"Shooting Stars" of the Stock Market: "Don’t Be Fooled by This"

Stock-Markets / Stock Market 2022 Mar 06, 2022 - 10:29 PM GMTBy: EWI

"A funny thing happened on the way to the revolution"

A meme stock has been defined as “the shares of a company that have gained a cult-like following online and through social media platforms.”

This “following” is largely comprised of novice investors who hope to make a quick profit. You may remember two well-publicized examples of meme stocks back in 2021: Gamestop and AMC Entertainment. There have been others.

Well, Robinhood Markets has been described as “the brokerage behind the meme stock revolution.”

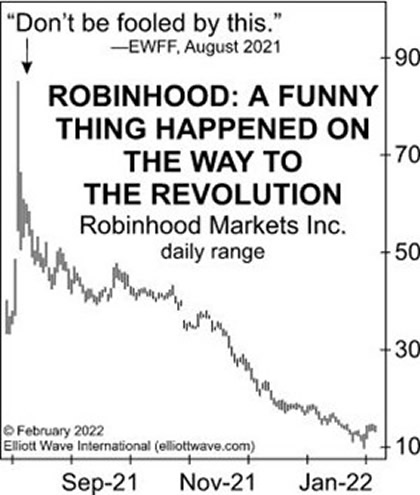

Indeed, the shares of Robinhood itself went public near the end of July 2021 and its new share price doubled in early August 2021.

The August 2021 Elliott Wave Financial Forecast, a monthly publication which provides analysis of major U.S. financial markets, issued this warning:

Don’t be fooled by this. Meme stocks and the financial market’s entire constellation of shooting stars are a product of the ebullience at the end of a [historic] bull market.

Fast forward to this updated Robinhood chart and commentary from the February Elliott Wave Financial Forecast:

The chart shows the immediate outcome [after our August 2021 warning], an 88% decline in Robinhood’s price. … We forecast that other shooting stars of 2021 would continue to flame out, with the “final highs in the major U.S. averages” to follow. So far, that forecast is tracking.

Indeed, the Meme Stock Index that the Elliott Wave Financial Forecast showed in August is down 55% from its January 2021 high.

You might have thought that the speculative fever surrounding “hot” stocks and even the broad market would have cooled down significantly since the recent wild price moves.

However, on March 1, a CNBC headline expressed this sentiment of a firm’s chief investment officer:

There are a handful of tech stocks that are so cheap you need to be buyers here

This chief investment officer might turn out to be right. Then again, “cheap” stocks can get a lot cheaper.

As you might imagine, not all of Elliott Wave International’s forecasts work out to a “T,” however, EWI’s read of the Elliott wave model says that bargain hunting may not be the best idea now.

If you would like to delve into the details of how the Elliott wave model can help you forecast financial markets, you are encouraged to join our free event, “Calm, Cool, Collected and Unperturbed: 5 Free Insights to Prepare Investors.”

Now through Monday, March 7, you'll see 5 interesting investor insights from the current, February issue of our legendary, award-winning Financial Forecast -- including our big-picture view of U.S. stocks, bonds, investor psychology, cultural trends and more.

So instead of hitting the panic button with everyone else and trying to deconstruct a never-ending barrage of mostly useless information, join “5 Free Insights to Prepare Investors” and let us help you cut through the noise.

style="padding-top: 10px; border-top: solid 1px #CCCCCC;">This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.