The Federal Reserve in Denial Mode - Bond Market Explained

Interest-Rates / US Bonds Aug 17, 2014 - 08:55 AM GMTBy: EconMatters

Business Media Rock Star

Business Media Rock Star

On Thursday Mohamed A. El-Erian was on CNBC`s Halftime Report and he said something that a lot of people have been saying regarding the bond market, and it needs to be cleared up, because the amount of poor understanding regarding the bond market by people who make their living, i.e., are in the financial market business is astounding. It is even more mind blowing given that Mohamed A. El-Erian actually worked at a Bond Firm in PIMCO, and helped manage Harvard` s endowment in the past.

Just Mirrors What Everybody Else Says

He reiterated what many have said, and I will paraphrase that the Bond Market and Stock Market are telling you two different stories about the economy. This is just flat out wrong, and shows a poor understanding of what has been going on in the Bond Market ever since QE and zero percentinterest rates became the default central bank policy. And frankly it is a mistake that should never be made by someone who worked at PIMCO, a firm that specializes in bonds for goodness sake! I know his role was mainly to represent PIMCO and go on Television, and create exposure for the firm, but he has access to the best minds of the industry every day, and he is completely clueless when it comes to such an important distinction regarding the bond market. Moreover, since many people make this same mistake I thought I would clear this false notion up once and for all regarding bonds.

Read More >>> The Bond Market Explained For CNBC

The Bond Market Basics Explained

Here goes the Bond Market just like the Stock Market is a long oriented market, what that means is that right now we are in a Bull Market for Bonds, i.e., price is going up. When I say long oriented, this is with regard to price and not yield, long oriented refers to the fact that many of the participants are long only, they don`t short bonds, they don`t short bond futures, they only invest from the long side of the market, i.e., they only buy bonds, so by default they are long price and not yield.

Long-Oriented Market: Pension Funds, Insurance Firms, 401k Money, Bond Funds

This is similar to the Stock Market as 401k money doesn`t short the stock market or the bond market. Generally speaking, investors either designate money to go into bond funds or stock funds from the long side. The same could be said for many insurance companies, pension plans etc. they only buy bonds. Just as the majority of the stock market participants have a bias or predilection to play from the long side of the market, the same can be said for the bond market.

Bond Vigilantes have been “Bought Out”!

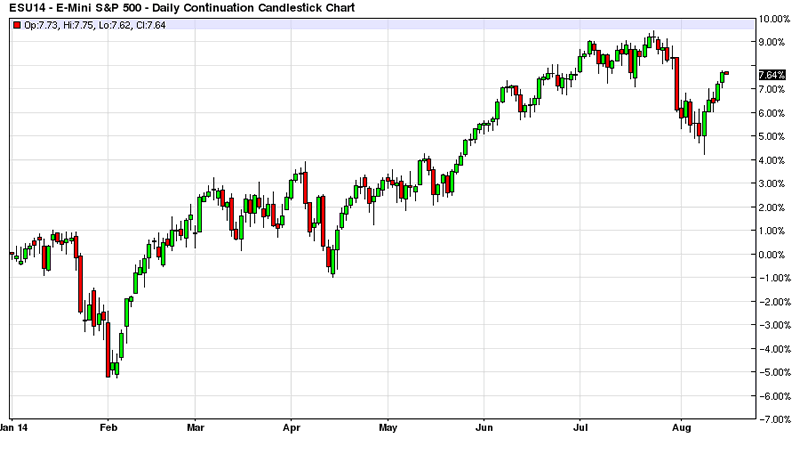

The days of the ‘bond vigilantes’ dyed a long time ago in the united states, they were prevalent in the European Mess a couple years ago before Mario Draghi gave an implicit backstop that killed this vigilante movement. So by nature the bond market is a long biased market, and investors are loving the bull run in bonds, just like the bull run in stocks, and throughout this loose monetary experiment, bonds and stocks have spent the majority of the time both being in full bull market mode, it is because of the liquidity provided by ZIRP & QE Infinity where the Fed is outright buying bonds.

