A Post-Petrodollar Play for Triple-Digit Gains

Currencies / Fiat Currency Sep 23, 2014 - 06:58 PM GMTBy: Money_Morning

Peter Krauth writes: It's now clear as day that both Russia and China are making concerted efforts to move off the petrodollar system.

Peter Krauth writes: It's now clear as day that both Russia and China are making concerted efforts to move off the petrodollar system.

I've previously written about this petrodollar phenomenon as a developing trend.....

Well now it's no longer developing, it's in active mode.

The result of this trend will roil the currency markets, and we can expect these seismic shifts to affect the U.S. dollar, and the stock market.

The changes open up profit opportunities, too, and I've found the perfect stock to benefit from the petrodollar's demise.....

Russia's Petrodollar "Attack" Is Now Transparent

First, let's talk about where we are right now, even as our currency is under siege...

Back in May I highlighted the importance of the 30-year Gazprom agreement with China to supply natural gas, valued at a colossal $400 billion.

As usual, the deal's value was quoted in U.S. dollars. But I told you to expect that, before long and thanks to a recent slew of banking agreements, payments from China would likely be made in rubles, while Chinese exports to Russia would soon be paid for in renminbi.

I also said that we needed to prepare for a seismic currency shift, given that an ever-increasing amount of trade and large transactions between China, Russia, and several of their trading partners (swap deals) are taking place in their own currencies, bypassing the U.S. dollar completely.

Well, the wait is over. It's now official.

Russia's RIA Novosti (which cited Kommersant, a national Russian politics/business paper) one of Russia's largest news agencies, has indicated that Gazprom Neft will export 80,000 tons of oil via the Eastern Siberia-Pacific Ocean pipeline (ESPO)... And will accept payment in yuan.

Kommersant said the currency change was a result of Western sanctions. In reality, this process had started much in advance of Western sanctions resulting from the Ukrainian conflict. Sanctions were a convenient excuse to expedite the whole process.

Yet Russia is now taking still more steps, with help from China, to circumvent the petrodollar with a move that will surprise you....

Russia and China Are Planning a One-Two Punch

China UnionPay (CUP) is the second-largest payment network in the world by transactions value. Only Visa is bigger.

It's a debit/credit card like any other. Although CUP is from China, it's accepted in over 140 countries, and I can tell you first hand its logo is plastered all over Western Europe.

Now Russia has turned its gaze to CUP, at least temporarily.

Thanks to American sanctions, Visa and MasterCard blocked Russian-originated transactions back in March. That prompted wealthy Russians with dollar and euro assets to repatriate their capital for fear of having their assets frozen.

In a counter-move, Russia has decided to launch the China UnionPay credit card within its own borders.

CUP expects as many as 2 million cards in Russia within a few years, while Russia's largest banks are already in the preparation and testing phase with the system.

China UnionPay is only a stop-gap measure. Russia plans are to have its own payment system up and running with two to two years.

But Russia's not stopping at non-dollar transactions or China UnionPay either.

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) completes 1.8 billion transactions daily worth $6 trillion. Now Russia wants to become a full-fledged member of the system.

As a third arrow in its payment quiver, Russia is preparing to establish its own SWIFT interbank payment processing center.

Together, Russia's Central Bank, finance, and economic departments have readied a bill. Once its Central Bank is technologically ready, the bill will be introduced.

Deputy Finance Minister Alexei Moiseyev indicated they'd "...transfer all operations to internal processing inside Russia... we have prepared a bill. We have consulted with the banking industry and the Central Bank."

So there you have it. Any doubts you may have had should now be totally erased.

Intent on moving away from petrodollar domination and its dependence on the West, Russia (with abundant help from China) is rapidly establishing its own payment agreements and payment transaction/transfer systems.

There's no way to sugarcoat it: that's bad news for the dollar.

But the opposite is true for oil, where we have an inverse relationship: when the dollar goes down, oil prices rise. And this is a situation that can play right into our hands.....

These Canadian Shares Are the Key to This Play

U.S. shale oil and gas production is getting a lot of attention, and rightly so. But considering that the United States can only export crude to Canada, Canadian refiners deserve special attention. In fact, I've found one that can work to our profitable advantage.

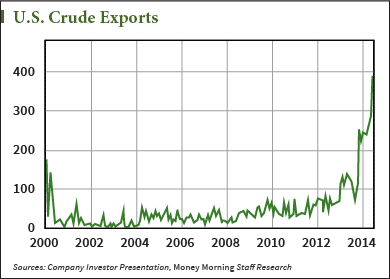

Take a look at this chart, and you'll see exactly why I'm excited about our opportunity to profit on the petrodollar trend.

U.S. exports of crude oil in June were 396,000 barrels per day, a number only exceeded once in history. Here's the kicker: 97% of those exports went to Canada, as U.S. crude exports are illegal - except to our northern neighbor.

