LIBOR Interbank Rate Credibility In Doubt

Interest-Rates / Credit Crisis 2008 May 13, 2008 - 11:42 AM GMTBy: Mike_Shedlock

Bloomberg is reporting Libor Poised for Shake-Up as Credibility Is Doubted .

The benchmark interest rate for $62 trillion of credit derivatives and mortgages for 6 million U.S. homeowners faces its biggest shakeup in a decade as lawmakers question if banks are understating borrowing costs.

For the first time since 1998, the British Bankers' Association is considering changing the way it sets the London interbank offered rate, according to Chief Executive Officer Angela Knight, who appeared before a parliamentary committee in London today. ``We've put Libor under review,'' Knight said in an interview yesterday. The BBA will announce changes May 30, she said.

The BBA, an unregulated London-based trade group, sets Libor by polling 16 banks each day on the rates they pay for loans in dollars, British pounds, euros and eight other currencies. The association is under pressure to show the rates are reliable following complaints by investors that financial institutions weren't telling the truth after the collapse of subprime mortgages nine months ago contaminated credit markets and drove up borrowing costs.

While the BBA set the one-month dollar Libor rate at 2.72 percent on April 7, the Federal Reserve said banks paid 2.82 percent for secured loans later that day. Secured loans typically yield less than unsecured debt.

"The Libor numbers that banks reported to the BBA were a lie," said Tim Bond, head of global asset allocation at Barclays Capital in London. "They had been all the way along."

The cost of borrowing in dollars for three months should be as much as 30 basis points, or 0.30 percentage point, higher than the current rate, Citigroup Inc. said in a report last month. Banks are understating borrowing costs on concern they will be perceived as "weakened" by the credit turmoil that forced banks to record $323 billion of losses and credit-markets writedowns, said Peter Hahn, a fellow at the London-based Cass Business School.

"Since the credit crunch, it's something that appears to have been manipulated," said Hahn, a former managing director at Citigroup. "We are in an extraordinarily delicate confidence time where a small event can shatter things quite easily."

The Bank for International Settlements said in a March report some lenders were manipulating the rates to prevent their borrowing costs from escalating.

Libor is used to guide banks in setting rates on most adjustable-rate mortgages. The prices they quote for credit default swaps are also linked to Libor.

"Libor is a proxy for the effective rates of the economy," said Rav Singh, an interest-rate strategist at Morgan Stanley in London. "Libor eventually feeds into the economy. There's so much on the back of the Libor problem. There are structured products, all the swaps and then there are the hedging positions."

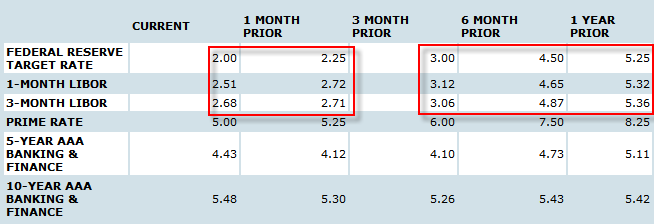

LIBOR As Of 2008.05.13

Curve watchers anonymous has been watching LIBOR.

The above table from Bloomberg .

Reasonable spreads can be seen in the red box on the right.

A year ago the spread between the Fed Funds Rate and LIBOR 7 basis points, today it is 52 basis points. Bear in mind these are snapshots. LIBOR was acting poorly many times over the past year, especially last August-September and November-December, where the spreads were even greater than they are today.

I checked LIBOR the day after the last Fed rate cut. It was 2.72 so it has been drifting lower in recent weeks. This has been the pattern. The Fed cuts rates and it takes weeks for LIBOR to come in. Historically that is not the case, nor should it be the case.

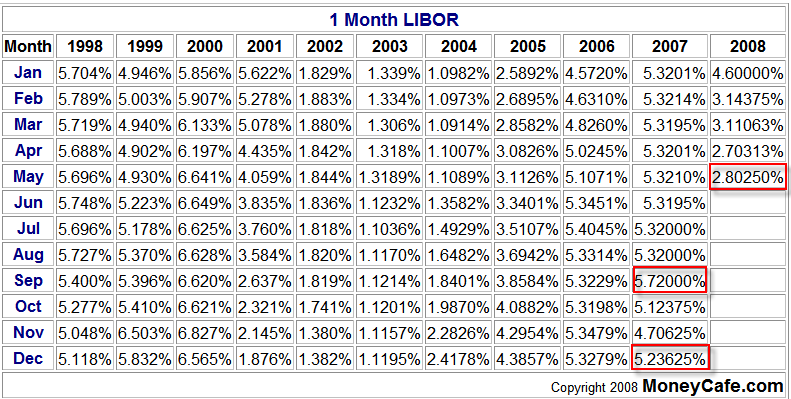

One Month LIBOR Table

The above chart thanks to MoneyCafe

Money Cafe reports one Month LIBOR on or after the first of the month for a one month deposit in U.S. Dollars on the last business day of the previous month. Thus the above table reflects a credit crunch in August and November.

At the end of April the spread between LIBOR and the Fed Funds rate was 80 basis points. It is now down to 51 basis points, assuming of course one can believe that is what banks are really charging each other for overnight loans.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance, low volatility, regardless of market direction. Visit http://www.sitkapacific.com/ to learn more about wealth management for investors seeking strong performance with low volatility. You are currently viewing my global economics blog which has commentary 7-10 times a week. I am a "professor" on Minyanville. My Minyanville Profile can be viewed at: http://www.minyanville.com/gazette/bios.htm?bio=87 I do weekly live radio on KFNX the Charles Goyette show every Wednesday. When not writing about stocks or the economy I spends a great deal of time on photography. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at www.michaelshedlock.com.

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.