US Dollar Collapse Imminent

Currencies / US Dollar Jul 23, 2009 - 06:52 AM GMTBy: Frederic_Simons

We don't like to make bold predictions. But this time, it is different (famous last words).

We don't like to make bold predictions. But this time, it is different (famous last words).

You might have seen that we at Crossroads FX tend to trade in a very systematic way, using signals of our proprietary trading system without asking too many questions. But you know, from time to time patterns emerge where you cannot resist.

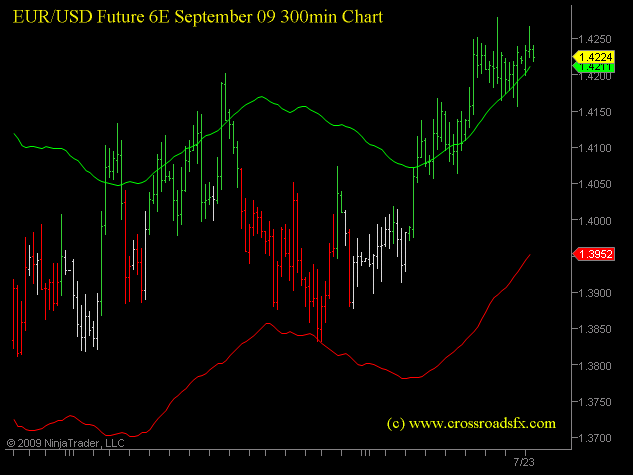

If you take a look at a 300min chart of the EUR/USD Future, everything looks like "normal business". The Euro is trading well above the green buy line in bullish territory, and the line of least resistance is safely pointing to the upside, predicting higher prices in the near future.

[Please click here for additional information about the trading system and how to read the charts]

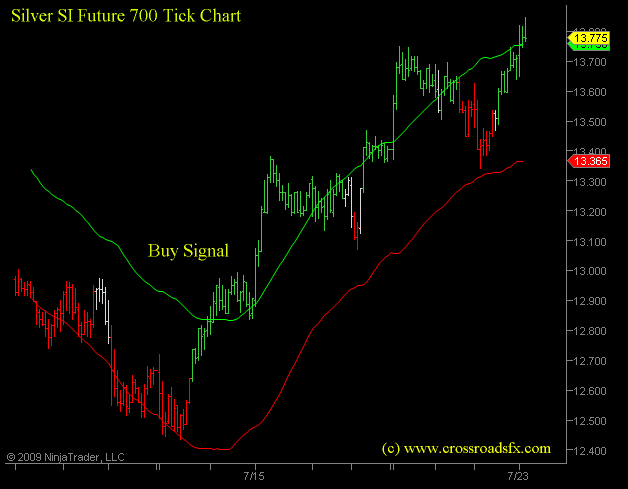

If you look at precious metals, you might also think: Ok nothing special. Nice uptrend for the last few days, but nothing of big interest.

Then we came across the following daily chart of the USD. When looking at a chart from a technical analysis viewpoint, you either immediately observe "your trade", or there is none.

To us, this chart is looking more than spectacular, as it displays a big descending triangle formation, which looks pretty much as if it will be resolved as it should. To the downside.

Now, the height of the pattern is about 11 points. From the breakdown point, which will be reached as prices fall below the two red horizontal lines around 78, the measured move to the downside will equal the height of the pattern.

This amounts to a price target of around 67 in the USD index. And as prices tend to move lower quickly when breaking down, the future chart may look like this in a few weeks time:

This is looking nasty, isn't it ? How to play this ? There are certainly a lot of ways to do it, and everybody has his own preferences. It looks however interesting to buy either some put options on the DX Future, or some EUR/USD call options. The big advantage of options is that you will have big leverage for relatively small change, with a limited risk of loss. In addition, if the USD should actually crash, implied volatilities will explode to the upside, which will add to the value of the options, making profits even bigger.

As far as the implications of a Dollar crash for precious metals and the bond market are concerned, we can only say: they might be of historic magnitude, and mark important upside breakouts for precious metals, and breaks to the downside for bond prices.

We think that when the USD crash comes, it will start with a big move, has little retracements, and take no prisoners.

Just in case: a first sign that the probable crash in the USD might be averted for the time being could be observed if and when the EUR/USD exchange rate falls below 1.3952, as this will turn the 300min chart bearish.

If you have any questions, please do not hesitate to contact us by writing an email to

New: Discounted subscription fees for retail (non-professional) investors. 3 Month subscription for only 75 USD !

By Frederic Simons

http://www.crossroadsfx.hostoi.com

© 2009 Copyright Frederic Simons - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.