Economic & Financial Markets Outlook 2009, Part1: Nightmare on Main Street

Economics / Recession 2008 - 2010 Jan 21, 2009 - 09:03 AM GMTBy: Ty_Andros

I remember growing up in Nebraska as a time of ups and downs that any child encounters growing up. Even though I was born in 1955, I was too young to be drafted into the Viet Nam war and my college years were very carefree as my parents were sending me through school to gather the tools that set the table to prosper and grow as I matured and aged. I was aware of the issues, but for the most part saw them on TV or in the news as an observer and student, safely tucked away in school and amongst friends. I am very grateful for what God has provided me to maneuver through the challenges of life.

I remember growing up in Nebraska as a time of ups and downs that any child encounters growing up. Even though I was born in 1955, I was too young to be drafted into the Viet Nam war and my college years were very carefree as my parents were sending me through school to gather the tools that set the table to prosper and grow as I matured and aged. I was aware of the issues, but for the most part saw them on TV or in the news as an observer and student, safely tucked away in school and amongst friends. I am very grateful for what God has provided me to maneuver through the challenges of life.

As an avid movie buff I learned to dream of the future and visualize myself in many of the worlds I saw on the silver screen. Only one genre held nothing for me: Horror films!

I didn't like them, go to them or relate to them in any way. Hurting others and being hurt by vicious human animals was nothing I could ever relate to. I never understood how anyone could enjoy them; Friday the 13 th , Freddie Kruger and Nightmare on Elm Street, Texas Chain Saw Massacre, and today's SAW series. These movies became less and less commercially viable and now are a fraction of what they were in the late 1960's through the late 1970's. Now they are set for a comeback, only they won't be on a movie screen, they will be in REAL life! Economic life…

Nightmare on Main Street

I speak of these things because to know is to be prepared and forewarned. For most people this is going to be the biggest nightmare conceivable and for that I am sad. But being an optimist, I see the opportunities and they are immense. EVERYTHING is mispriced to reflect the coming economic debacle and the policies which will be implemented to address it. Hyperinflation looms in the emerging WEIMAR G7.

Stocks, bonds, commodities, currencies, natural resources are ALL mispriced for what's unfolding. The VOLATILITY created will be enormous and “Volatility is opportunity” for the prepared investor. You must learn to make money in RISING and FALLING markets. Buy and hold is DEAD for now!

The world is not going to end as so many doom and gloomer's contend, it is going to CHANGE. It has needed to do so for a great while, and while it will be painful going to our new destination, once there the future will brighten as day follows night. The changes are unbelievable opportunities for those who recognize them and the demise of those who don't. The greatest transfer in wealth in history from those that store their wealth in paper to those that don't is unfolding right before our very eyes. It will continue until the G7 reforms its monetary system to reflect SOUND money.

In the last several months I have begun to prepare you with the “Crack-up Boom” series for the maelstroms that are unfolding. A massive paradigm shift away from everything we have known for all our lives to something we have read about in history books, with numerous twists; history never repeats itself but many times rhymes. As we have watched the credit crisis unfold over the last 2 years, most peoples' lives have been largely unaffected as residual momentum and habits, built up over decades, have crested and reversed, but now the slippery slope downward is set to accelerate VISCOUSLY.

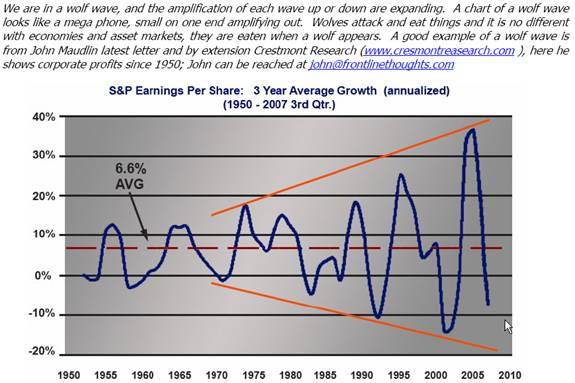

Let's take a brief look at the “2008 Pattern of the Year” from last year's outlook entitled Wolf Wave, which is a chart of S&P 500 earnings going back to 1950, and is a proxy for the earnings in the private sector of the G7:

Now in 2009, the wolf is in plain view to the public as INCOME and business are collapsing. The earnings per share are now slicing through the bottom of the mega phone and ACCELERATING to the downside. At the beginning of last year I projected 2008 earnings on the S&P 500 of $50 dollars, when most analysts were calling for $70 to $80, now the verdict is in and probably looks to be $48 dollars when the final tally arrives.

