Gold Big Picture: Most Important

Commodities / Gold and Silver 2014 Aug 22, 2014 - 04:06 PM GMTBy: Aden_Forecast

With gold again on the decline, it's time to take a look and focus on gold's big picture.

With gold again on the decline, it's time to take a look and focus on gold's big picture.

This eases a lot of doubt, especially when companies like Goldman Sachs are bearish on commodities. We'll focus on silver and palladium too.

GOLD: Still looking good

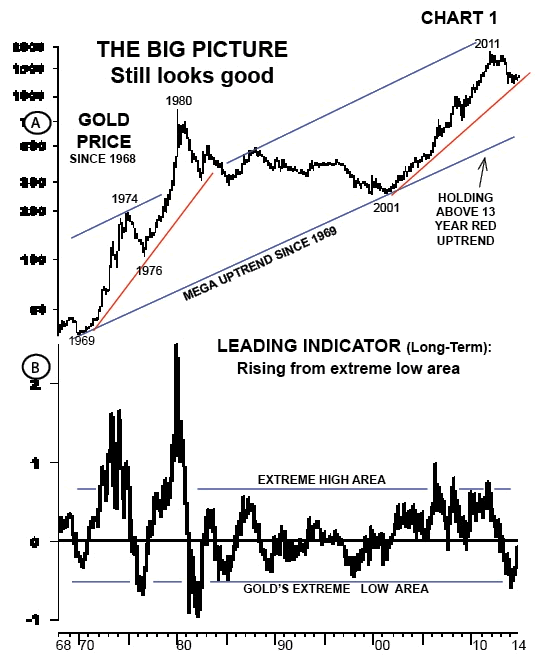

Looking at gold's big picture since 1968, you'll see what we mean.

Chart 1A shows that gold's decline of the last few years looks small in the big picture, within the mega uptrending channel since 1968.

Note that gold has had two major bull markets, in the 1970s and in the 2000s.

The major rise in the 70s didn't break its bull market red uptrend until several years after the peak in 1980.

The bull market red uptrend since 2001, however, is still intact. On a big picture basis, it'll be important to see if this trend holds.

That is, as long as gold stays above the lows of last year, at $1210, this trend will stay solid.

And according to gold's leading long term indicator (B), it's extreme low area...

Since these low areas tend to coincide with bottoms in the gold price, this tells us that gold is totally bombed out and the lows of last year are unlikely to be broken.

All things considered, it increasingly looks like 2015 could be the year of a strong change to the upside.

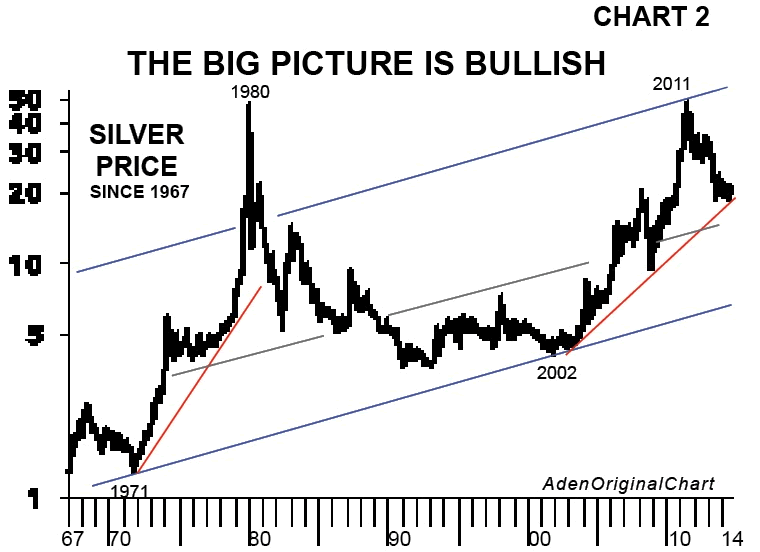

SILVER: Big Picture is bullish

Silver is similar to gold (see Chart 2). It's still in a major uptrend since 2002 within an almost 50 year uptrending channel. And its leading indicator is similar to gold's.

Silver tends to outperform gold when both are bullish. So once gold starts rising in earnest, silver could then make up for lost time.

PALLADIUM: In its own league, but also leading

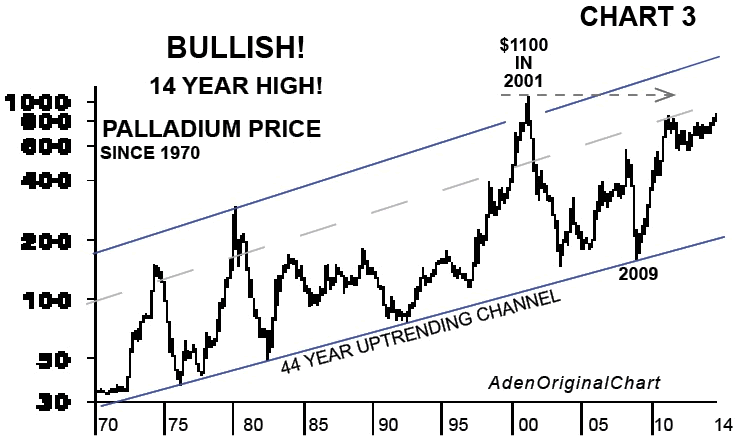

Palladium has risen 21% this year. It's clearly one of our star performers.

It's actually been in a perfect storm type of situation this year (see Chart 3).

Palladium is produced by Russia and South Africa. The ongoing tensions in Russia and uncertainty have been keeping palladium strong. The long strike in South Africa gave the extra push upward.

Palladium's big picture is bullish. The chart shows palladium approaching its 2001 record high area, as it continues heading towards the top of its 44 year upchannel.

Its leading indicator also backs up a bullish scenario. Technically and fundamentally, palladium is set to rise much further.

You want to stay onboard! For now, that goes for gold and silver too.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.