Bitcoin $650 Still in Play

Currencies / Bitcoin Jul 26, 2016 - 06:44 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

A recent development in the Ethereum ecosystem might turn out to be important for other digital assets, Bitcoin included. On CoinDesk, we read:

The ethereum ecosystem is returning to normalcy following a high-profile hack last month that resulted in nearly $60m worth of investor funds ending up under the control of an unknown group or individual.

The 'theft', as some would label it, was eventually reversed through what's known as a hard fork, a change in the code, 'approved' by an informal community vote, that effectively moved the disputed funds to a new account where investors could withdraw their original investments.

But while the immediate impact was limited to the ethereum platform, the implications of its decisions have echoed across the blockchain community, influencing everyone from already ardent ethereum developers to bank consultants seeking to build private blockchain solutions.

Joining this larger discussion have been bitcoin's software developers, many of whom have publicly claimed that ethereum's decisions not only permanently alter the value propositions of its platform, but have generated negative publicity that could harm all blockchain applications.

The general argument seems to be that the approval of the hard fork was actually based on a minority of users and that it did not reflect a broad consensus among all the users of the system. This is right in the sense that it seems that the developers have the ability to influence the decision making process and give a particular idea, like the one of the fork, considerable traction. So, it is not completely inconceivable that there might be further hard forks in the future should things go south. This, in turn, actually undermines the general principle that the transactions are recorded in an immutable ledger. In reality the ledger is not as immutable as one might have thought.

At the same time, the situation shows that the community of Ethereum developers was able to pull their resources together and agree on a solution which would mitigate the recent crisis. So, it could be argued that the Ethereum community, or at least part of it, was able to deal with a significant problem with relative speed.

The reality here is that with or without the fork, the situation reflected poorly on digital currencies. Namely, it shows that digital currencies are vulnerable to this sort of attacks, and in cases of crisis, there is no formal group deciding on the approach to tackle the problem. Rather than that, developers form shaky consensus to deal with the current problems. This shows that digital currencies still have a long way to go before becoming a more sustainable part of our payment system.

For now, let’s focus on the charts.

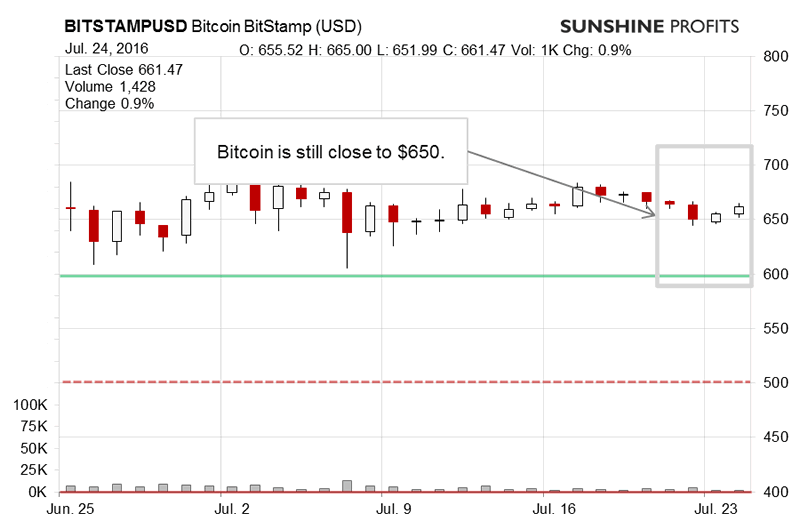

On BitStamp, we once again didn’t see much action. Does this mean that there’s no volatility ahead? Recall our previous comments:

The general idea hasn’t changed much. Bitcoin is still at $650, which might be an important level (…). One possibly significant bullish hint is that Bitcoin didn’t decline following the announcement of the halving of mining rewards. This might be a show of strength. The recent volume, however, has on the downside, which suggests that Bitcoin is yet to move a significant move in either direction from $650.

The delicate move down made the situation slightly more bearish, nullifying some of the previous upswing. The general picture remains. Bitcoin is in a bearish position but not quite bearish enough to go short just now. A breakdown below the 61.8% Fibonacci retracement level could be a trigger here.

Bitcoin is now above $650 but not much has changed. We still have room for declines but there is no indication that the move has already started. This might change in a matter of days, as even one day of strong action below the Fibonacci retracement might serve as a bearish confirmation.

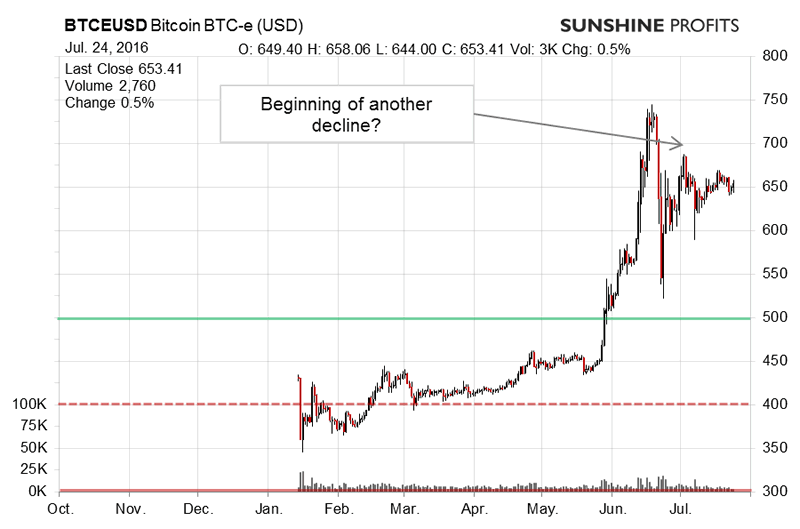

On the long-term BTC-e chart, we still clearly see the possible triple-top pattern. Previously we wrote:

The 38.2% Fibonacci retracement level is still very much in play. We haven’t seen a move below this level just yet. At the same time, we haven’t seen a move above the $700 level which might be the next important level on the upside. As such, the situation still has a bearish tilt in our opinion, but it’s not enough to go short just now.

The last couple of days actually look like a possible local top. We might see a sort of triple top with each consecutive top being lower than the previous one. This would be a bearish indication. The level at which the move might accelerate is still around $650. A move below this level might be an indication that a stronger decline would follow. This is not the case yet.

Again, not much change here. The current reading of the RSI is at around 50 which indicates that there still is room for declines going forward. The level to observe is still $650 as it coincides with the Fibonacci retracement and it might be a point at which the decline accelerates, in our opinion. We haven’t seen this just now.

Summing up, in our opinion no speculative short positions are favorable at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.