That line has now sliced below the mega phone formation and IS NOT going to turn up anytime soon. Now my expectations for the S&P 500 is $30 and if you include unfunded pension obligations it falls to $22 dollars, and at 10 times earnings that translates into 220 on the S&P 500, an approximate 70% decline from here. I expect GDP to decline AT LEAST 10% year over year and potentially up to 20% in 2009 and early 2010. In the recent manufacturing purchasing managers survey NO sectors of manufacturing were growing: NONE!

On the service side employment is crumbling as the self employed who provide discretionary services find that their customers are now only buying essentials. The Consumer Product Safety Commission passed a new regulation during the campaign season that required testing of many products for lead during a product scare over the summer. Now these DO GOODERS, but know nothings, are about to VAPORIZE 100's of thousands of small businesses and jobs in the first two weeks of February as it takes effect.

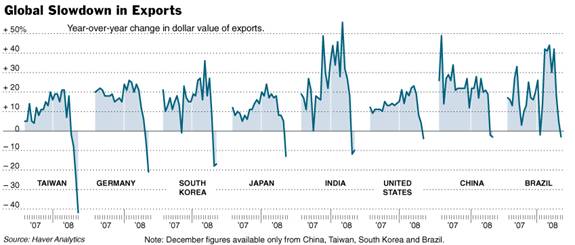

Look at international trade as financing has DISAPPEARED from the banking industry:

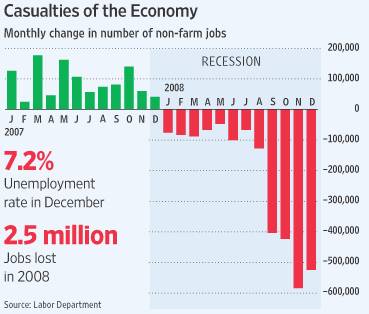

Now let's look at the collapse in employment and incomes which come from private sector jobs:

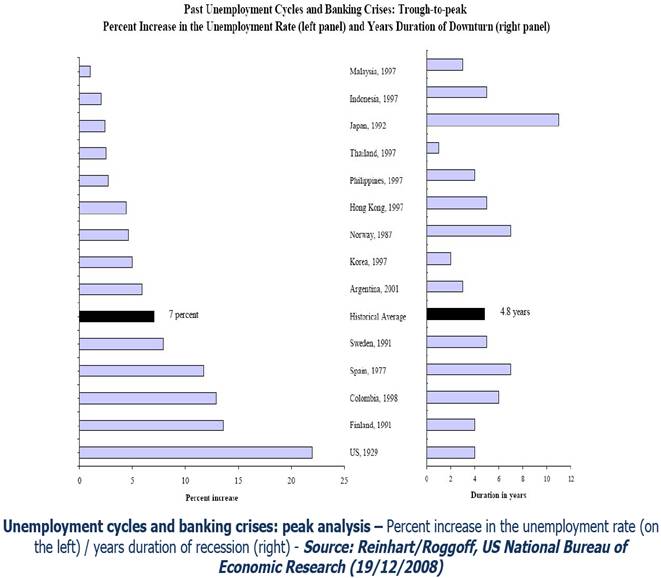

This is a reflection of the Wolf Wave as private sector companies lay off workers in order to maintain profitability and solvency. These pictures are of the United States but similar picture are IN PLACE throughout the G7. Look at the average peak-to-trough employment losses associated with the banking crisis:

This is a reflection of the Wolf Wave as private sector companies lay off workers in order to maintain profitability and solvency. These pictures are of the United States but similar picture are IN PLACE throughout the G7. Look at the average peak-to-trough employment losses associated with the banking crisis:

John Mauldin is reporting that last week's initial declaration of 524,000 new unemployment claims MASKS the true number of 952,151 (he says it's not a typo and I believe him). Think of it, almost a million jobs lost in one week and I believe this is just the beginning. He goes on to report that continuing claims rose to 5,832,746 and, if I recall correctly, that is DOUBLE the number from a year ago. Unemployment is set to DOUBLE AGAIN this year in the US and EUROPE .

