells us that FED does not wait for fantastic numbers. What we have seen so far was enough for the FED to hike rates in many of the previous cases.

Avg. Hourly Earning of Production and Nonsupervisory Employees vs FED Rates

5-Blow you see a simple version of the Taylor model which provides us a theoretical FED rate. The model was consistently implying higher rates during the Greenspan era. Now it (blue line) points to about two percent. You can see that during the hight of the crises the model implied a negative rate which is of course (are we sure?) impossible.

However that’s what QE is for. And right now the shadow rate in the States is actually negative! http://www.frbatlanta.org/cqer/researchcq/shadow_rate.cfm

To wrap up, I can not argue for an immediate rate hike but the Federal Reserve must end the QE as soon as possible and must stop communicating dowish signals. History has taught us, they don’t serve for the greater good and it does not end kindly.

Sant Manukyan

Is Menkul Degerler Investment

Manager, International Capital Markets

Twitter:@SantManukyan

Mail: smanukyan@isyatirim.com.tr

© 2014 Copyright Sant Manukyan - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.