As Bitcoin Breaks All-Time Highs Near $18,000 Its Future Has Never Been So Uncertain

Currencies / Bitcoin Dec 17, 2017 - 03:23 PM GMTBy: Jeff_Berwick

Bitcoin has yet again hit another all-time high today of $17,645.89 on the Coindesk Price Index.

Bitcoin has yet again hit another all-time high today of $17,645.89 on the Coindesk Price Index.

Yet, while much of the traditional financial world are piling into bitcoin, the direction of bitcoin has perhaps never been so unsure.

I’ve posited my conspiracy theory of how Blockstream and others may have surreptitiously hijacked bitcoin. But, whether that is the case or not, one thing is absolutely for sure; Bitcoin has changed dramatically in the last year from its initial intention and objectives as outlined by Satoshi’s white paper.

The title of the white paper itself, after all, was “Bitcoin: A Peer-to-Peer Electronic Cash System.”

And, now, according to many of the Bitcoin Core developers, bitcoin’s objective is no longer to be an electronic cash system.

This is a massive change that seems to have gone unnoticed or unchallenged by most. Yet, it could potentially mean the death of bitcoin.

Many of bitcoin’s detractors like to point out that bitcoin has no intrinsic value. Of course, nothing has intrinsic value, so they are making a non-argument from the get-go.

But, when pointing out why bitcoin has subjective value, some of the main points were:

1.)It is a digital cash that facilitates transactions perfect for the digital age

2.)It is cheaper to use than traditional cash and transfer systems

3.)It is faster than traditional cash and transfer systems

Now, with the direction Bitcoin Core is taking bitcoin, none of those points are fully true any longer.

But, all of those points would still be true if the bitcoin block size was just increased from 1mb to 8mb.

As a reminder, 1mb is less than what was held on this archaic storage medium from the 1980s.

Bitcoin Cash forked from Bitcoin on August 1st in a dispute that the block size would fix the speed and cost problems associated with bitcoin’s growth. And, it has been partially proven right. Bitcoin Cash transaction fees, on average, cost less than $0.20 USD while the average bitcoin transaction fee sits over 100x higher around $21 USD and bitcoin cash confirmations take on average 8.5 minutes while bitcoin confirmations take at least an hour on average. Plus Bitcoin Cash can do roughly 31 transactions per second while bitcoin can only do between 4-8 per second even with Segwit.

Yet, Bitcoin Core proponents say that increasing from the ludicrously tiny 1mb to 8mb is too dangerous!

Instead, they have created an entire mishmash of very convoluted and complicated side chains that, so far, have not fixed the cost and speed problems.

And, that is assuming they even want to fix those problems. According to many Core developers, they think high transaction fees are a good thing and show the value of the network.

When pushed and asked when or how bitcoin will ever be usable in day-to-day transactions in the future, the answer is always “the lightning network” and the estimated time of arrival is always, “we don’t know.”

Here is one of Bitcoin Core’s top developers, Adam Back’s, answer to that very question:

"So I mean for today, you could have, some bitcoin business have a tab, so you pay them and you work your tab there and presumably you can cash your tab out if you don't use it. If you have repeat custom... or maybe the shops in the local area could make a shared tab or something in anticipation of... you know somebody in the local area ... technology expert could make a local bitcoin tab that's interoperable between the shops and some sort of app to do it."

Yes, that was his answer. And, scarily, he did not appear to be massively intoxicated. That was his sober answer… that maybe, in the future, you can get a bitcoin tab at your local shop if someone creates the technology so that you can use bitcoin to maybe buy things. Maybe.

In the meantime, bitcoin is the DMV of cryptos. Long lines waiting to pay expensive fees and a lot of frustration.

In fact, if bitcoin isn’t and doesn’t have a plan to be used as digital cash then it really shouldn’t even be called a cryptocurrency… because it is missing the “currency” part.

And, even if the lightning network does come to Segwit bitcoin there are a lot of questions about just how it would function.

This video does a good job of explaining some of the issues:

And, while we wait, unconfirmed transactions continue to pile up. You can see the list in real time here . It is currently over 150,000 transactions that are in the queue waiting.

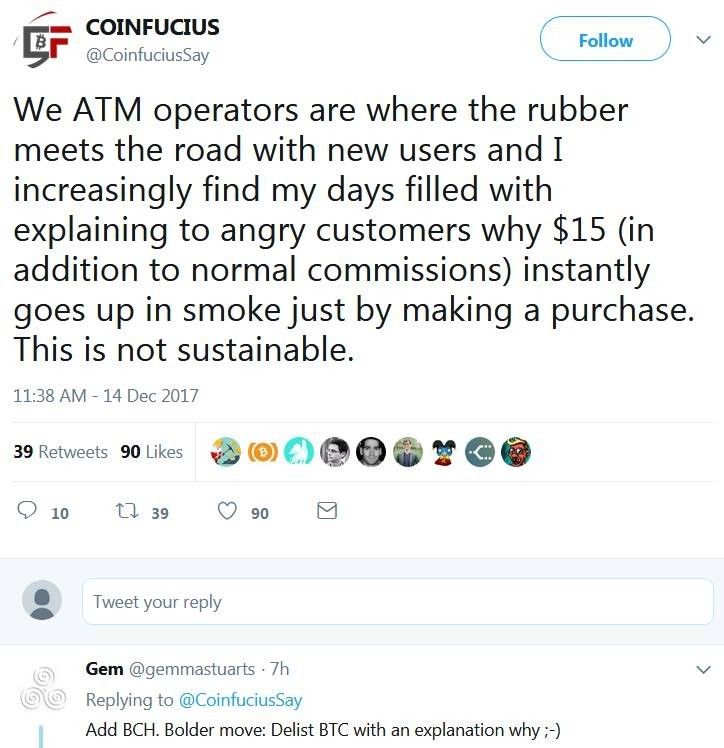

And, across the world, businesses based on bitcoin being usable as a currency are either going out of business or having major problems.

This week I had the opportunity to interview Amaury Sechet, the lead developer of Bitcoin Cash about all these issues. You can see it here:

Both Roger Ver and Amaury Sechet will be speakers at the upcoming Cryptopulco conference at Anarchapulco in February.

As well, to ensure fairness, Bitcoin Core proponent, Trace Mayer and Bitcoin Core developer Jimmy Song will also be speaking at the event.

Discussions could get heated. And rightfully so. The stakes have never been higher.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.