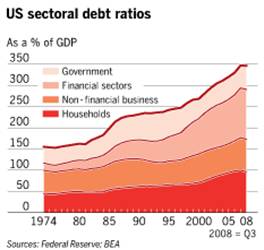

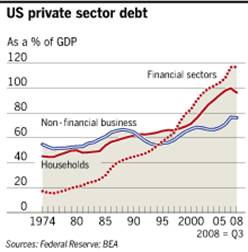

Let's now take a look at the outstanding borrowing and UNFUNDED obligations which must be serviced by these declining incomes:

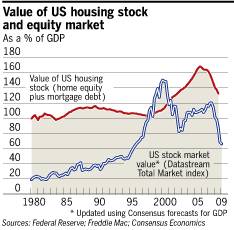

Wow, debt to GDP of 350%, almost 100% higher than when the great depression started. Now let's look at the value of the assets by which this borrowing is underpinned in the United States :

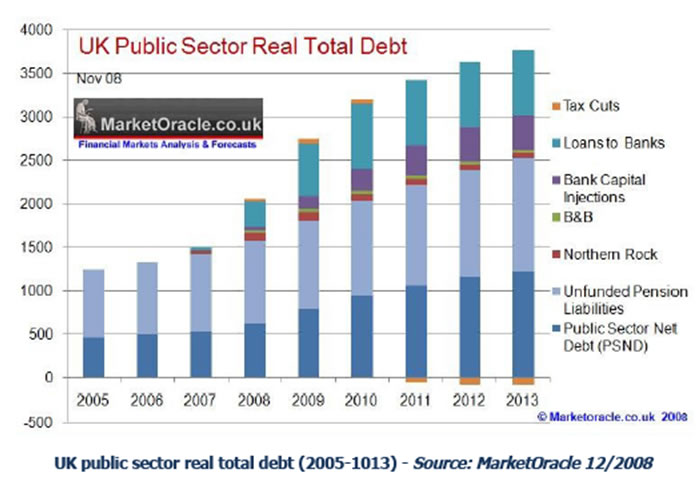

As housing is set to decline another 20%, keep in mind my projections for the S&P 500. Keep in mind also that government debt is serviced through taxes and as incomes and asset values collapse so do government revenues. Just for fun, let's take a look at the UK , and see how it compares to US liabilities from the www.Marketoracle.co.uk :

As housing is set to decline another 20%, keep in mind my projections for the S&P 500. Keep in mind also that government debt is serviced through taxes and as incomes and asset values collapse so do government revenues. Just for fun, let's take a look at the UK , and see how it compares to US liabilities from the www.Marketoracle.co.uk :

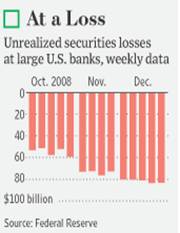

Future borrowing and ultimately money printing to finance these obligations, or to repair the lenders' balance sheets (American and European Banks), is set to SKYROCKET! Cumulatively the sum as of January 1, 2009 is almost 5 trillion dollars and RISING as the bank bailouts are woefully under funded, as was demonstrated in last week's BAILOUT of Royal Bank of Scotland, Bank of America and Citigroup; Unrealized losses are piling up at record rates (see below, Europe is worse), the US Bank rescue has consumed $350 billion and the next tranche is being detoured into rescuing new sectors at a rapid rate such as autos, credit cards, mortgage holders, commercial real estate and the list keeps on GROWING; lobbyists are lining up like pigs at the trough to get in on the giveaways. Meanwhile, unrealized bank losses just keep on piling up as this chart illustrates:

In December alone over $320 billion was vaporized off the balance sheets of the nation's BIGGEST banks! Only we haven't been told yet… After almost a year of DE-LEVERAGING nothing has been accomplished as income and BOOK value have shrunk FASTER than the money can be shoveled in. Europe is the same boat or worse, depending on the country.

