It’s a New Macro, the Gold Market Knows It, But Dead Men Walking Do Not (yet)

Commodities / Gold & Silver 2024 Apr 07, 2024 - 02:13 PM GMTBy: Gary_Tanashian

On the occasion of another standout payrolls report, we note that the macro is indeed changing beneath the surface

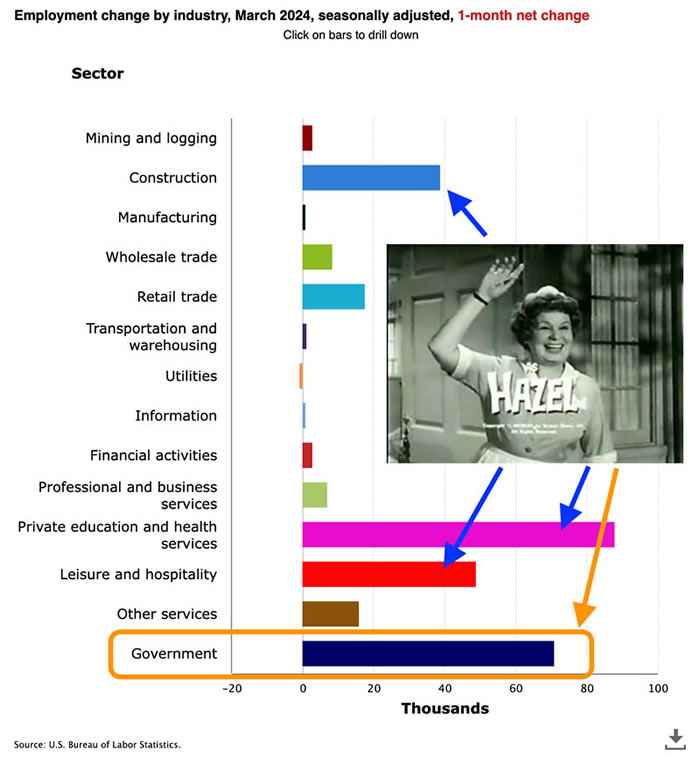

Another payrolls report, another beat of expectations. Here is the breakdown of the details as posted earlier. However, let’s pluck one graphic from that post and illustrate a phenomenon I’ve been watching unfold for several months in a row; that of unabated government hiring this election year.

The USS Good Ship Lollipop sails along, supported by its vast services economy and construction (a product of the services industries, not a productive industry itself, unlike for example, manufacturing) as well as a continued trend of brisk government hiring this election year. I am not going to play politics (I am dispirited by both major parties) but as usual, I am going to lay out facts so that we can properly manage the situation from an investment perspective.

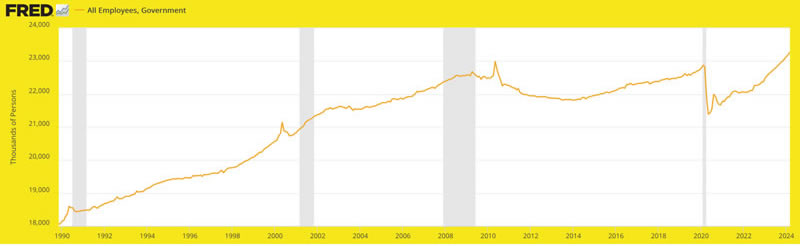

The string of government hiring has been anecdotal, as seen by my eyes and recollected by my brain over the last many months. Here is something a little more concrete, courtesy of the St. Louis Fed. Government employment has ticked a new all-time high. Since June of 2022 the figure has been robo-trending upward.

St. Louis Fed

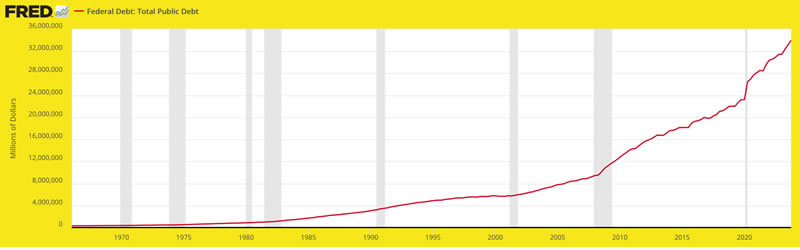

So the Payrolls picture appears rosy as all those services and all that governmental bloat continue apace as the public debt ticks above $34 Trillion.

St. Louis Fed

It is beyond the scope of this article to go into the details of why this leveraged disaster in waiting has not yet resolved into negative market price action. There are many other warning indicators in play. But my work implies that certain forces are doing their best to keep up appearances this election year.

