Stock Market Fantasy Finance: Follow the Money

Stock-Markets / Stock Markets 2020 Jul 19, 2020 - 07:11 PM GMTBy: The_Gold_Report

Sector expert Michael Ballanger takes a look at the latest moves in the financial and precious metals markets, and updates his investment strategy moving into late summer.

I've only just returned from the majesty of Georgian Bay, where the first fishing derby of the season had me summarily trounced by my female partner 12 to 5, with most of her catches in the 1- to 2-pound category and mine barely larger than the lure that attracted them.

Adding to this humiliation was that, despite that I have harangued incessantly about the urgency of "setting the hook" once you get a strike, I lost four 1-pound-plus bass within three feet of the dinghy by failing to properly execute that about which I constantly lecture.

It is like a seasoned professional investor standing at the lectern emoting and evoking on the need to "never underestimate the replacement power of equities within an inflationary spiral," after which he ignores the volcanic eruption of coordinated global stimuli, both monetary and fiscal, and tries to short the market. The phrases "practice what you preach" or "eat what you kill" might come to mind, but the phrase that aptly describes the current market absurdity is, "Follow the money!"

During a brief time at an Internet-signal-friendly anchorage just south of Parry Sound, I read the latest explanation for a 6% jump in the Shanghai market, where Chinese Communist Party (CCP) officials had been urging its 1.4 billion people to "buy stocks" because the pandemic fears were "largely overblown." Buried in the last few paragraphs was the real reason, and it was that many of the CCP billionaire supporters were feeling the pain of sagging stock prices, and the last thing the CCP bigwigs need is donor unrest.

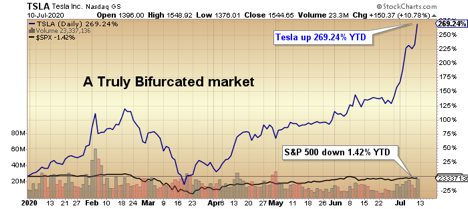

This is a common thread around the world, where every politician finds the need to secure a larger and larger pool of re-election funding. There is no better way to do that than to hand each citizen enough government welfare cash to allow the average mask-wearing, basement-living, laptop-trading millennial to buy 100 shares of Tesla Inc. (TSLA:NASDAQ) in April under US$500. They then send out a flotilla of central bank "governors," also call "spokesmen" (but should be called "salesmen"), to actively promote the ownership of Tesla (or Amazon or Netflix) as a truly capitalist endeavor, but solidly American to the core.

Then they unleash a torrent of social media marketing gimmickry, which includes unregulated "target prices" issued by a twenty-something unemployed college grad with a math degree who has been trading since March and who has no understanding of things like "price-earnings ratios" or "yield compression" or—most importantly—"margin call." The legions of basement dwellers now totally bored with video games and sports betting, all collectively manning their day-trading cockpits as bona fide rookies in the world of high finance, decide en masse to buy Tesla with their government stimulus cash and voila! They all get a wondrous lesson in Econ 101, as the tsunami of demand dwarfs the smaller tsunami of supply—and what to their wondering eyes should appear? A US$1,544 share price!

Let there be no confusion of brains with bull markets. If you follow the money, it was precisely what Powell & Co., the White House, and of course the Wall Street bankers wanted and needed to prolong the 2009–? Ponzi-schemed bull market in overpriced, overhyped stocks.

Happily, this fiscal and monetary madness, made possible only by the arrival of a mysterious pandemic, which appeared some four months after the Fed executed their "pivot," has now been revealed for what is was—a crisis-driven excuse for flooding the debt-soaked global landscape with enough phony liquidity to allow all of those junk bonds to be removed painlessly from the portfolios of Blackrock and JP Morgan and Goldman and a plethora of submerged hedge funds in danger of insolvency.

In keeping with the timeless brilliance of Sir Winston, following the money leads us directly to that "phrase of the decade," which is, "Never let a good crisis go to waste!" And with "Waste not; want not" at the fore, the paper-conjurers have unleashed a global debt surge that is several orders of magnitude larger than 2009–2011 print-fest. And finally—finally—the gold and silver markets have started to respond, and happily, in a big way.