Brand new sell signals on the weekly charts and the “falling out of the BOTTOM” of the trend channel signal the POTENTIAL for a crash: RSI declining, slow stochastics on new sell signal, MACD on new sell signal and ADX trend gauge at a healthy 37 (rarely do trends change when ADX is at this level.)

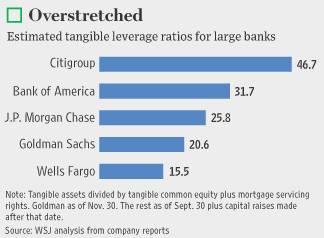

The financial sector shareholders will be left with nothing, and rightly so, as management has failed to protect shareholders and shareholders have not exercised proper oversight and KICKED the bums out. The losses this year by the biggest banks in the EU and US project to over 2 trillion, and either the government RECAPITALIZES the banks or the FINANCIAL systems will CEASE TO EXIST. I predict that most of the top 50 banks in the world will be RESCUED to the tune of at least another 2 trillion dollars in the coming year.

Let's take a quick tour around the world's major stock indexes on the weekly charts:

Brand new sell signals on the weekly charts and falling out of the bottom of the trend channels once again signal the POTENTIAL for a crash. RSI declining, slow stochastics on new sell signal, MACD on new sell signal and ADX trend gauge are at healthy levels.

RELENTLESS lower lows and lower highs… Notice anything familiar about these markets? They are a CHORUS to the downside, virtual reflections; the CAC in Paris and many more are a reflection of these as well. Notice how they all have gone back to the exponential moving averages and FAILED. A 28% move higher on average but still looks sideways before now heading lower.

Here's a snapshot of global risk appetite as seen by the Euro/Yen contract, please note the 5 waves down since mid-July and realize this was the leader in the stock market selloff in the last half of 2008. Notice the sideways range bound activity since October. During this period, the stock markets have been correcting the previous move lower by drifting higher on low volatility till they reached their weekly exponential moving averages and corrected the extreme oversold conditions on the market. Now look how it has broken down since January 6 th and is now plowing through the low of the consolidation.

As it breaks out lower, it is releasing the energy accumulated during the sideways activity and you can expect it to decline rapidly lower and pull the global stock markets DOWN with it as RISK is taken off the table, along with the Euro/Yen CARRY trade. I believe the corrections in stocks since October are actually the halfway point of the decline; if so, the market declines seen from July till November 21, will be duplicated in time and price movement from this point on, signaling another crash over the coming 6 weeks to 4 months.

As it breaks out lower, it is releasing the energy accumulated during the sideways activity and you can expect it to decline rapidly lower and pull the global stock markets DOWN with it as RISK is taken off the table, along with the Euro/Yen CARRY trade. I believe the corrections in stocks since October are actually the halfway point of the decline; if so, the market declines seen from July till November 21, will be duplicated in time and price movement from this point on, signaling another crash over the coming 6 weeks to 4 months.

VERY STOCK INDEX is following and working on outside down months on the charts, aka Key Reversals, Cambridge Hooks and bearish engulfing patterns, signaling that the next leg down for the FINANCIAL sectors and broad markets has begun or is about to.

OBAMA'S “Economic Stabilization and Recovery” plan, which is initially estimated at $850 billion (expect it to climb to over $1 trillion) contains NOTHING that creates permanent jobs. It is the biggest destruction of precious capital and piece of PORK ever proposed. It's a joke and a disaster ROLLED into one.

Here is a link to the overview from the House Appropriations Committee: http://wsj.com/public/resources/documents/AmericanReinvestment2009115.pdf . This is a disaster which returns NOTHING in long-term jobs or income. Here a brief overview from a recent www.wsj.com :

Here are highlights of the $825 billion economic recovery plan drafted by House Democrats and President-elect Barack Obama's economic team. Most provisions are temporary.

