Financial Market Forecasts and Investments Strategy

Stock-Markets / Stocks Bear Market Nov 24, 2008 - 10:42 AM GMTBy: Mike_Stathis

Market Guidance: Past, Present and Future - Despite the strong closing bounce off the new intraday low of around 7400 reached on Friday, it's likely the Dow has further downside. These lows may not occur for another 12-18 months. Alternatively, they could occur at any time. The timing is impossible to predict in advance. The important thing to focus on as it stands today is the likelihood that the stock market will head lower down the road. So you should adjust your investment strategy to reflect this scenario.

Market Guidance: Past, Present and Future - Despite the strong closing bounce off the new intraday low of around 7400 reached on Friday, it's likely the Dow has further downside. These lows may not occur for another 12-18 months. Alternatively, they could occur at any time. The timing is impossible to predict in advance. The important thing to focus on as it stands today is the likelihood that the stock market will head lower down the road. So you should adjust your investment strategy to reflect this scenario.

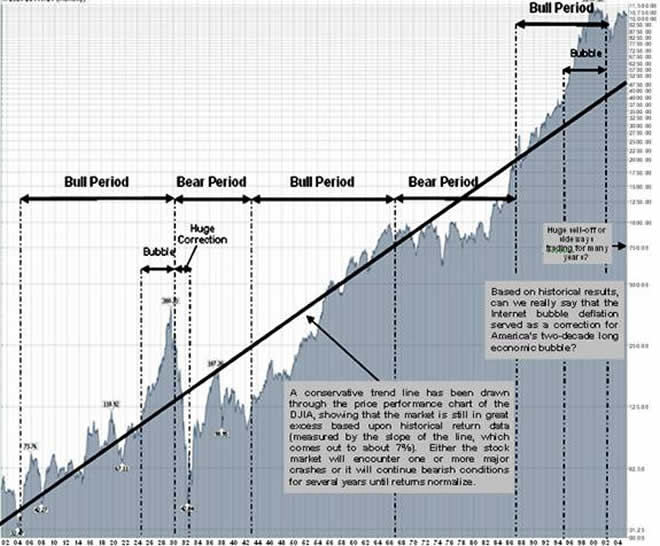

As I first reported in the 2006 edition of my book “ America 's Financial Apocalypse,” the fair value of the Dow Jones Industrial Average was around 5500 by least-squares analysis (chart below). This was a very rough estimate that could be raised to as high as 6200. While I mentioned I would “not be shocked to see the market collapse to this level,” I felt it was unlikely. I felt a series of crashes would push the Dow down to the 10,000 level where it would trade sideways for many years, only to mount a series of devastating crashes thereafter. Thus, even I am a little surprised how badly things have deteriorated in such a short period of time.

Figure 16-1. Historical Chart of the DJIA Showing Periods and Fair Value.

Source: America 's Financial Apocalypse: How to Profit from the Next Great Depression. Original Edition, 2006.

[Now you hear about the self-proclaimed experts talking about the same analysis, as if it were timely. You know who they are - the same clowns on TV who want you to think they warned you of this mess early on, when the fact is they were bullish up until a couple of months ago. Just check their track records and you will see for yourself. They rely on the fact that most investors have short memories.

I wonder how many of these guys reference my book and why they refuse to acknowledge my forecasts. I know for a fact my book made it to many mutual and hedge fund managers because I was contacted by some who specifically made me promise not to disclose their praise for my book, most likely because they did not want their clients to know this catastrophe was coming.]

But you should note that the Fed and Treasury's responses to the financial crisis have assured there will be even more devastating crashes down the road, most likely just as the market appears to be headed for another strong bull run. When this will occur I cannot say. But you can bet it's going to happen. You can't create trillions of dollars out of thin air without harsh consequences down the road. The effects will be even worse when you hold down interest rates for a prolonged period.

With the Dow hovering around 8000, the problem is that there have been absolutely no signs of capitulation whatsoever. What that means is that the Dow could fall much lower from current levels. Even worse, we are still at the early stages of the economic fallout. Consumers have not fallen yet and hedge funds have only begun to fail. Hundreds of corporations will file for bankruptcy and thousands of banks will fail. The results of the holiday spending should begin another downward turn. I invite you to check back to a couple of articles I wrote a few months ago to serve as guidance for your investment strategy. http://www.marketoracle.co.uk/Article6229.html

http://www.marketoracle.co.uk/Article5751.html

So is this 5500-6200 level possible? Certainly. In fact, we know that during reversion to the mean, the stock market almost never goes exactly back exactly to the mean. Instead it overshoots. What this means is that the Dow could go lower for a period prior to gravitating around the mean. Keep in mind that as time passes, the market fair value will increase based upon the slope of the chart.