I try to keep my tin foil hat in excellent working order and only use it on very rare occasion, when FACTS actually line up with tin foil. “Facts” have indicated a fiscally stimulative government and logic has considered the potential of former Fed chief Yellen to be in coordination with the current Fed, which has been regulating liquidity through its bond markets operations. See this X thread sent to me by Austrian economist Michael Pollaro.

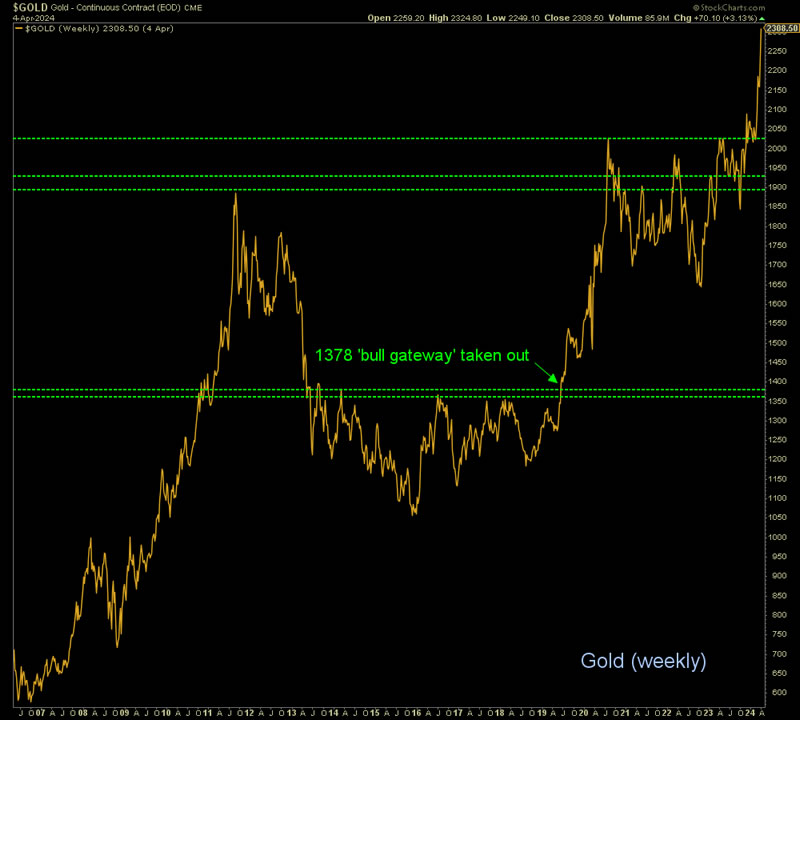

Some question why gold has not gotten hammered on the joyous employment news. Well, maybe it is just time. With such an obvious farce as the painting of the jobs picture by government hiring and knock on effects (in construction and services) of governmental debt spending to keep the economy fiscally stimulated this election year, gold is simply looking ahead; jumping the creak if you will. Currently it is acting as an inflation scout (one of its utilities, under the right circumstances), but in my opinion it is also looking beyond that.

Gold is the anti-bubble after all, and it appears not to be waiting for bubble markets to pop before getting a move on into the new macro picture, which will be post-bubble and counter-cyclical with, in my opinion, some severe market liquidity issues out ahead, possibly later in 2024 or early 2025. NFTRH has two targets for gold based on patterns. One is within hailing distance at 2450, and the other, 3000+, is in the offing. Likely after some bloody battles are fought along the way.

As for the dead men walking, the major US stock indexes are still bulling along. SPX, for example, a primary beneficiary of bubble policy, clings to its daily EMA 20 and by the SMA 50 (blue), its uptrend from October, 2023. All those gaps below? They’ll be addressed one day. But for now, this dead man keeps on walking because… payrolls! Because… fiscally stimulating government! Because… Fed tight, but not too tight!

I believe there is a good chance that when the stock market takes a real bear, the precious metals may also get hammered. But the breakout on the gold chart above is more than just a positive technical signal. It represents a major positive move in the making for the anti-bubble and as such, a negative one coming for traditional bubble beneficiaries.

Here is the work done so far by gold vs. the S&P 500. It’s been a hard move up within the intact daily chart downtrend. So the trend is still negative, but this is the work (a break through the downtrending SMA 200) that would need to be done to begin a narrative about a trend change (and the end of the bubble macro).

Gold is even stronger lately vs. global stocks (ex-US). The trend is neutral after a massive spike upward for the monetary metal in relation to global stocks.

These things take time, patience and perspective. But the process is moving forward toward a coming economic bust and counter-cyclical environment. That is what gold’s major breakout is signaling. We are and have been tracking the process every week in NFTRH. It’s time folks. It’s time not be thinking as most have been trained to think over the last two bubbly decades. So says the Continuum below, the work in the article above, and many other indications beyond the scope of this article.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed interim market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can also keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter ;@NFTRHgt.

By Gary Tanashian

© 2024 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.