SPENDING

Energy: $32 billion to fund a so-called "smart electricity grid" to reduce waste; $20 billion-plus in renewable energy tax cuts and a tax credit for research and development on energy conservation, energy efficiency and renewable energy, and a multiyear extension of the renewable energy production tax credit for wind, hydropower, geothermal and bioenergy; $6 billion to weatherize modest-income homes.

Science and technology: $10 billion for science facilities; $6 billion to bring high-speed Internet access to rural and underserved areas; $1 billion for the 2010 Census.

Infrastructure: $32 billion for transportation projects; $31 billion to build and repair federal buildings and other public infrastructure; $19 billion in water projects; $10 billion in rail and mass transit projects.

Aid to the poor and unemployed: $43 billion to provide extended unemployment benefits through Dec. 31, increase them by $25 a week and provide job training; $20 billion to increase food stamp benefits by 13%; $4 billion to provide a one-time additional Supplemental Security Income payment; $2.5 billion in temporary welfare payments; $1 billion for home heating subsidies; and $1 billion for community action agencies.

Education: $41 billion in grants to local school districts; $79 billion in state fiscal relief to prevent cuts in state aid; $21 billion for school modernization; $16 billion to boost the maximum Pell Grant by $500; $2 billion for Head Start.

Health care: $39 billion to subsidize health care insurance for the unemployed and provide coverage through Medicaid; $90 billion to help states with Medicaid; $20 billion to modernize health information technology systems; $4 billion for preventative care; $1.5 billion for community health centers.

Housing: $13 billion to repair and make more energy efficient public housing projects, allow communities to buy and repair foreclosed homes, and help the homeless.

Law enforcement: $4 billion in grants to state and local law enforcement.

TAXES

Individuals: $500 per worker, $1,000 per couple tax cut for two years, costing about $140 billion; greater access to the $1,000 per-child tax credit for the working poor; expanding the earned-income tax credit to include families with three children; a $2,500 college tuition tax credit; repeals a requirement that a $7,500 first-time homebuyer tax credit be paid back over time.

Businesses: An infusion of cash into money-losing companies by allowing them to claim tax credits on past profits dating back five years instead of two; bonus depreciation for businesses investing in new plants and equipment; a doubling of the amount small businesses can write off for capital investments and new equipment purchases; allows businesses to claim a tax credit for hiring disconnected youth and veterans.

This is “MAKE work and consumption” of the WORST sort . Once spent, nothing will be left behind to pay for the borrowing except you, me and our children's FUTURE INCOMES. Not one item will “produce more than it consumes”, create wealth, savings and permanent employment from which the borrowing can be repaid. Another proposed expenditure is $600 million for NEW CARS for government. Of this money that's to be spent how much will be lost to waste, fraud, abuse and lack of proper oversight? My guess is well over 50%. The tax rebates go to people that DON'T pay taxes and is thinly disguised WELFARE. In fact, most of the stimulus is welfare…

Remember how well last summer's stimulus checks worked? Or how about the stimulus checks in 2002 from the first BUSH tax plan? NOTHING CHANGED, NO NEW JOBS were created in the private sector. Great plans from the public serpents in WASHINGTON , DC -- economically illiterate, fiscally and morally bankrupt LAWMAKERS and their supporters. This is a recipe for expanding corruption in Washington as lobbyists bid for bucks with campaign contributions.

This is nothing but PORK of the worst kind; it's like children sitting around creating a wish list of FRIVOLOUS spending. It has absolutely NOTHING to do with REVIVING THE ECONOMY and it won't. IT'S WELFARE AND WORKFARE of the worst variety. CAPITAL DESTRUCTION, CAPITAL DESTRUCTION!!! It's just a BIG government wish list come to life for the SOMETHING FOR NOTHING constituents and campaign contributors!!! It addresses nothing of the declining incomes' in the private sector. Wealth creation, jobs and rising incomes come from the private sector and NO WHERE ELSE!

