Marc Faber Favours Commodity Stocks In India, Asia and Gold

Commodities / Gold and Silver 2015 Dec 11, 2014 - 02:42 PM GMTBy: GoldCore

Respected economic historian and author of the “Gloom, Boom and Doom Report,” Dr Marc Faber has warned about the continuing and coming decline of western economic power.

Respected economic historian and author of the “Gloom, Boom and Doom Report,” Dr Marc Faber has warned about the continuing and coming decline of western economic power.

He believes that the generation of young people starting to work today will be the first in two hundred years to have a lower standard of living than their parents had. He believes dividend paying Asian stocks will grow wealth in the coming years and remains an advocate of owning physical gold.

In a video interview with Barron’s, Dr Faber states,

“I meant that with respect to western societies and Japan where essentially the younger people – today’s generation – will earn less than their parents and they will have less wealth than their parents, inflation adjusted.”

“[This is] because we will have wealth taxes, we will have more estate taxes and we have essentially declining real median incomes in the western world and Japan.”

Faber has consistently warned since the late 1990’s that this dynamic would come to pass as the West and the U.S. in particular exported its industrial infrastructure and binged on consumer junk fuelled by easy credit while the emerging economies of east Asia used the proceeds to focus on production rather than consumption to become industrial powerhouses.

He went on to say,

“In the countries that opened up post breakdown of the socialist/communist ideology – China, Soviet Union, Eastern Europe - and India of course we have an entire generation who will earn much more and will have a better standard of living than their parents had.”

He highlighted certain factors that are leading to this lower standard of living for young western people. Banks now generally charge more to hold one’s money than the interest they pay out. He cites the yields on Swiss ten year bonds at 0.46% as an example of how people, and especially young people, are disadvantaged relative to previous generations.

“These people will not enjoy the compounding impact that I enjoyed having started to work in 1970 when bond yields were 6% and they went to 15% and so forth. So during that period of time wealth was accumulating very rapidly plus we had a huge boom in real estate and in equities and bonds between 1980 and 2007.”

“That is not going to happen again.”

Agricultural commodities including palm oil and Asian companies processing agricultural produce is where Dr. Faber currently sees value. Some of these companies in Malaysia and India, for example, pay dividends between 2% and 4%.

The young people who invest in these types of company will see their wealth steadily rise as opposed to their western counterparts who rely on the casino of rising paper asset prices.

Faber also likes the stock market in India and thinks it could see gains of 15% next year. The new government is free market and enterprise friendly and Faber believes the central bank in India is the “world’s best central bank.”

Dr. Faber is a long time proponent of owning physical gold. He has consistently urged people to act as their own central bank in acquiring bullion coins and bars as financial security and he believes that storing gold in Singapore is the safest way to own gold today.

Dr Faber has said that in the long term, he thinks gold could rise to over $10,000 per ounce.

More importantly, he continues to emphasise the importance of owning physical gold as part of a diversified portfolio in order to protect against a coming stock market correction and the possibility of another global financial crisis and crash.

The short Barrons Interview with Dr Faber can be seen here

Our recent comprehensive Webinar with Dr Faber can be seen here

MARKET UPDATE

Today’s AM fix was USD 1,219.50, EUR 980.94 and GBP 778.24 per ounce.

Yesterday’s AM fix was USD 1,228.25, EUR 991.88 and GBP 783.82 per ounce.

Spot gold fell $2.20 or 0.18% to $1,227.40 per ounce yesterday and silver climbed $0.04 or 0.24% to $17.08 per ounce.

Gold in Singapore ticked marginally lower and this trend continued in London. Gold is down from Wednesday’s seven-week high as the dollar and European shares firmed, leading to a decline in a safe haven bid for gold.

The precious metal is still on track for a 2.6% weekly gain so far, its strongest since mid-October, as safe haven demand and short covering have given support.

Gold remains just below its highest in more than six weeks as investors weighed the possibility of deflation contributed to by falling energy prices against signs of rising demand.

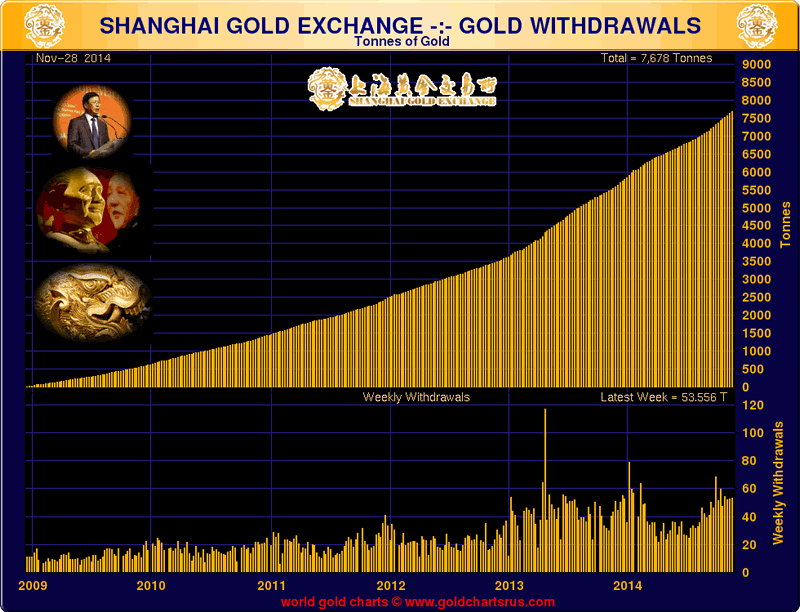

Chinese demand saw volumes on the Shanghai Gold Exchange (SGE) for gold of 99.99% purity rise for a second day yesterday to 28,152 kilograms. This is the highest since November 18 in the world’s biggest gold buyer.

An improvement in sentiment was seen in the holdings of SPDR Gold Trust, the world's largest gold exchange-traded fund. The fund saw inflows of nearly 3 tonnes on Wednesday, bringing total holdings to 724.80 tonnes.

Silver continues to consolidate above $17 per ounce, while platinum rose 0.4 % to $1,238.25 an ounce and palladium gained 0.5% to $814.70 an ounce - the highest level since September.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.