Obama's Economic Train Wreck Gathers Speed

Economics / Recession 2008 - 2010 Mar 08, 2009 - 07:47 PM GMTBy: Gerard_Jackson

It's becoming increasingly clear to market players that Obama and his merry band of economic vandals are completely clueless about economics and the role of markets. These people are purely political. For them, economics is simply a matter of tax, spend and regulate. The thought that their economically and socially destructive policies could also rip the electoral ground from under them has yet to materialise.

It's becoming increasingly clear to market players that Obama and his merry band of economic vandals are completely clueless about economics and the role of markets. These people are purely political. For them, economics is simply a matter of tax, spend and regulate. The thought that their economically and socially destructive policies could also rip the electoral ground from under them has yet to materialise.

They are trying to rule the US the same way that Chavez is ruling and ruining Venezuela. Not because they idolise that swaggering ersatz Castro but because they largely share the same mindset. This is why their first response to criticism is not to debate the issue but to demonise and destroy critic. In this they have the enthusiastic support of America corrupt mainstream media.

Only intellectual arrogance married to economic illiteracy can explain Obama's blasé attitude to market conditions. This is why he pompously announced:

What I'm looking at is not the day-to-day gyrations of the stock market, but the long-term ability for the United States and the entire world economy to regain its footing. And, you know, the stock market is sort of like a tracking poll in politics. You know, it bobs up and down day to day. And if you spend all your time worrying about that, then you're probably going to get the long-term strategy wrong.

It completely escaped him that it's "not the day-to-day gyrations" that matter but the trend -- and the trend is inexorably downward. Investors looked into Obama's crystal ball and they don't like what they saw: more spending, more government, more bureaucratic empires, more costly regulations, more union control, more taxation, more assaults on energy production. The economic consequences of this massive intervention will be severe, and they know it.

Even so, the vast majority of Americans are still unaware of monumental costs of this program. The American Institute for Economic Research estimates that Obama's spending and bailout program will cost US taxpayers $8 trillion . And Mr Hope and Change still has more spending projects on line.

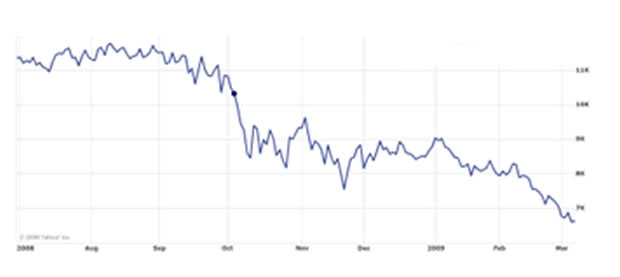

The whole damned monstrosity is anti-growth and no amount of covering up by his media and academic stooges can hide that fact from the markets. It is as if Obama and his crew have deliberately adopted a policy of squeezing the economy "until the pips squeak". It is this policy of economic vandalism that fuels the bear market, as indicated by the chart below, not the recession.

It's true the market was heading down before Obama was elected. It is also true that the downward trend steepened once it became odds on that he would be the next president, proving once again that markets have fare greater foresight than political pundits and media cheer leaders.

So how low, for example, can the Dow go? On 6 March it closed at 6,626.94. It was 13,000 last May, a drop of 49.02 per cent. Share prices fall in a recessions because earnings fall. Because markets are forward-looking they factor anticipated earnings (discounted) into current share prices. It follows that the lower future earning will be the lower will be share prices and the same goes for the price-earnings ratio. Moreover, the longer markets expect a recession to last the longer it will take share prices to recover. When we consider that the Obama stimulus package is really an anti-recovery policy I think it is quite possible that the Dow will fall to 4,000 or even lower and remain there for sometime. Obama's response to this dismal picture was to tell Americans:

Profits and earning ratios are starting to get to the point where buying stocks is a potentially good idea.

Markets do not require investment advice from a man who thinks a firm's profits equal the price of one of its shares. Even if he understood the P-E concept it would not justify his rosy recommendations. At the moment I believe the average P-E is about 12 as against the historical of average of 14. Given the market trend and Obama's assault on profits and investment, the 12 figure strongly suggests that the P-E still has a long way to fall. Perhaps this why the markets chose to ignore President Obama's investment advice?

Unfortunately Obama's attack on economic reason is not all that Americans should be worrying about. To all intents and purposes Bernanke has abandoned control of the money supply. From last August to January Bernanke allowed the monetary base to explode by about 112 per cent, raising it from $0.8 trillion to $1.7 trillion. The chart below reveals the dangerous monetary trend that has been creeping up on America for decades. The last bar on the chart clearly indicates that if the past trend is adhered to a massive monetary expansion is in the pipeline.

Money base -- AMS --

Austrian money supply definition:

Cash+demanddeposits with commercial banks and thrift institutions + government deposits with banks and the central bank + demand deposit at foreign commercial banks and foreign official institutions + sweeps.

Monetary base: currency and coins held by individuals, firms, depository institutions and at the central bank.

Sweeps: Demand deposits that have been reclassified as savings deposits.

If the trend had been maintained the last bar would have been about 1,000.

This is a reckless monetary expansion by any measure and one designed to increase bank lending. Without lending by the banks Bernanke's monetary policy, including his negative interest rate policy, will be doomed. This view is strengthened by the fact that during the same period AMS grew by 20 per cent, which means banks have actually been lending.

I believe that markets would be correct in predicting that the US is heading for highly inflationary period. Although this is bad enough, we find that at the same time as expanding the monetary base Bernanke undertook to underwrite mammoth foreign exchange risks that would normally have been shared with the Treasury on a 50-50 basis. It's looking more and more like Bernanke is over from the Treasury in order to advance Obama's agenda. A shrewd move from Obama's angle as the Fed is not normally held politically accountable.

Part of Bernanke's monetary plan appears to be one of reducing the money supply once the economy gets moving. However, some observers believe that Bernanke's feckless monetary policy has seriously weakened the Fed's capacity to exercise the necessary monetary restraint. It's neither here nor there, even if this were not the case any attempt by Bernanke to reduce the money supply if the economy got moving would be bound to reverse the recovery.

(Rightly or wrongly, I am of the opinion that Bernanke is a Democrat first and an economist second. The consequences for the economy will not be pretty).

No matter how bad the situation gets it will have no effect on Obama's Leninist-like supporters in the media. These are politically motivated pathological liars for whom reason is an obstacle to happiness, governed as they are by magical thinking. Then again, a good economic lancing (figuratively speaking) might bring about -- for some of them at least -- a remarkable change in perspective.

*One should note that the widening gap between AMS and the money base is caused by the fact if a comparatively constant per centage change is maintained between two variables then as they increase the unit difference between the two will increase in absolute terms. The per centage difference between 10 units and 11 units is 10 per cent while the absolute difference is 1 unit. The per centage difference between 1,000 units and 1,1000 units is still 10 per cent but the absolute difference between them is 100 units.

By Gerard Jackson

BrookesNews.Com

Gerard Jackson is Brookes' economics editor.

Copyright © 2009 Gerard Jackson

Gerard Jackson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.