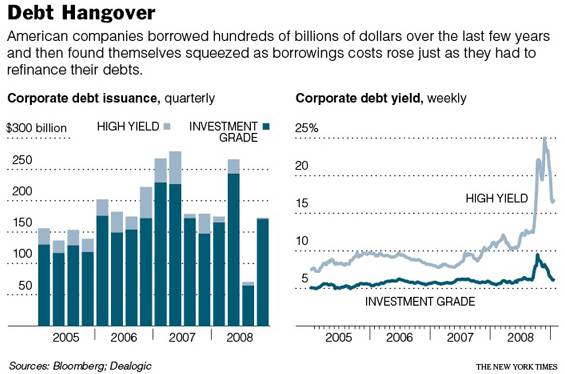

A minimum of over $10 trillion of GOVERNMENT and corporate debt has to be rolled or issued this year in the US and Europe . Many corporations no longer have the level of business activity necessary to roll or issue new debt. This total does not include states and municipalities, that REFUSE to cut spending like the private sector is doing AS FAST AS THEY CAN, which will probably add $400 billion under water. The private sector will increasingly be PUSHED aside by government as it attempts to roll previous obligations of finance into new investments. Look at corporate debt issuance in the US :

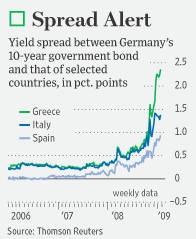

As economic activity recedes and corporations try and go to the markets, you can expect these spreads to widen considerably to levels FAR wider than last October; Europe is in equally as bad shape. LARGE SCALE corporate bankruptcies loom in 2009, and with them MILLIONS of private sector jobs and incomes will be lost. The pile of debt just keeps imploding lower in an avalanche of defaults. If you are in corporate bonds, sell into this rally and get out!! In the Euro zone investors are increasingly skittish of sovereign debt as illustrated by this chart of interest rate spreads between the quasi-banana republics of Spain , Greece and Italy , as well as German Bunds:

This is ugly, but a bigger canary in the coal mine occurred last week when the German Bundesbank held an offering for 10-year Bunds and couldn't sell them all; originally scheduled for 6 billion Euros, only a little less than 4 billion could be sold because insufficient bidders FORCED them to reduce the offering… Keep in mind, Germany is the only country in Europe that still boasts a big manufacturing sector and therefore creates wealth!

This is ugly, but a bigger canary in the coal mine occurred last week when the German Bundesbank held an offering for 10-year Bunds and couldn't sell them all; originally scheduled for 6 billion Euros, only a little less than 4 billion could be sold because insufficient bidders FORCED them to reduce the offering… Keep in mind, Germany is the only country in Europe that still boasts a big manufacturing sector and therefore creates wealth!

How long will foreign and domestic lenders buy this debt knowing income is collapsing and money and precious capital is disappearing into the black hole of the financial and public sector's BAILOUT plans?

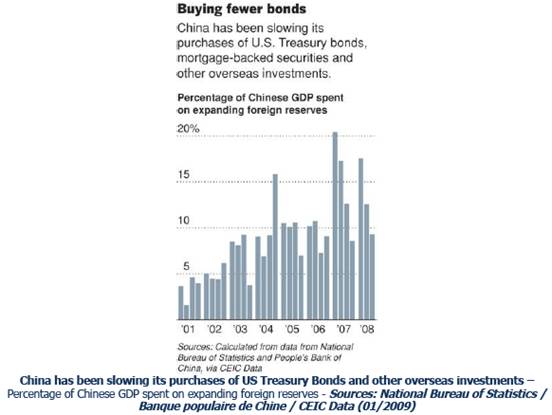

Now look at the Chinese and their increasing UNWILLINGNESS to throw good money after bad:

They have their own problems to deal with and you can expect this to continue to decline. How about the rest of the emerging world? You can expect them to address domestic problems as well. Their foreign exchange reserves will increasingly be kept at home. Do the big government fools in London , Washington , Brussels , Paris and Berlin expect their citizens to absorb TRILLIONS of dollars, Euros and Pounds of debt issuance that PAYS NOTHING? Interest rates are headed to ZERO throughout the US , G7 and Europe …

