U.S. Dollar Expected to Extend Losses Ahead of Negative GDP Data

Currencies / Forex Trading Mar 26, 2009 - 04:13 AM GMTBy: ForexPros

A violent day was had by all today as the USD whipsawed in big ranges before ending the day mixed. Comments by Treasury Secretary Geithner combined with better-than-expected US data combined to confuse traders in both directions but USD bears appear to prevail into the end of the New York session. Speaking on the possibility raised by the Chinese of a one-world economic currency were deflected by Geithner into a possibility of increasing SDR money through the IMF were misinterpreted on face-value throwing the USD into a big slide against the majors extending lows back under important intraday S/R; the Greenback recovering against some pairs but not others as the day wore on.

A violent day was had by all today as the USD whipsawed in big ranges before ending the day mixed. Comments by Treasury Secretary Geithner combined with better-than-expected US data combined to confuse traders in both directions but USD bears appear to prevail into the end of the New York session. Speaking on the possibility raised by the Chinese of a one-world economic currency were deflected by Geithner into a possibility of increasing SDR money through the IMF were misinterpreted on face-value throwing the USD into a big slide against the majors extending lows back under important intraday S/R; the Greenback recovering against some pairs but not others as the day wore on.

GBP high prints at 1.4736 went unchallenged in New York although a big-figure rally tagged stops in the crosses; the GBP falling after the London fix to 1.4513 despite RHS interest at the fix.

EURO rallied to a high print at 1.3651 before dropping back under the 1.3500 handle in less than 30 minutes only to regain the 1.3600 handle mid-day for a short time; the rate ends around 1.3570 area in thin trade after both sides got baked on the volatility. Traders note that despite the large swings in price the rate is firm into the close and expect another round of sellers to try for the 1.3300 handle and buyers to try for the 1.3700 handle overnight suggesting more high volatility is due. Aggressive traders can look to buy a dip in the rate back under the 1.3500 handle in my view.

USD/JPY held firm all day near the 97.90 area occasionally poking its nose over 98.00 to look for stops or offers but fell back to lows late in the session ending around 97.10 area; the early dip to low prints at 96.91 did not find the rumored large stops resting under the market but no doubt there will be a probe for them overnight.

USD/CHF low prints at 1.1168 were unchallenged during the day but the rate dropped to the 1.1170 area more than once before ending around the 1.1200 area; a secure close under the 200 day MA of 1.1209 will likely discourage the bulls near-term. Traders also note that the rate had the lowest close in two-months suggesting the SNB intervention has failed (as expected) and more losses to end the week are likely.Aggressive traders can add to open shorts in the rate on any strength in my view.

USD/CAD is holding gains near daily highs of 1.2358 failing to extend losses on the whipsaw early in the day; low prints at 1.2218 were quickly bought but the rate still holds below the 100 day MA seen as eventually bearish for the pair. In my view, the resulting whipsaw on the Geithner comments clearly shows that traders are nervous and unclear in overall USD direction. I think traders need to accept that USD strength is probably going to be challenged to end the month and further losses are likely.

Look for the Greenback to extend losses the next 24 hours or so; it should get quiet ahead of US GDP tomorrow with a negative number well factored in.