Since I took profits in the miners in April after loading the gun on April 16, the day the HUI bottomed at 142.51, the index has more than doubled in response to all the previously discussed nonsense. I exited in April around the 250 level, partly due to overbought conditions but more because of the seasonal weakness that normally arrives during the May–July period. I also was reluctant to tempt fate and risk giving back the 157% year-to-date portfolio return I am currently sporting.

Nevertheless, when conditions change, I change, and the breakout above US$1,800/ounce in August gold has forced me to start thinking about the GDX/GDXJ dynamic duo again. I normally wait until August (and I still may), but since we have a new high in the HUI and a new monthly high in gold, all we need is for silver to close above the September 2019 high at US$19.75/ounce for all cylinders to kick into "afterburner mode."

One indicator that could have provided a clue was a close in the gold-to-silver index (GSR) below the 50-dma (daily moving average) at 94.96, which it did on Friday. Silver prices look like they could test the highs very shortly, and since the bullion bank behemoths are still short over 350 million net ounces, they have few arrows left in their collective quivers with which to beat back the mountain of demand that is inhaling all supply in Pac-Man-like fashion.

The next chart tells the story of how traders panic into lemming-like marches to oblivion. Note how the narrative of a U.S. dollar short squeeze played out in March, despite the most dollar-bearish fiscal and monetary policies in U.S. history. After watching Powell, Mnuchin, Canadian Finance Minister Morneau, and virtually every European Central Bank spokesperson on cable every day and night since the first mention of "QE to Infinity," I now strongly object to the notion that they are "printing money" to ease the pain of their citizens. They are not printing "money;" they are printing "debt," and it is debt that will never be repaid, ever. All currency created digitally or in the U.S. Bureau of Engraving and Printing is nothing more than another person's (or entity's) obligation to repay; it is not "free." Since gold and silver are the only two items that meet the true definition of "money," and since you cannot print gold or silver, then the term "money printing" is flawed, and for now will be replaced with the term "debt printing," in reference to the counterfeiting actions of the global central banks.

The U.S. dollar initially spiked as a safe haven trade back in March, but then crashed as soon as the Fed/Treasury Keystone Kops Brigade began their hyperinflationary tap dance. Thus far, they have been successful in thwarting the forces of deflation by creating dollar-bearish policy initiatives that, at least for now, have kept the deflationary tsunami at bay.

However, the last three months have brought about a slow erosion of the dollar and a possible retest of the March 9 lows. If it breaks those lows at 94.50 basis the dollar index, then I will be expecting gold at $2,100/ounce and silver at $25/ounce quickly. However, the cretins in Washington and New York will fight it at every turn, and with all the ammunition available to them, so I must remain vigilant and cautious until they demonstrate a dedicated apathy to such an event.

I remain 69.61% long the basket of junior developers and explorers in the 2020 GGMA portfolio, while holding 30.39% cash with a 161.61% return year to date (YTD). While I have not been holding either of my two beloved miner exchange-traded funds (ETFs; GDX/GDXJ) since April, my decision to overweight the developers (such as Getchell Gold Corp. [GTCH:CSE], up 183.3% YTD), and make Getchell my #1 holding, with Aftermath Silver Ltd. (AAG:TSX.V) close behind, is now starting to yield results.

I do not need to announce to anyone that my cautiousness in the past three months was, shall we say, "unwarranted," and is a $#$%$# understatement of the highest order. However, in the middle and latter stages of precious metals bull markets, penny explorers become juniors and juniors become intermediates and intermediates become seniors. Such is the natural rotation of the miner hierarchy as investment flows fall deeper and deeper in love with them; the danger occurs when that love turns to infatuation and obsession, but we are many months and possibly years from that happening.

The most recent subscriber issue has a few additions to both the portfolio and the trading account in advance of the arrival of August. I have always used August as my "accumulation month," and while it is usually the latter part of August, events here in July might have forced me to accelerate the accumulation of more than a few possible ten- to twenty-baggers looking out to next May.

We deserve it.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.