Focus on Price, and Not Yield

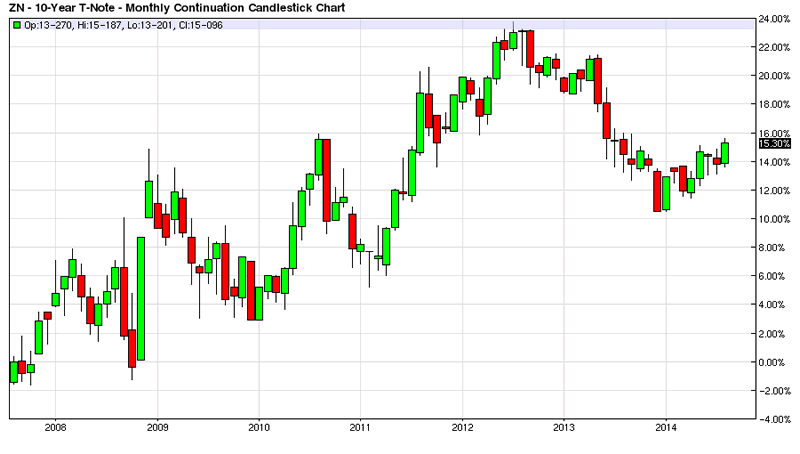

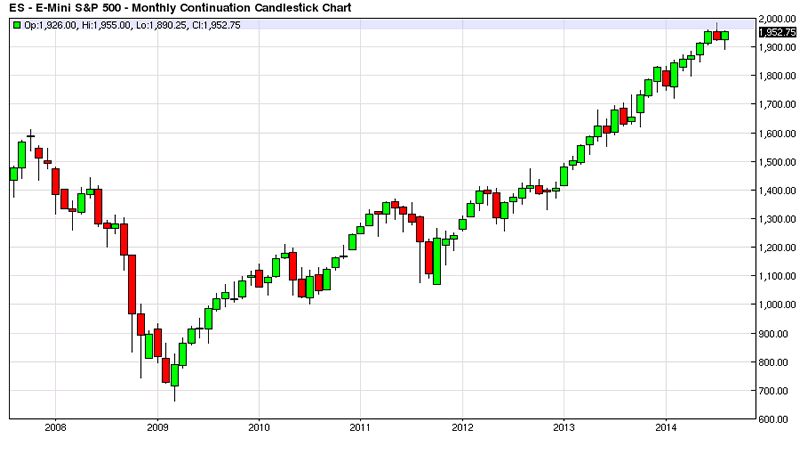

So the fundamental mistake is to think in terms of a low yield telling you anything about the economy, as it is price that you should be focusing on. And for the same reason that stocks are near all-time highs is the same exact reason bonds are near all-time highs in price. Lots of liquidity to buy assets, all assets whether it is commodities, stocks or bonds. To repeat -- stocks and bonds are not telling you two different things, they are telling you the exact same thing: There is a bunch of cheap money sloshing around the financial system Thanks ZIRP and QE Infinity!

Read More >>> The U.S. Bond Market Is Not Japan Or Europe

[As an aside, sure the German 10-Year yield is lower because Europe is struggling right now and it started going lower when investors tried to front run European QE as a possibility, however whether the German Bund is 1% or 1.3%, it is also primarily low in yield for the same exact reason that all bond yields are low, Global ZIRP by Central Banks creating massive liquidity in the financial system, i.e., borrow cheap and buy anything resembling an asset, as there is more liquidity than there are assets to purchase! This is one sign that you have a destructive Global Monetary Policy by Central Banks that incentivizes poor and inefficient capital allocation strategies by financial players.]

ZIRP Equals Bull Market for All Assets!