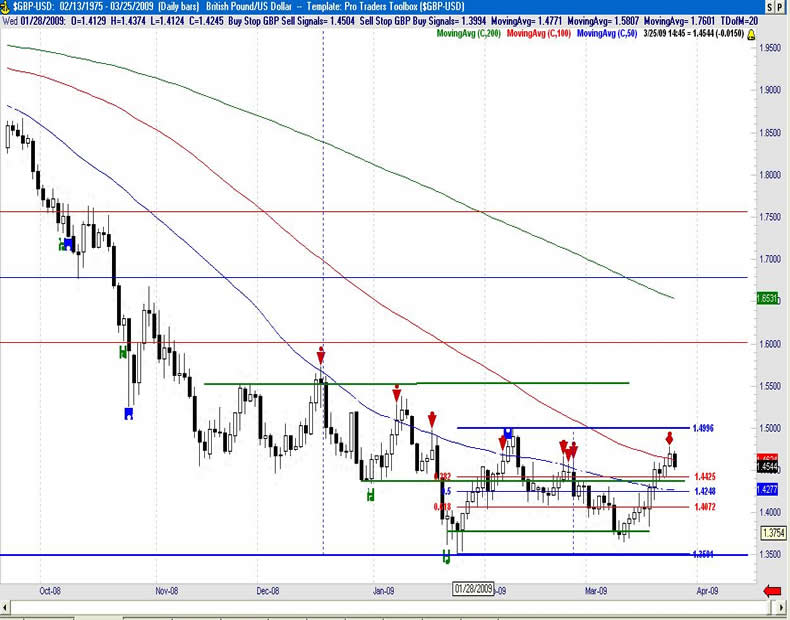

GBP/USD Daily

Resistance 3: 1.4880, Resistance 2: 1.4820/30, Resistance 1: 1.4780

Latest New York: 1.4540, Support 1: 1.4450, Support 2: 1.4280, Support 3: 1.4050

Comments

Rate two-way and violent, likely stops under 1.4600 area cleared with bids around 1.4550 taking the other side. Lows late in the day argue that the toolbox signal valid; aggressive traders could lighten up on longs near-term. Traders report large names on the dip and the rate is likely to follow EURO higher if EURO can rally. Overhead resistance now approaching the 1.5000 area with some tech resistance around 1.4880. Support likely on the dip to 14440/50 area. Traders report stops cleared over the 1.4710/30 area but expect another try from early shorts. The door is open to a rally back to the 1.5000 area. Some in-range stops driving some trade into the lows but traders feel the lows likely remain secure. The volume needs to come up and I think the shorts have yet to bail as a group; that may be starting in earnest now. Traders report stops in-range adding for two-way action. Two-way action continues suggesting that shorts are aggressively adding and longs are trying to find a bottom. Next upside target is 1.4800 area, downside is near support at 1.4450 area

Data due Thursday: All times EASTERN (-4 GMT)

26th-31st GBP Nationwide HPI m/m

5:30am GBP Retail Sales m/m

5:30am GBP Revised Business Investment q/q

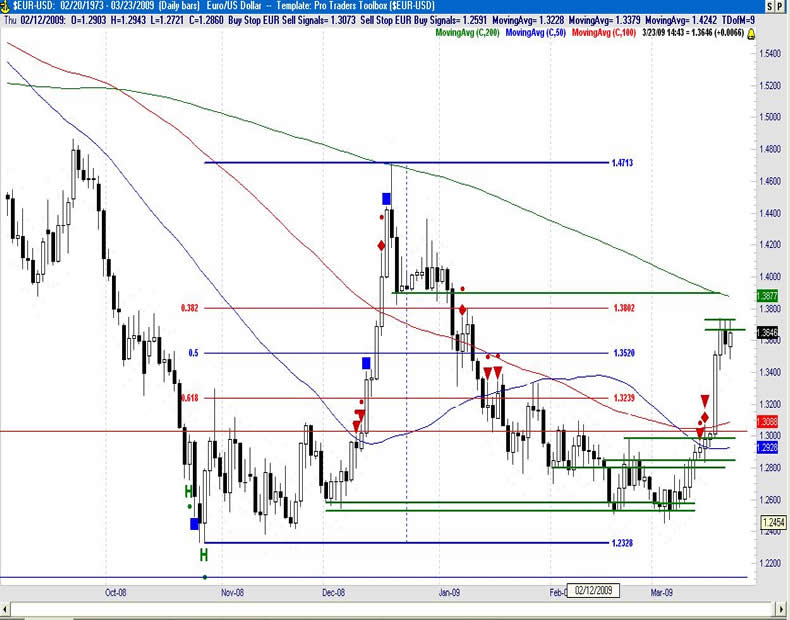

EUR/USD Daily

Resistance 3: 1.3980, Resistance 2: 1.3820, Resistance 1: 1.3740

Latest New York: 1.3591, Support 1: 1.3420, Support 2: 1.3350, Support 3: 1.3300

Comments

Rate dips on news, clears stops under 1.3450/60 and sovereign bids seen into the lows. Rate makes highs in NY after the news suggesting the rate is attractive on dips and shorts are weak. Action remains two-way; is not advancing as aggressively yet. Stops likely building above the 1.3740 area. Upside stops in-range likely cleared in size above the 1.3620 area today but offers cap ahead of larger stops said to be over the weekly highs. If the rate can close above 1.3650/60 area more upside is likely. Overhead resistance above 1.3350 area negated so a pullback to there would also be a strong buy. Traders note big names on the buy side on dips overnight; Asian sovereigns seen buying around the 1.3480 area overnight. Bulls are likely in control of the market and any significant pullback is a buying opportunity in my view. Expect two-way action.

Data due Thursday: All times EASTERN (-4 GMT)

3:00am EUR GfK German Consumer Climate

5:00am EUR M3 Money Supply y/y

5:00am EUR Private Loans y/y

Join us for the Afternoon US Dollar Wrap-Up daily at 3:15 pm Central/Chicago time (GMT -6)

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.