Shipping Said to Have Ceased… Is the Worldwide Economy Grinding to a Halt?

Economics / Global Economy Jan 12, 2016 - 07:25 AM GMTBy: Jeff_Berwick

Last week, I received news from a contact who is friends with one of the biggest billionaire shipping families in the world. He told me they had no ships at sea right now, because operating them meant running at a loss.

Last week, I received news from a contact who is friends with one of the biggest billionaire shipping families in the world. He told me they had no ships at sea right now, because operating them meant running at a loss.

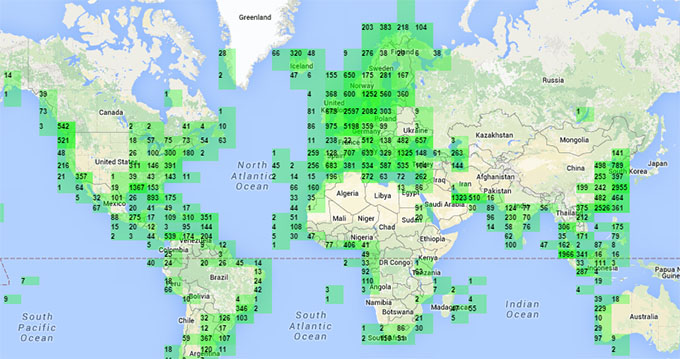

This weekend, reports are circulating saying much the same thing: The North Atlantic has little or no cargo ships traveling in its waters. Instead, they are anchored. Unmoving. Empty.

You can see one such report here. According to it,

Commerce between Europe and North America has literally come to a halt. For the first time in known history, not one cargo ship is in-transit in the North Atlantic between Europe and North America. All of them (hundreds) are either anchored offshore or in-port. NOTHING is moving.

This has never happened before. It is a horrific economic sign; proof that commerce is literally stopped.

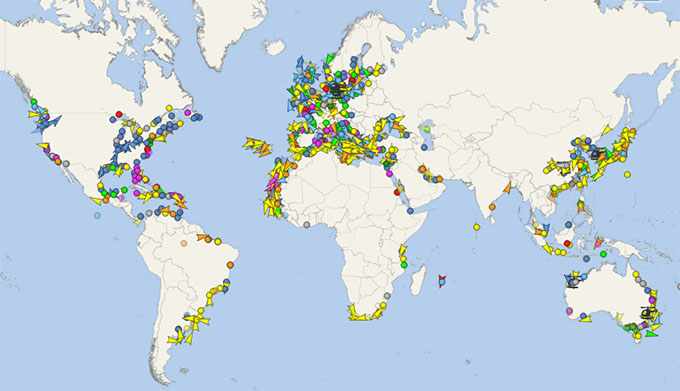

We checked VesselFinder.com and it appears to show no ships in transit anywhere in the world. We aren’t experts on shipping, however, so if you have a better site or source to track this apparent phenomenon, please let us know.

We also checked MarineTraffic.com, and it seemed to show the same thing. Not a ship in transit…

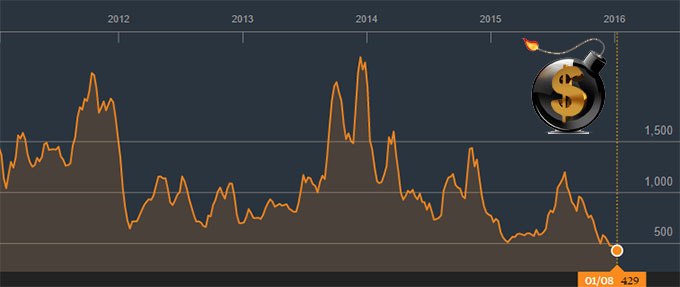

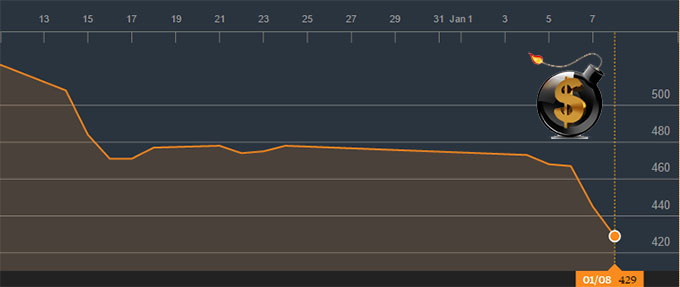

If true, this would be catastrophic for world trade. Even if it’s not true, shipping is still nearly dead in the water according to other indices. The Baltic Dry Index, an assessment of the price of moving major raw materials by sea, was already at record all-time lows a month ago.

