Europe’s Coronavirus Pandemic Dilemma

Politics / Pandemic May 28, 2020 - 03:01 PM GMTBy: Dan_Steinbock

In the ongoing battle against the global pandemic, belated responses will result in huge human costs and massive economic damage. In Europe, losses are climaxing in the 2nd quarter of 2020.

Before advanced economies – including those in Europe - began to flatten the epidemic curve, they fattened it for 6-8 weeks. These COVID-19 delays will prolong the global pandemic and cause secondary waves of imported infections and residual clusters both in Europe and worldwide (for the full story, see my report on the historical COVID damage: https://www.differencegroup.net/coronavirus-briefs ).

In the United States, the Trump administration's futile effort to “protect the economy” (read: the markets) backfired disastrously. The European Union was more willing to battle the virus but was unable to do so proactively because it lacks the needed common institutions for effective response.

As the consequent political backlash will soon wash across Brussels and the continents major capitals, the EU federalists are likely to demand "more integration" to deter past policy delays in the future. In contrast, the advocates of sovereign states will insist on "less integration" to overcome the EU's institutional deficiencies.

The current status quo – sub-optimal integration that undermines both the bloc’s and the sovereign states’ effective responses – is ridden with pitfalls.

Late mobilization in the euro area

On January 25, 2020, the European Centre for Disease Prevention and Control (ECDC) was still painting a fairly rosy picture about the virus spread: “Even if there are still many things unknown about 2019-nCoV [coronavirus], European countries have the necessary capacities to prevent and control an outbreak as soon as cases are detected," it reported.

Yet, inadequate EU preparedness involves not just its small virus-alert agency, but delays at the highest levels of EU institutions.

In Brussels, the full continental response took a few days even longer than in the U.S., although some member states had been more proactive, and the most affected countries had to mobilize earlier.

On March 10, 2020, when Italy already had 9,200 confirmed cases and over 460 deaths, its EU ambassador Maurizio Massari pled for help. Just days later, Italian Foreign Minister Luigi Di Maio hailed the arrival of a Chinese plane loaded with medical equipment and doctors to help fight the coronavirus. "Many foreign ministers offered their solidarity and want to give us a hand ... [and yet] the first aid arrived from China" said Di Maio in a pointed rebuke to the EU.

Subsequently, many European observers and policymakers suggested that Chinese aid efforts were a sinister ploy to divide Europe. What they set aside was the question why Brussels and individual European economies failed Italy at the time of its greatest need.

When the EU mobilization finally began – another two weeks after Massari’s pleas - the number of cases in Italy had soared tenfold, while the deaths had tripled.

6-8 weeks of delays

As part of the EU’s joint response to the COVID-19 outbreak, the European Parliament almost unanimously adopted three urgent proposals in an extraordinary plenary session, on March 26, 2020. Now Brussels hoped to mobilize up to €37 billion to support national health care systems, SMEs, labor markets and other vulnerable parts of its member economies. The EU also extended the EU Solidarity Fund to cover public health emergencies. The measures would make up to €800 million available for European countries in 2020.

However, the “urgent” proposals followed two months after multiple first cases in Europe and the WHO’s international emergency alert; that is, after 250,000 recorded cumulative cases and more than 14,000 cumulative deaths.

Although the European CDC had virus information after the first week of January, as did China, Hong Kong and Singapore, Brussels did not respond proactively. Nor did the EU take a stronger preemptive stance between the 1st week of January and the 30th day, when WHO chief Tedros declared the international emergency.

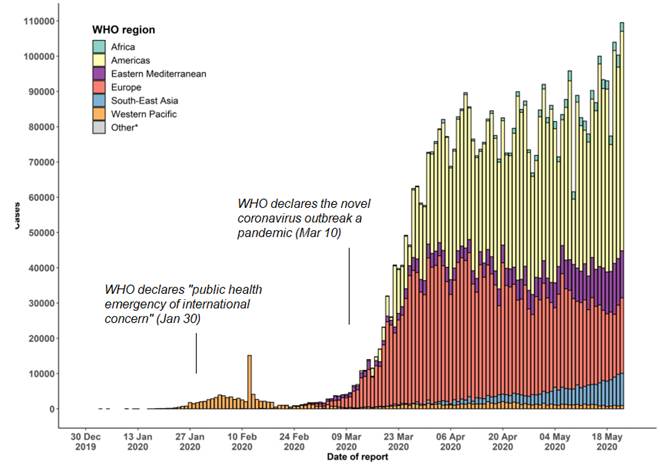

What’s even more distressing is that Brussels chose not to mobilize between January 30 and March 10, when the WHO declared the global pandemic. Instead, effective mobilization began only toward the end of March, which virtually ensured the extraordinary and protracted human costs and economic damage (Figure).

Figure Human Costs of Coronavirus Complacency*

*Confirmed COVID-19 cases worldwide through May 23, 2020

Source: WHO, Difference Group.

European Commission President Ursula von der Leyen acknowledged that “the EU was not ready when the pandemic first began sweeping the continent, and member states did not offer enough support to hard-hit Italy."

Despite the economic damage, the European Commission, as President Trump in the U.S., hoped to introduce early “exit strategies” to the lockdown measures, especially after Austria and Denmark announced plans to ease restrictive measures. After pressure by member states, the EC was forced to delay plans for exit.

Following the belated virus response, premature opening would have resulted in still another disaster.

Costs of complacency

Due to the belated response, prior efforts at fiscal support measures proved soon inadequate. So, by late April, European leaders gave Brussels green light for a huge €1 trillion stimulus package to ease the EU’s recovery from the coronavirus crisis.

However, markets are struggling. By year-end 2019, the Euro Stoxx 50 had recovered from 2,200 in 2012 back to 3,800; now the index is still hovering around 2,900. Despite mounting human costs and economic damage, the European Central Bank (ECB) responded only after its “emergency meeting” on March 18, 2020; that is, after 75,000 recorded cases and 11,000 deaths in Europe. That’s when the ECB moved ahead with large asset purchases and a new round of quantitative easing, while interest rate stayed at the zero-bound.

The delays in Brussels penalized severely the euro area’s annual GDP growth rate. In the 1st quarter in 2020, the bloc’s economy plunged -3.3% from a year earlier. But that was just a prelude to the expected carnage of -14.7% in the 2nd quarter.

Today, there were 2 million recorded cases and some 175,000 deaths in Europe. And by the 2nd quarter, the cases could climb to 2.4-2.7 million and deaths up to 225,000-235,000, respectively. These recorded losses are just a fraction of real losses. Without vaccination and therapies, the human costs will climb until the epidemic curves normalize, earliest by 2021.

After a disappointing start, Europe’s collective response to the coronavirus crisis was the “most impressive anywhere in the world”, said European Commission President Ursula von der Leyen in mid-April. Since the statement followed almost quarter of a year of missed opportunities, the self-congratulatory tone was not warranted.

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2020 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.