In conclusion : An economic PEARL HARBOR , a tsunami, a horror show and nightmare on Main Street is unfolding in the savings short over the indebted G7. There is plenty of cash in the bank but DON'T expect it to enter these debt offerings or the stock markets; it is SCARED to death and rightly so. NO WAY are these SAVERS going to plow their money into covering someone else's INSOLVENCY. There is only one escape route for DESPERATE crony capitalist elites, G7 central banks and government SERPENTS' handmaidens and that is the printing press. It's an easy choice for them. Public sector pension shortfalls in the US are almost $1.2 trillion, in the private sector $500 billion plus and it is UNFUNDED. The problems in the EU are proportional…

The UK just rescued its banks and financial sector for the second time in 3 months, look for the rest of the G7 to do so as well and in short order. The Royal Bank of Scotland just announced a 41 billion Dollar loss (largest loss in British corporate history) and that is just the first to do so. Nationalization of the G7 banking systems looms dead ahead…

When you run into cash to avoid the economic crash it will be only a temporary safe haven as deflation will increase its purchasing power for a short while until the public WAKES up to the MONEY PRINTING. Then it will turn on a dime and the Crack-up boom will appear.

When the stimulus packages FAIL you can expect the governments to double down over and over again, and at some point inflation will IGNITE. Sovereign governments are now in a competitive currency DEVALUATION raceway, trying to devalue their way to export competitiveness, and the only currencies that can't be debased are GOLD and silver so expect more and more people to acquire the “barbarous” relics -- the only true money. Devise your plans to exercise the indirect exchange into tangibles.

The solution to insolvency is never “borrowing and spending more”, but it is too late this time. You can't repeal the laws of nature. There is no such thing as a free lunch and millions of fools who believed so are about to get a lesson in ECONOMICS 101; which the schools no longer teach. The only way you get to solvency is by producing more than you consume which begets savings and rising standards of living; if you don't believe me ask the CHINESE, Brazilians and many in the emerging world.

I read lots of analysis from the EU and they all point the finger at the US . HA HA, HA.. You are in the same boat my friends, concentrate on helping your readers rather than practicing hubris.

VOLATILITY is OPPORTUNITY and you will see more of it this year than you can imagine. Buy and hold is DEAD. Find professional managers who can help you make money in up or down markets (this is what I do), who are professional traders and risk managers with track records and who will work on an incentive basis. Stocks, bonds, commodities, raw materials, interest rates and currencies are set to run all over the place -- learn how to turn this into opportunities for yourself.

Restore gold backing to your paper money (it's quite easy to do). The BABY BOOMERS are NOT going to retire with their accumulated stock and real estate gains of the last 30 years. Buy, hold and hope is going to prove to be VERY BAD ADVICE! YOU MUST LEARN TO MAKE MONEY IN RISING AND FALLING MARKETS. Devise a plan for the indirect exchange as outlined by Ludwig Von Mises.

Government Bonds and G7 currencies are FOOL'S gold. Supposedly safe but actually the ultimate place of insolvency, they are not money, they are IOU's of corrupt governments and central banks and they are BACKED by nothing but the respective governments' promises to pay. Many corporations WILL survive but figuring out which ones have the managers to survive will be PROBLEMATIC as the economic conditions will make it very hard to tell. Get out of your corporate bonds as well. Stay away from ANYTHING that moves to the public bailout trough as you will end up with NOTHING.

The US and European banking and financial communities are set for IMMOLATION. Bonds are bombs and paper is ultimately poison, short-term treasuries are only a temporary SAFE haven and will crumble under the relentless printing presses and monetization that is the only escape route for the crooked public servants and their elite supporters. HI HO, HI HO….it's off to the printing presses they go, as the next great depression has begun.

Look for Part Two of the 2009 Outlook coming in the next issue!

Please remember that subscribers receive Tedbits two to three days before it is posted on the web. Subscribers will also start receiving guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2009 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.