It's highly likely those export numbers will continue, as crude from the North Sea or West Africa are costlier. Indeed, Carl Larry, president of Oil Outlooks & Opinions LLC said: "The margins for U.S. crude are just so good that there is no reason a Canadian refinery wouldn't want to use it if possible."

Enter Imperial Oil

Enter Imperial Oil

There are currently 12 companies operating refineries in Canada, however only three of them have more than one refinery in operation. Of those three, one is set to outperform the others...and by a wide margin.

Imperial Oil Ltd. (NYSEMKT: IMO) is a $44 billion, integrated Oil and Gas Company engaged in the exploration, production, and sale of crude oil and natural gas in Canada. The company operates through three segments: upstream, downstream, and chemical. The downstream segment is engaged in refining of crude oil and represents about 37% of firm's net income.

Despite its size, Imperial has managed to show impressive financial results.

For starters, EPS has grown from $1.76 in 2009 to $4.46 in 2012, a 153% increase. In 2013, the EPS dropped below the 2012 number, however, the 2014 is well on its way to be another record year, with trailing 12 months EPS at $4.58.

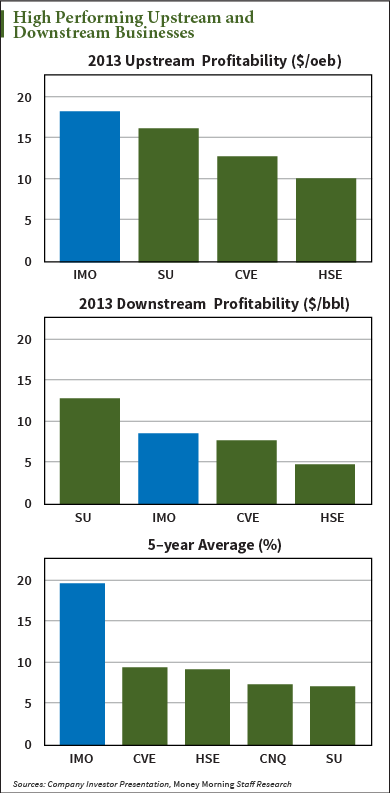

Compared to its peers, Imperial has managed to extract the best margins in its upstream operations and comes second in the downstream segment, as we see at right.

More importantly, Imperial's return on capital employed (ROCE) is something to be envied. In 2013, the company printed a ROCE of 13%, 3% higher than its next competitor. Long term, the return on capital number is even more impressive. A five-year average ROCE of almost 20% is twice the return that peers enjoy, as we saw in the above graph.

Let's be clear, there aren't many firms out there that enjoy this type of competitive advantage. It comes as no surprise then that Imperial has outperformed peers in terms of shareholder value creation, distributing over $13 billion in buybacks and dividends since 2004.

As an investor, this is exactly what I am looking for because it is ultimately the return on capital that tells me whether the company is a value creator.

Now, I would be hesitant to recommend Imperial, or any stock for that matter, if I didn't think its growth prospects are excellent.

Luckily, we don't have to worry about Imperial running out of investment opportunities any time soon, given its asset base and production opportunities. And you don't have to dig deep to see what I mean.

Imperial's capital expenditures, an excellent indicator of company's growth prospects, averaged over a $1 billion between 2000 and 2009. For 2010 to 2014 period, the number is almost $6 billion per year, a 600% increase. That capital expenditure (capex) investment is put to good use, given Imperial's 5- year, 20% average return on capital employed.

This one's almost a no-brainer: A company with proven history, strong return on capital, and excellent growth opportunities.

In fact, here's what Richard Michael Kruger, Imperial's CEO said the following: "We estimate Imperial will exhibit the strongest per share growth in the peer group over the next several years."

But it gets even better...

Imperial is lowering refining costs with something they call "advantaged feeds," which, among other things, means U.S. crude. The more Imperial uses U.S. crude, the more it lowers its cost and maximizes refining value, which translates directly into a higher share price.

In 2012, U.S. oil represented approximately 75% of company's throughput; however, that number is expected to reach 100% by end of 2014.

Taking into account the company's value creation ability, future growth prospects, quality asset base, and margin improvement from cheaper U.S. crude, Imperial is valued on the cheap side. Imperial was recently trading at 12 times its TTM P/E ratio, significantly below the company's median multiple of 17 times. Assuming a conservative 17 P/E multiple, the stock would reach as high as $74.70, a 55% increase from current levels.

Keep in mind, this only takes into account multiple expansion and does not consider earnings growth. Incorporating EPS growth, the stock could easily see triple-digit levels.

A triple-digit gainer: The perfect profit from a petrodollar shakedown.

Source : http://moneymorning.com/2014/09/23/a-post-petrodollar-play-for-triple-digit-gains/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.