Bitcoin Price Strong Move Possibly Ahead

Currencies / Bitcoin Jul 15, 2014 - 06:12 PM GMTBy: Mike_McAra

In short: we still support speculative long positions in the market, stop-loss at $550.

In short: we still support speculative long positions in the market, stop-loss at $550.

Reid Hoffman, LinkedIn co-founder, expressed his views on Bitcoin in a CNBC interview:

Another one that I've been paying a lot of attention to in the last 6 to 12 months has been Bitcoin. I think it's an incredible system that's created a ledger that is across -- a distributed ledger across the whole world for it can be money but it can also be other things. I think there's a lot of different things happening.

Asked about investment in the currency, he replied:

Well, at this moment, it's so early, I wouldn't have someone buy a bitcoin, put any money into Bitcoin unless they were willing to lose their money. It's very early. It's very speculative but the platform nature of it, you can then begin to express electronic contracts. You can have Bitcoin stand for something that isn't just a bitcoin. (…) It could mean your car, so then your car could be accounted for on a general ledger that is then -- you know, you can do electronic contracts. You could put liens against it. You could all kinds of other things. Moving it all into electronic age in terms of how it operates and so that's the reason I think the platform layer, the bitcoin as a ledger layer is the most interesting layer.

Hoffman actually touches upon a point rather overlooked in articles we tend to read on Bitcoin. Namely, the concept of Bitcoin is not limited to money as such. The idea of the general ledger verified by users is one that could be transferred to other fields in which the verification of the flow of goods is necessary.

There, of course, might be more uses for the ledger than that. Bitcoin startups are currently working on various solutions for the currency. Some of them might, in the future, change the way we think of Bitcoin. Exactly how is not sure.

For now, let’s take a look at the charts.

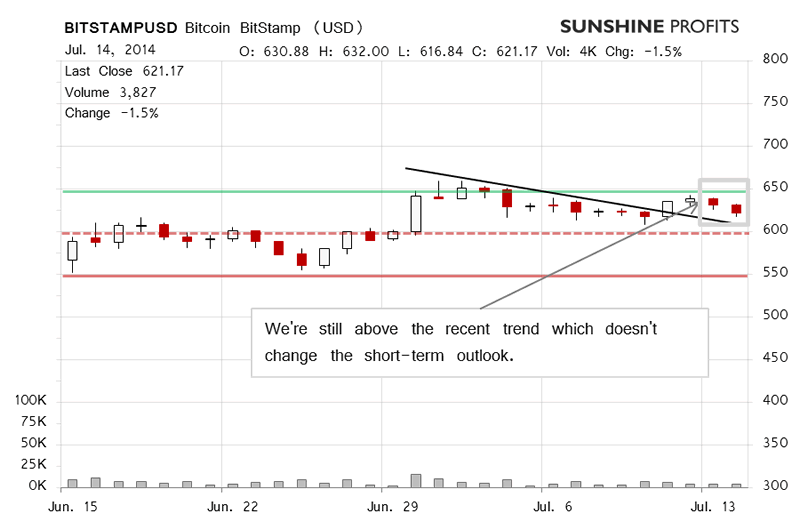

On BitStamp, not much has changed since yesterday, so you’re probably thinking, “is not much enough to change the short-term outlook?” We try to answer that.

First, recall what we wrote yesterday:

The most recent trend now appears to be down (declining black line in the chart) but the interesting portion is that, even when taking into account today’s action which is not visible on the chart, the exchange rate has remained above the trend and this might inspire some confidence.

There is also the fact that the exchange rate has remained above $600 (dashed red line), which suggests that the move down we’ve seen today might only be temporary.

The last point is further supported by the volume levels which are decidedly lower than yesterday and suggest that the move might not have underlying strength.

Seeing Bitcoin go down might tempt to close long speculative positions but we have the potential returns in mind and right now it seems that staying on the long side of the market is still preferred to getting out, in our opinion. Consequently, we don’t want to hurt your performance by closing out a potentially promising position prematurely.

Yesterday’s move down and today’s weak action (this is written before 11:30 a.m. EDT) are not enough to make a meaningful change in the short-term outlook. This is further confirmed by the weak volume today. No significant move has occurred, and consequently, even though the most recent move was down, we think keeping long speculative positions open might be favorable for your returns, and your returns, in our opinion.

Our yesterday’s remarks are still up to date:

(…) we don’t suggest decreasing one’s long speculative positions today. It is our opinion that the short-term outlook remains bullish and that there still might be a trading opportunity in our bet on higher prices.

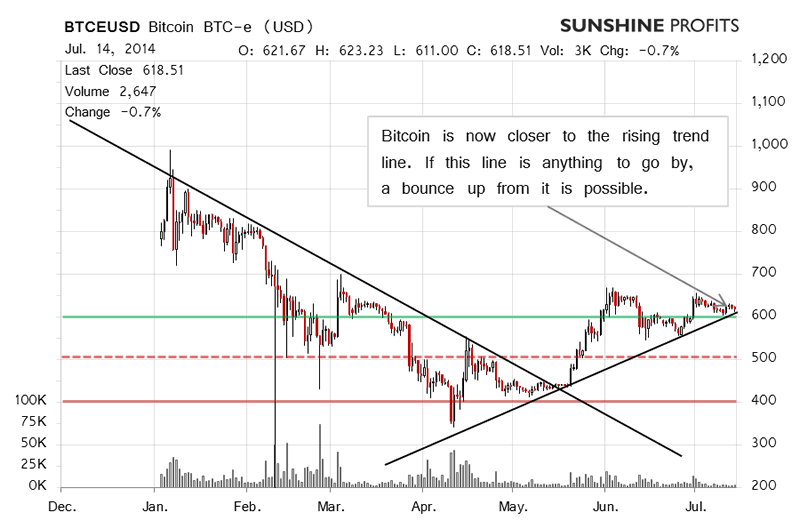

If there’s one thing that has indeed changed, it is the fact that Bitcoin has now come closer to its medium-term trend line (rising black line on the chart). This might mean that more serious action is ahead of us. “Is it wise to keep long positions open in such circumstances?” you might wonder. This is precisely what we’re trying to establish. At the moment there are no indications that the medium-term trend has changed, we are after a serious breakout as far as the long-term trend is concerned and all the recent declines have been on relatively low volume. These factors suggest that the next big move might be to the upside. We think that the best course of action might be to keep longs intact in anticipation of a significant move up.

Summing up, in our opinion long speculative positions might be the way to go now.

Trading position (short-term, our opinion): long, stop-loss at $550.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.