The Loonie Takes Flight -- BUT a "Labor Miracle" is NOT the Reason Why

Currencies / Canadian $ Dec 05, 2017 - 03:26 PM GMTBy: EWI

One day before the jobs numbers went viral, Elliott wave analysis already called for a USDCAD decline

One day before the jobs numbers went viral, Elliott wave analysis already called for a USDCAD decline

Friday December 1 was a lucky break for loonie bulls. That day, the government agency Statistics Canada revealed the nation's economy added 79,500 new jobs in November, "blowing past" the 10,000 that economists expected. As one major news source described it:

"Canadian dollar posted its biggest gain in nearly three months against its U.S. counterpart on Friday after a stronger-than-expected domestic jobs data fueled expectations for further Bank of Canada interest rate hikes early next year..."

"The labor miracle in Canada continues." (Dec. 1 Reuters)

Absolutely, a jobs number that's EIGHT times bigger than expected is a significant event for economists; some would even call it "miraculous." But here's the part we have trouble with: The spike was NOT the cause for the Canadian dollar's surge.

The reason we know that is because Elliott wave analysis foresaw a loonie rally before the jobs "miracle" was released.

On November 30, a day before the surprise numbers went viral and stirred up a media frenzy, our Currency Pro Service editor Jim Martens set the stage for a decline in the USDCAD: (a falling U.S. dollar/rising Canadian dollar)

Here is Jim's analysis from his November 30 Currency Pro Service intraday update:

November 30 2:30 PM:

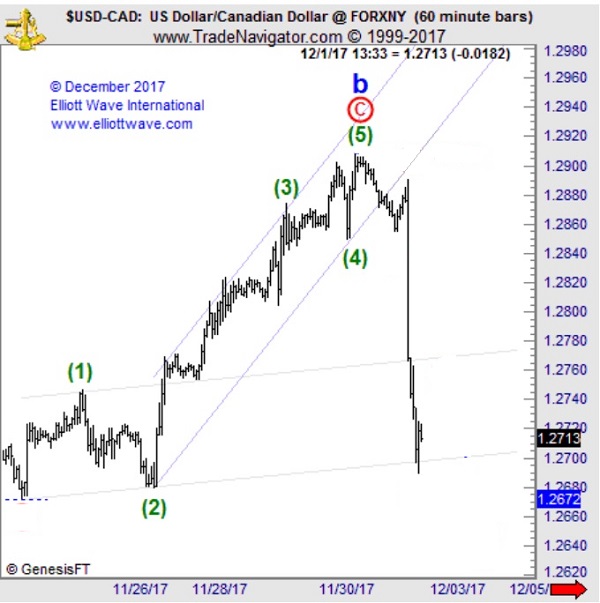

"USDCAD pushed to a new high on the day. Despite the new high the rally from 1.2672 might still represent wave b of a larger flat correction. A double top with 1.2915 would best serve the flat scenario. It would lead to a wave c decline that reaches below 1.2666. -- Jim"

Jim also referenced the upcoming jobs data report:

"Unemployment Claims is the next high impact economic release due out in the U.S. at 8:30 AM ET [Friday morning]."

Obviously, Jim had no way of knowing that the jobs claims would outperform expectations eight-fold. His analysis wasn't based on the "fundamental" data, but rather on the Elliott wave pattern unfolding on the USDCAD's price chart.

The next chart shows you how the currency pair followed its Elliott wave script to a T, with the greenback plunging and the loonie rising.

What makes forecasts like these possible is the fact that Elliott wave analysis tracks and forecasts market psychology. It's the collective psychology of market players that create trends.

The loonie was poised to strengthen against the dollar regardless of what the labor report had said; there didn't have to be any CAD-bullish news, period.

Trading Forex: How the Elliott Wave Principle Can Boost Your Forex SuccessLearn how to put the power of the Wave Principle to work in your forex trading with this free, 14-page eBook. EWI Senior Currency Strategist Jim Martens shares actionable trading lessons and tips to help you find the best opportunities in the FX markets you trade. |

This article was syndicated by Elliott Wave International and was originally published under the headline The Loonie Takes Flight -- BUT a "Labor Miracle" is NOT the Reason Why. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.