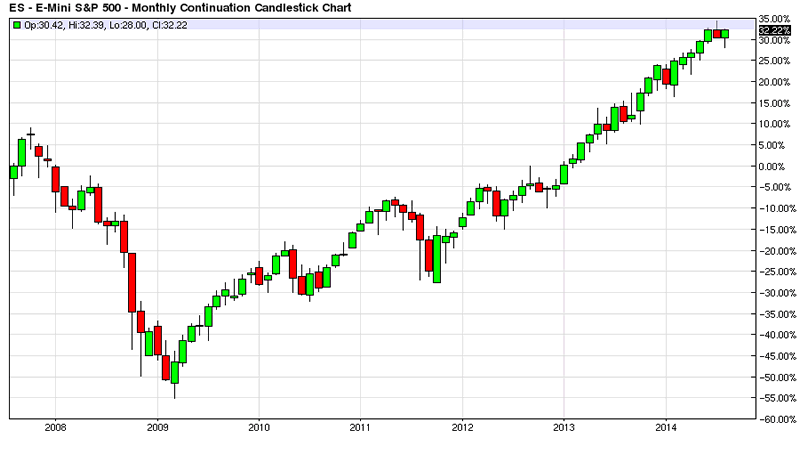

Basically, since the beginning of ZIRP both stocks and bonds have been in a bull market, and have had a considerable headwind at their backs pushing “PRICES” up! ZIRP for the most part has rendered the old relationship of Bonds and Stocks being ‘opposing’ markets obsolete, i.e., when things are bad in the economy the bond market is in bull mode, and when things are good then the stock market is in bull mode, there is some of this relationship on the margin, but not like in pre-ZIRP days! In other words the Federal Reserve has completely destroyed this relationship through ZIRP and QE, and it is one of my major criticisms of the program, the Fed should not be involved in financial markets, this is not their purview!

It`s all about making money!

So the only thing the bond market is telling you, Mohamed A. El-Erian, is that thanks to ZIRP there are a lot of investors thinking they can make money being long bonds, just like stocks, whether it is for the yield arbitrage carry of zero percent borrowing, or the price appreciation because so many people are pre-disposed to be long bonds, and there is just so much liquidity in the system and too few assets period whether they are stocks, bonds, commodities or rare artwork, in the end it is all about making money.

The bond market is long because they think they can make money, they don`t give a rat`s ass about Europe`s economy or geo-political concerns, only so as it helps their current already long disposition. [Sure Geo-political concerns have some investors truly seeking safety, but more than anything hedge funds are front running this tendency, and crowding into the trade, but whether the 10-year is 2.40% or 2.6% is really minor relative to why it is below 3% yield in a 2.5% GDP growth environment, and this is a result of ZIRP and an abundance of cheap money with a need to be put to work chasing returns. If you cancel ZIRP overnight the 10-year yield wakes up the next day at 4% even with any geo-political concerns! Think of it this way, what was the 10-year yield in the Iraq war during the first Bush presidency with a normal monetary policy? It`s not like the economy was growing drastically better during this stretch versus now, the major difference is then there was a ‘normal’ fed funds rate, and it is essentially zero, and in an ‘abnormal’ mode!]

Think of it this way, no matter how much one is predisposed to buy bonds, with a normalized fed funds rate, pick what it should be in a 2.5% growth economy, but it sure the heck isn`t zero percent or 25 basis points, let`s just say a fed funds rate of 2.5% which is still extraordinarily low, well obviously the 10-year cannot trade with a yield of 2.5% yield because investors would be losing money when you factor in the inflation rate, they just wouldn`t make that trade, and the 10-year yield would probably conservatively be somewhere in the neighborhood of 5.5 to 6% yield, so you can see it all starts with the Fed Funds Rate! And having a ZIRP Rate in a non-recession era environment is just bizarre central bank policy, and has no economic validity behind it. In short it is just creating massive bubbles in markets like bonds, and the ‘normalization’ process or exit is just a recipe for disaster – it is insane, irresponsible central bank policy!

Investors have been primarily long the bond market since ZIRP began, and only get out when the GDP numbers, or inflation reports, or the employment numbers get real hot, and they need to protect their massive profits!

