Stock Market Bottom Pickers Beware of the Dow Jones Bear Market

Stock-Markets / Financial Markets 2009 Jan 29, 2009 - 04:42 AM GMTBy: Chris_Vermeulen

We had a slow start to the week with prices drifting sideways and upward on below average volume. Wednesday the market put in a nice rally with small and mid cap stocks leading the way higher. The chart of the Dow or the DIA exchange traded fund shows the low volume clearly. Most indexes are now trading just below a short term resistance level and Wednesdays rally was on light volume. I don't like to be a bear, low volume rallies are not a bullish sign.

We had a slow start to the week with prices drifting sideways and upward on below average volume. Wednesday the market put in a nice rally with small and mid cap stocks leading the way higher. The chart of the Dow or the DIA exchange traded fund shows the low volume clearly. Most indexes are now trading just below a short term resistance level and Wednesdays rally was on light volume. I don't like to be a bear, low volume rallies are not a bullish sign.

Gold and Gold Stocks

Gold and gold stocks continued to pullback today after putting in a reversal candle last Monday. Looks like investors were pulling their money out of precious metals and buying small and mid cap stocks today.

Gold Chart:

Gold is trading at the top of it s range and is currently at the high of the previous bounce which generally causes resistance. Buying at this level carries high risk considering support is down around the $82 level (7% risk from support). Waiting for a proper pullback and reversal is important in keeping risk low.

Gold Stocks:

Gold stocks have been posting solid gains and out performing the broad market for the past 3 months. Technically they do have some issues now. They are trading below the 200 moving average and have not been able to break above it. Also momentum and stochastic have turned down as well. To top that off, resistance has been tested 3 times in the past month and in most cases that means it's not going to move higher. That being said, gold equity ETF's like XGD.TO, GDX etc… are getting close to a possible buy signal, and with any luck it could be within the next 2-5 days. We need a couple things to fall into our favor before that happens though.

Gold Stocks Chart:

Crude Oil:

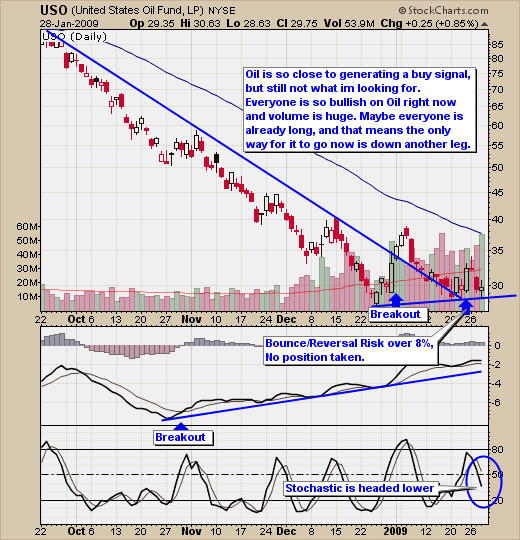

Oil is such a hot topic and investment, although I think most people are losing their shirts trying to pick a bottom. Buying at support when risk is very low after a trend line breakout and reversal candle, change in momentum, and everything else for that commodity looks to be in my favor is when I put my money to work. Oil Looks really tempting right here but I don't have a buy signal and I think its about to continue its slide lower in the next few days.

Crude Oil Chart:

Conclusion:

With volatile times like what we are in now, cash is a safe position to be in. Only when the stars align with a proper setup with risk under 3% for a trade will I take a stab at the markets. I don't want to sound like a broken record but it seems like everyone is bullish on Gold & Oil right now and if that's the case, almost everyone should be long, leaving only one way for it to go, down. We all work way too hard for our money and to toss our money in when things are like a yo-yo is just silly. Patients are a must in times like this.

I have put together a package for yearly subscribers which is if you join for a year ($299) I will send you $300 in gas vouchers FREE which are valid at the major gas stations in USA & Canada. Valid At: Chevron, Texaco, Sunoco, CITGO, Mobil, Esso, Shell, BP, And More... as Holiday Special!

If you interested please act fast as I only have a few of these gas vouchers before they are gone for good.

If you have any questions please feel free to send me an email. My passion is to help others and for us all to make money together with little down side risk.

I look forward to hearing from you soon!

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.