Bitcoin after Extreme Volume

Currencies / Bitcoin Sep 22, 2017 - 06:03 PM GMTBy: Mike_McAra

Bitcoin is on the Bloomberg Markets main page again. This is yet another sign of the currency becoming yet another asset class. In the article, we read:

Bitcoin is on the Bloomberg Markets main page again. This is yet another sign of the currency becoming yet another asset class. In the article, we read:

Bitcoin is looking increasingly likely to splinter off again in November, creating a third version of the world’s largest cryptocurrency as miners and developers pursue separate visions to scale its rapidly growing marketplace.

Major industry players, including the bitcoin investor Roger Ver known as “Bitcoin Jesus” for proselytizing on behalf of the digital currency, say consensus between opposing camps looked increasingly unlikely. That opinion was echoed by some of the biggest mining pool operators and also programmers -- known as “Core” developers -- who were instrumental to developing the infrastructure of the original bitcoin network.

In recent weeks, a group of miners -- people who crunch complex math problems to generate and transact the digital currency -- split off from the legacy bitcoin to use a new version known as Bitcoin Cash. Ver is moving some of his funds into the new offshoot as he anticipates what would be the second split of the currency of 2017. Ver admits he could potentially benefit from such a schism as more coins are created.

The fact that a mainstream media outlet like Bloomberg is starting to cover Bitcoin and some of its technicalities is definitely a sign that the interest is near its all-time high. Actually, the fact that we are seeing increasingly more stories on Bitcoin in mainstream media after the currency peaked (at least temporarily) is a confirmation that a top might be in. This, of course, is not certain (nothing in the market is). As for the next possible split – we don’t think it is a game-changer for Bitcoin. Previous splits were not and even the recent, highly-publicized creation of Bitcoin Cash doesn’t seem to have made all that much impact (in line with our previous hints). As long as the traditional version of Bitcoin remains the largest one in terms of market cap, it seems other versions of the Blockchain are not likely to change the Bitcoin space. We would have to see more dramatic events here.

For now, let’s focus on the charts.

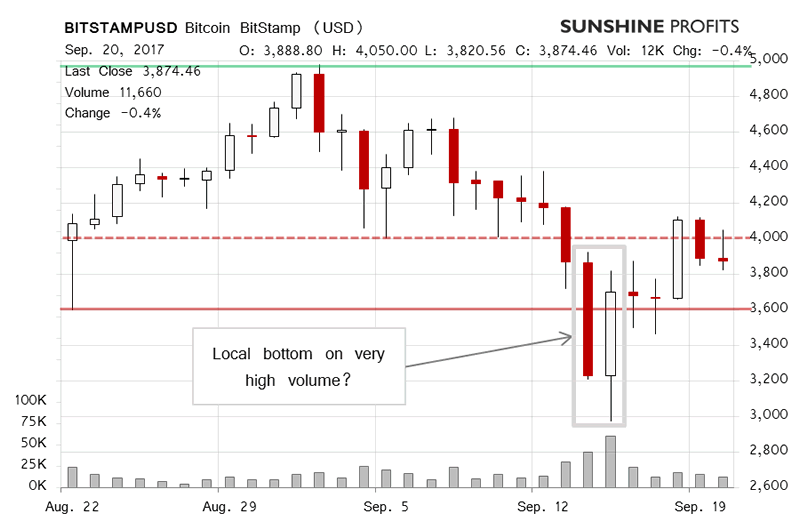

On BitStamp, we saw relatively significant appreciation on Monday, followed by weaker depreciation. All of this on relatively low volume. Recall our recent comments:

(...) it transpired that in the short term the market did turn around. Quite interestingly, Bitcoin erased almost exactly 50% of the preceding rally before bouncing slightly to the upside from this level. This is similar to what we saw at the previous downturn. It might just be the case that the 50% level right now is the trigger that might be the beginning of the next big move to the downside. Alternatively, a lack of breakdown below this level might be read as a bullish signal.

The fact that we saw mostly appreciation afterwards makes the short-term situation a lot more bullish. Right now, if we look at the mid-July to early-September rally, we see that the very recent appreciation has pulled Bitcoin above the 38.2% retracement level based on the move up. This means that the bearish indications we had on our hands previously are largely nullified. Quite notably, this means that all the retracements based on longer time horizons are not invalidated either and that we don’t immediately view the move down as a necessary trigger for a more pronounced move down.

Basically, nothing changed as we haven’t even seen a break below the 38.2% retracement based on the recent rally (around $3,777). We are close to this level but visibly above it. By extension, other more long-term retracements haven’t been broken either and the current situation isn’t bearish. If anything, the current environment seems slightly more bullish than bearish (marginally, but still).

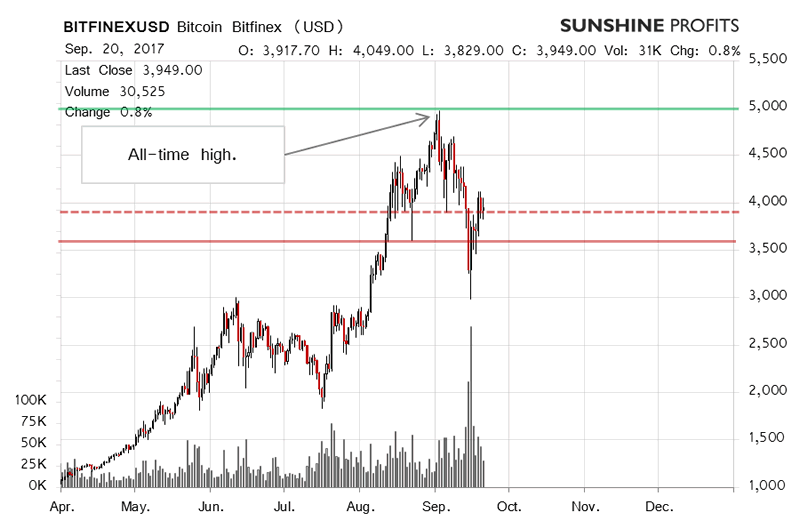

On the long-term Bitfinex chart, we see the recent rebound. In our previous alert, we wrote:

(...) we might have actually seen a change as the currency went above all the important retracement levels in all time horizons. This is a decisively bullish indication. Also, the reversal to the upside took place on the most pronounced volume in recent history. Does this mean that the situation is now bullish again? We wouldn’t necessarily say so. The improvements in the outlook are, in our opinion, more short-term in nature. At the moment of writing these words (...), it seems that Bitcoin might be pushed to the all-time high once again. If this happens, then how Bitcoin trades around this level might be a clear hint as to the next big move. At the same time, important support levels are not that far away, so all of this can change in a matter of days or even hours. This seems to be a very important market juncture. (…)

These comments are still very much up-to-date. Bitcoin has stayed above the most important support levels, which makes the situation slightly more bullish. At the same time, the recent local bottom was formed on extremely high volume, while the current move up is taking place on relatively small and falling volume. This dulls (at least for now) the bullish indications. The short-term outlook for the currency is still slightly more bullish than bearish, however, the risk at this point seems to great to open any hypothetical position as Bitcoin might deny the slightly bullish hints in a matter of hours.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.