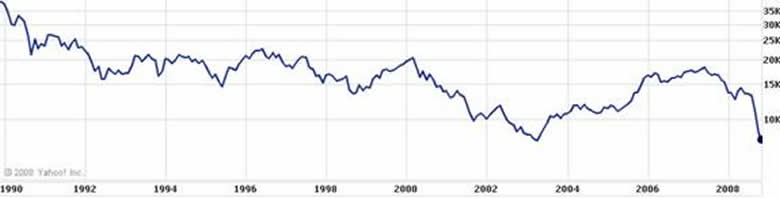

Just from studying this basic chart alone, common sense would lead one to conclude that the stock market is headed for an additional 10 to 15-year period of poor performance. When you consider the economic data, things look much worse. If you think this isn't possible, you've most likely been watching too much TV or listening to Wall Street. Just ask Japan about this possibility. Have a look at the 20-year performance of the Nikkei 225 below. After reaching nearly 40,000 in 1989, the Nikkei is still down by over 75%. But as you can see, it didn't crash over a short time period. It has been in a downward trend since 1989.

Now back to the Dow. Last Friday the Dow recently hit a critical support level and briefly broke below it, although it mounted a strong rally to close just above this 7800 level. I will discuss my short-term forecast from here in a minute.

The good news is that the sooner and more intense the fallout, the sooner the market will recover. But you shouldn't expect another bull market period for a long time. Notice I said bull market period as opposed to bull market. While we might experience “bull market” performance in the future, they will be followed by bear market performance. But a sustained period of strong performance is unlikely at this point. Overall, we will continue the secular bear market for many years as I predicted in my 2006 book.

Note that I like to use basic charts for a good reason. I want to illustrate that you do not need to get real fancy in order to see what's happening. In fact, many times the fancier the chart is the more one can get distracted from the basic information.

Short-term Rally?

On the bright side of things, I am becoming increasingly optimistic of short-term upside of around 15-20% through the end of January. If this rally does materialize, you should expect it to be erased shortly thereafter. One thing is for certain. The stock market will be filled with tremendous volatility throughout 2009. And the economy is only going to get worse. There will be periods of optimism followed by deepening realities. As a result, this will continue to be a market only for the best of the best traders. All others should consider staying out, select only safe-dividend stocks or start building positions in Chinese stocks like an ETF index (FXI). Remember, there are going to be hundreds of hedge fund blowups and corporate bankruptcies. Many companies will slash or eliminate dividends so you need to stick with only the stocks with the safest dividends.

As you might know, some of the biggest and best-known investors have been blown out in 2008, from Griffin at Citadel, the great bear himself Jeremy Grantham, and even the overrated Warren Buffett himself, not to mention many others. Keep that in mind before you decide to take on this market. If you are an investor with a horizon of 20 years you should start buying, but slowly and only after major sell-offs.

I continue to like healthcare, specifically Pfizer and a handful of HMOs like United Health and Cigna (at current levels). I've also recently taken a position in Alcoa and I am eye-balling Dow Chemical. As well, I am rebuilding positions in oil trusts such as Pen Growth and Harvest Energy. But these are intended to be long-term positions and I'm willing to accept further downside, so I am building my positions accordingly.

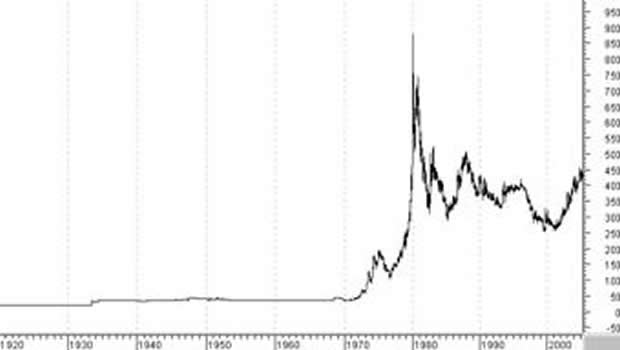

Soon I will be looking to enter gold and maybe silver. For those of you who missed the previous bull run in these metals, you'll have another opportunity to catch a ride back to the top. However, I wouldn't jump aboard until I see a strong surge, as I still see another 10-15% downside. Anything more would be reason for concern and could cause a major trend reversal. I've cautioned investors on numerous occasions about the absolute need to trade the precious metals' volatility. The buy-and-hold approach isn't going to work. In fact, it's more deadly than using it with stocks because stocks generally tend to go up over time while gold eventually reverts back to historical levels.

The dollar maintains its recent strength but only as a safer haven to other currencies, excluding the Yen. Once the investment community realizes the increased credit risk of the U.S. government, the dollar will reflect its true value. Most likely, this time will occur once the economic storm has bottomed and begins showing signs of improvement. Mind you this is just speculation. The only thing I am certain of is the inherent weakness of the dollar. But as we all know, assets can remain over- or undervalued for a very long time prior to correcting.

Understand once again that commodities are highly volatile, so you should take profits when you can because you should realize by now that stocks go down much faster than they go up. And the market bottom is ahead not behind us. No matter how much I like any investment, you'd better believe I'm going to continue to take profits when I can because avoiding market risk is the top priority. Cash is king and those who have it for market crashes will be poised to do very well.

By Mike Stathis

mike@apexva.com

Copyright © 2008. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

Mike Stathis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.