Neither Krugman Nor Bernanke Can Distinguish Excessive Money Printing From Excessive Savings

Economics / Quantitative Easing Apr 07, 2009 - 02:02 AM GMTBy: Mike_Shedlock

Earlier today Calculated Risk posted a video and links to Krugman's Talk In Spain on March 17. Here is the video. A partial transcript by me follows.

Earlier today Calculated Risk posted a video and links to Krugman's Talk In Spain on March 17. Here is the video. A partial transcript by me follows.

Krugman: " I am rather a supporter of Mr. Bernanke at the Federal Reserve which is partly because I think he is the right man for the job, partly because before he was demoted to his current position he was a professor at Princeton University which is where I also teach.

How does this end? What can make this better? One answer is a stronger European economy. This problem would be much easier if Europe was a vigorously growing economy with a positive rate of inflation.

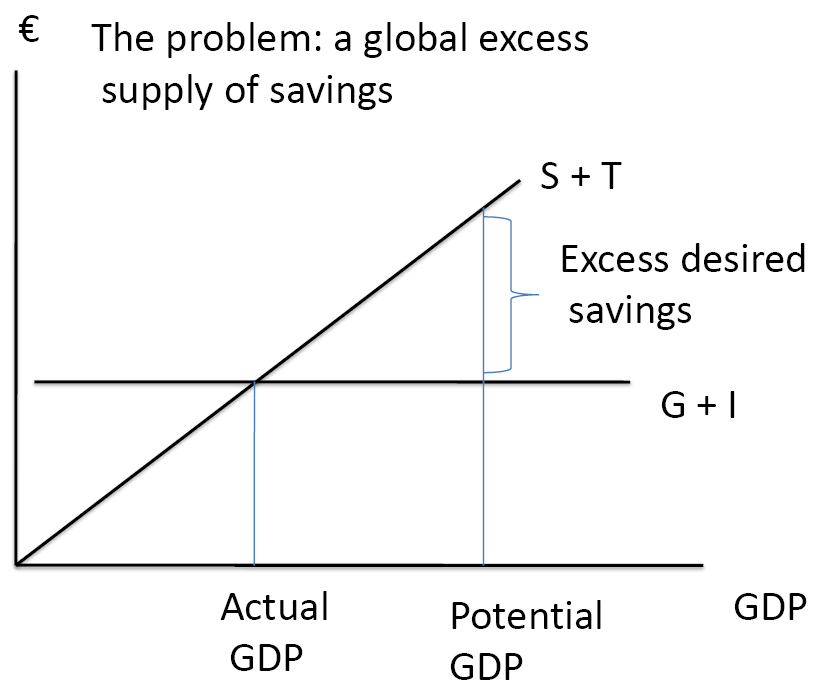

Around the world people want to save more than business is willing to invest. We have a global paradox of excessive savings. The best thing that could happen to the economy would be to find a lot more investment opportunities, anything that provides quantum leaps into what we can do that would be worth doing even in a depressed economy. "

Note that Krugman is repeating the mindless chatter of Bernanke about excessive savings. The "Savings Glut" theory is easily refuted.

- Global Savings Glut Revisited December 2006

- Global Savings Glut Exposed September 2007

- Bernanke Blames Saving Glut For Housing Bubble June 2008

Problems With Academic Wonderland

The problems with such equations are many. For starters it assumes that one can correctly determine the ideal GDP when GDP figures themselves are ridiculously distorted. For example consider the following two cases.

1. The Government sends everyone in the country between 18 and 62 a check for $40,000. This does not add to GDP.

2. The Government hires everyone in the country to sponsor a road and collect trash. The salary is $40,000 a year. The results of the above would be a nearly identical waste of money, yet in case number two, every dime spent would add to GDP.

Clearly this is nonsense and one can see that by this formulation potential GDP is limited only by the capacity to print which is in theory infinite.

What Portion of Government Spending Is Productive?

Inquiring minds are asking "What portion of government spending is productive?"

- In the case of dropping bombs in Iraq, government spending was and remains negative.