In the last month it has dropped even more, especially in the last week.

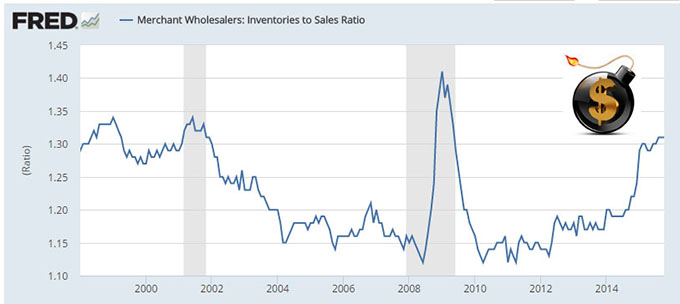

Factories aren’t buying and retailers aren’t stocking. The ratio of inventory to sales in the US is an indicator of this. The last time that ratio was this high was during the “great recession” in 2008.

Hey, Ms. Yellen, what recovery? The economy is taking on water at a rapid rate.

The storm has been building for some time, actually. Not so long ago, there was a spate of reports that the world’s automobile manufacturers were in trouble because cars were not selling and shipments were backing up around the world.

ZeroHedge reported on it this way:

In the past several years, one of the topics covered in detail on these pages has been the surge in such gimmicks designed to disguise lack of demand and end customer sales, used extensively by US automotive manufacturers, better known as “channel stuffing”, of which General Motors is particularly guilty and whose inventory at dealer lots just hit a new record high.

Here is a photo of unsold cars in the United Kingdom from that article.

The world’s economy seems in serious trouble. You can’t print your way to prosperity. All you are doing is hollowing out your economy. Draining it. And sooner or later it’s empty and you have to start over after a good deal of crisis and chaos.

It’s no coincidence that China is struggling desperately to contain a stock implosion. Reportedly, banks have been told they are forbidden to buy US dollars and numerous Chinese billionaires have gone missing. And the markets have just opened on Monday and are again deeply in the red.

Here at The Dollar Vigilante we’ve specialized in explaining the reality of the global faux-economy and why it’s important that you not believe mainstream media lies.

Every month we publish at least two editions of our TDV newsletter that, as our subscribers are aware, has predicted much of what is going on today. If you’re not a subscriber, you ought to take advantage of our current low rates before they go up on February 1. You can subscribe here.

And set aside time for our one-day TDV Internationalization & Investment Summit that features some of the most insightful financial minds on the planet including Ed Bugos our extraordinary, in-house gold analyst and Austrian economist. I’ll be there as well as a presenter and also to answer your questions about our upcoming Super Shemitah Trends and Jubilee Year analysis.

We’ve gained literally thousands of subscribers because of the accuracy of our forecasting and investment recommendations over the past year. Now is your chance – perhaps a final one – to get out in front of the chaos racing toward us by attending our one-day Investment Summit, followed by the three-day Anarchapulco Conference.

I guarantee you’ll come away refreshed, invigorated and armed with insights to help you cope with what’s going to be a very volatile and challenging 2016.

In the meantime, keep your eye on this shipping story! If it is true and worldwide shipping is disastrously foundering, it’ll only be a matter of days before grocery store shelves will reflect that with increasingly bare shelves.

Are people upset now? Just wait. Interruptions in goods and services, most critically food, almost happened in 2008 during the Great Financial Crisis. For three days worldwide shipping was stranded due to shipping companies not knowing whether or not the receiver’s bank credit was good.

That crisis was staved off due to a massive amount of money printing. It was a temporary stay of execution, like bailing out the Titanic with coffee cups, however, and one that may reach much larger proportions in 2016.

Sailors watch the weather to see if it is safe to set sail. Investors should be watching the economic climate with the same intensity.

We are already sailing through very stormy waters.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2015 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.