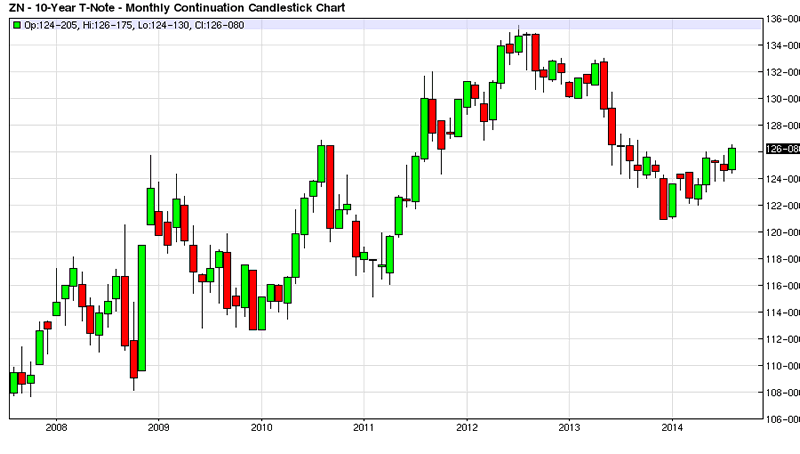

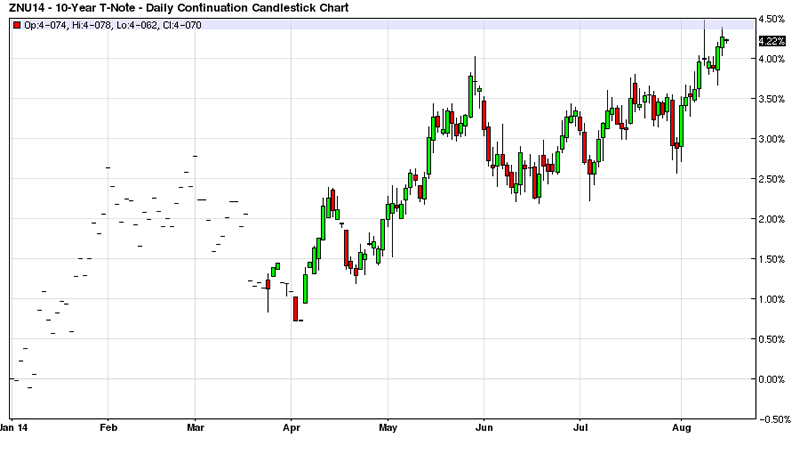

Pull Up a 7-Year Chart for Bonds & Stocks – they tell the same ZIRP Story!

This is what has been going on in the bond market for the last 7 years! This isn`t a new phenomenon, to have low yields and high prices! The business media made the same mistake that El-Erian made by focusing on the yield, i.e., a low yield means the outlook is bad; whereas the business media should focus on Price like the actual market participants, high price means a bull market for bonds just like stocks, and keep being long until the Bull Run ends! In short both markets are telling the same exact story, tons of liquidity because of ZIRP, and why they probably will be both telling the same exact story when the liquidity dries up, sell, sell, sell!

Stocks & Bonds both in Bear Market when ZIRP Ends!

We are already seeing the QE tapering start to de-juice the oil markets, my guess is that bond yields start to rise and stocks start to sell off as QE ends altogether, remember there is still QE money coming into markets every month through October! And once there is no QE backstop, and interest rate rises are just around the corner, March 2015 by my best guess, bond yields and stock declines will be saying the same exact story again, no more liquidity in the form of ZIRP, run for the exits, and they will both be in bear markets!

When the Levee Breaks: Planned or Forced Normalization Process?

The bond market is such a crowded trade from the long side with 7 years of ZIRP behind it, that when it breaks, i.e., yields start climbing as interest rates rise, the velocity of yield rises is going to spook the stock market, and there is no ‘safe haven’ for them to hide out in, not even Gold in a rising interest rate environment. This is what scares the hell out of the Federal Reserve, and why they keep stalling, and trying to push the inevitable down the road by moving employment and inflation targets.

The problem with this strategy is they make the ‘exit’ far worse, they exacerbate the problem because instead of raising the fed funds rate by 25 basis points at a time, they will be forced by external factors getting out of control to raise the fed funds rate by 50 basis points at a time and maybe even a 100 basis points at a time, if the inflation numbers on the wage side really start spiking, which based upon economic theory is in the cards.

Everything has ‘Costs’ associated with them!

So a ‘normalization’ of the fed funds rate that happens in a shorter period versus gradually rising the rate which they could start doing right now is just another indication that utter incompetence and sheer irresponsibility resides at one of the most important institutions from a power perspective in the Federal Reserve, and the US needs to start recruiting different types of individuals for the Federal Reserve.

As from the Greenspan Era through the Yellen era, these Fed members are just not qualified for the job, given their policy decisions and performance over this Central Bank Era. It is so irresponsible that it borderlines on ‘criminal stupidity’, creating bubble after bubble in the economy and asset prices, and never running the model out to its conclusion when the unintended consequences of extreme policy measures come into play. The Federal Reserve needs members who have actual market experience trading products, and understand market dynamics within the framework of broader economic theory.

The Federal Reserve in Denial Mode

If you routinely do stupid and irresponsible things with regard to extreme monetary policies, why should you be surprised when financial markets do extreme things when you remove extreme monetary policy? The incompetence at the Federal Reserve right now is just off the charts, and nobody seems to be paying attention because Financial Markets are too busy getting fat at the ZIRP trough!

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.