- In the case of pork barrel projects in Congressional slush funds, the answer is very little.

- In the case of pothole filling and bridge repair, the answer might be a great deal. However, excessive wages paid vs. what would be paid in a true competitive bidding process will need to be factored in.

- In the case of government sponsorship and takeover of Fannie Mae, Freddie Mac, and AIG, the answer is close to zero.

Government spending simply cannot be as productive as private sector spending. Yet Krugman thinks government spending can lead us out of this mess. It cannot.

There is no such concept as an ideal growth rate in GDP other than the growth that would be achieved if government simply got out of the way and stopped wasting taxpayer money.

Printing vs. Savings

Both Bernanke and Krugman mistake printed dollars accumulating in China and Japan as excessive savings. The reality is that spending without prior saving (i.e. printing money) results in bubbles that eventually pop.

The global credit bubble has now popped and Bernanke and Krugman both want banks to lend when there is every reason for banks to not lend.

The reason banks are reluctant to lend is prior excessive spending led to malinvestments and overcapacity in autos, homes, durable goods, strip malls, and damn near everything else. There is simply no reason for banks to lend or for credit worthy borrowers to borrow.

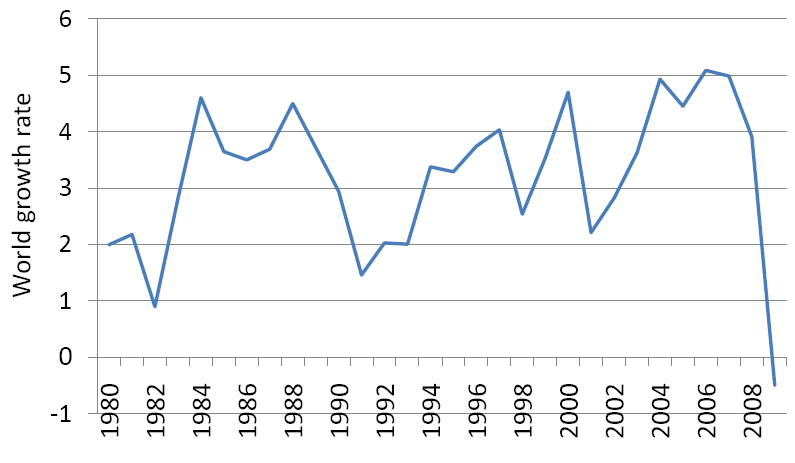

First Global Output Decline Since 1930's

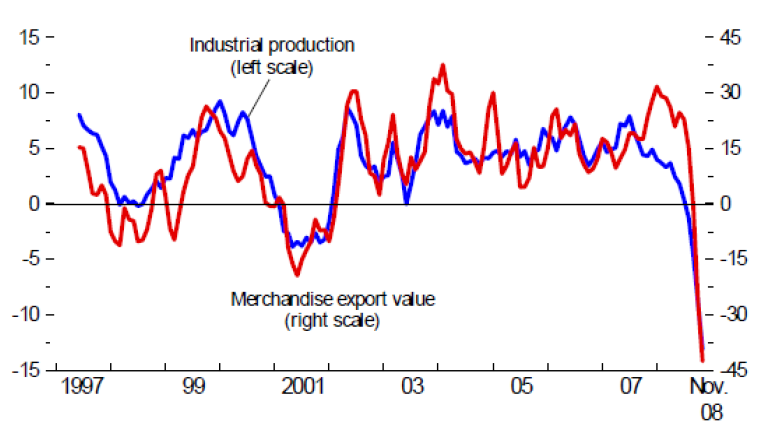

Industrial Production Annualized Three Month % Changes

The charts above show what happens when consumers are tapped out, wages are low, jobs are very difficult to find, and in short what happens when credit bubbles pop.

Thus the charts are not a result of excessive savings, but rather of prior excessive spending on a Ponzi pace that could not be maintained.

Unfortunately, neither Krugman nor Bernanke can distinguish cause from effect, or excessive printing from excessive savings.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.