Gold and Silver Currency Wars and Credibility Traps

Commodities / Gold and Silver Stocks 2015 Mar 19, 2015 - 11:13 AM GMTBy: Jesse

The Fed not only blinked today. They were twitching like someone afflicted with Tourette's syndrome.

The Fed not only blinked today. They were twitching like someone afflicted with Tourette's syndrome.

The reasons are pretty clear.

The Fed had to take out the word patient today, or lose all credibility, and risk scaring the markets back into reality.

As I pointed out earlier today, in the assessment of an agency in the Treasury, the markets are at a two sigma level of potential volatility, ie like 'quicksilver.'

And of course, as is apparent to anyone who actually reads anything with a critical eye, the real economy is wallowing all over the place.

Finally, the recent moves by most of the rest of the world's central Banks have been to fully engage in the currency war by cheapening their currencies. The Fed would have looked like flaming idiots if they had raised rates today, given all the weak economic factors, the exceptionally low interest rates because of inbound capital flows from abroad in search of yield and safety, and the subsequent undue strength of the dollar that was already stifling exports and manufacturing.

So the Fed did the only thing it could do. It took out patient, and gave plenty of signals that they would not be raising rates anytime soon.

They also took metrics like the unemployment figure off the table. They have bought into Stanley Fischer's proposal that the Fed must resume the cloak of 'mystery' in its policy actions in order to be able to more effectively manipulate markets to achieve its policy ends.

I will say that I think this mystery is going to extend mostly to the public. I believe that they will be keeping the biggest insiders very informed through a variety of side and back channels. The better to eat you with, my dear. Pity the small players and investors in these markets.

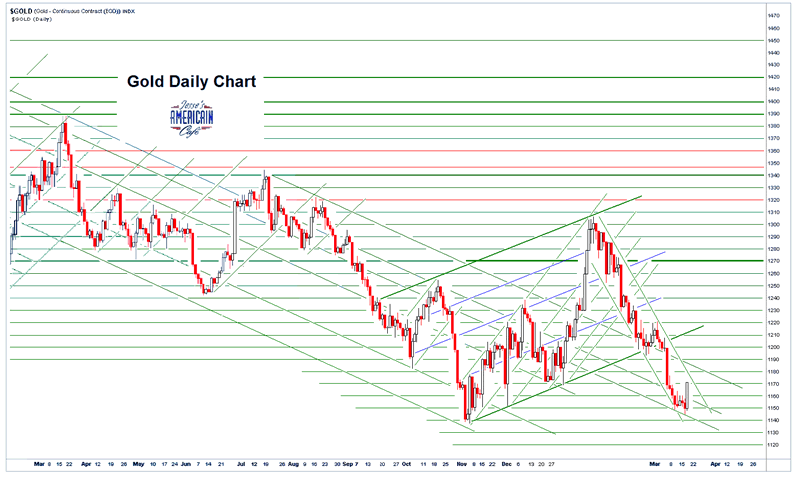

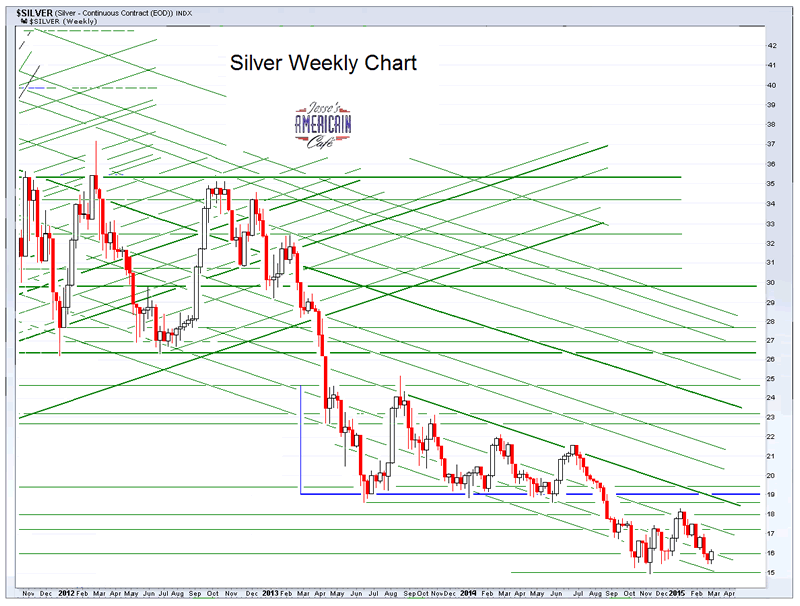

Gold and silver took off like a scalded cat as the dollar dumped. The only surprise I had was that we did not test resistance around 1185. But who can predict the movements in these paper markets?

Nevertheless, the Fed has just tipped its cap, and bent its knee, and acknowledged that they too are in the currency war. Like so many other things they have screwed up they cannot fully admit it. They are caught, like most of the world's bankers and financiers, in a credibility trap.

Gold and silver will ultimately prove to be the last resort in a global game of 'beggar thy neighbor,' no matter how much fog and mystery the money masters care to distribute to better mask their intentions.

So as I have done for so long, I get right, sit tight, and hunker down while the great currency game plays itself out on the global stage.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2015 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.