How to Profit from the Global Warming ClImate Change Mega Death Trend - Part1

Politics / Climate Change Feb 17, 2024 - 02:50 PM GMTBy: Nadeem_Walayat

Dear Reader

Firstly I'm a climate change denier!

I deny the right of climate change to prevent me from getting richer! Large swathes of planet may become a scorched earth but I will be more than able to afford top end AC units, climate suits and indoor grown crops and meat to ensure it's impact on oneself and ones patrons proves to be limited, 10c for 10x!

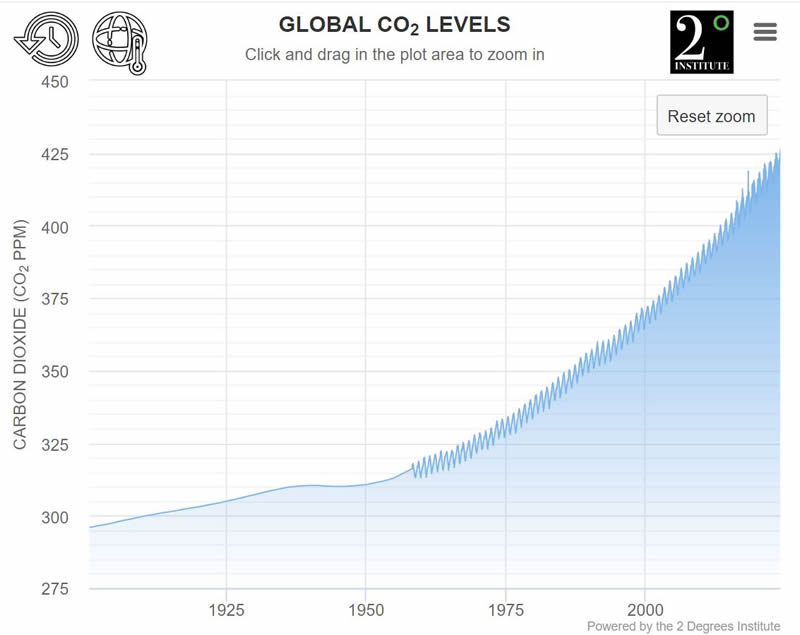

I here a lot of too and fro about the science of global warming whether it's real or not but for me it's not rocket science, in fact it's pretty simple, we humans dig carbon out of the ground that's been locked away for hundreds of millions of years and then pump it into the atmosphere as Co2 a potent green house gas, what's so hard to grasp about that?

Yes, I understand that the amount of carbon that's being pumped into the air by humans is a mere pinprick to the amount of carbon that comprises the carbon cycle. So lets keep things simple, say the carbon cycle comprises 100,000 gigatons of carbon, where roughly half of which is locked away in the oceans,and carbon in the atmospheric is just 1000 gigatons and human activity adds a minute extra 1 gigatons of carbon into the atmosphere annually resulting in an increase of a mere 0.1% more co2 as a direct consequences of human activity, so no wonder many folks who look into the numbers decide that man made climate change is a load of nonsense.

However the key point is this that the trends are made at the margins, its why stocks bull markets rise on a wall of worry because it is very easy to construct a bearish narrative, humans only needed to have a pinprick effect to send the system haywire, off seeking a new higher equilibrium and that's where we are headed..... CO2 is a signaler, pay attention to the signals and you'll be on the right side of the mega-trends. That marginal +1gt per year is all it takes to trigger a huge rise in global temperatures as well as trigger black swan events such as the release of Methane from the ocean floor or from thawing permafrost which is about X30 times as potent a green house gas as co2! And remember this trend has been in motion for over 200 years.

Global Warming - Our goose was cooked decades ago! And what we have done since is to merely pay lip service to climate change! We collectively as a species have done NOTHING to prevent what is now starting to unfold, instead the reality is the exact opposite of all that spews out of the mouths of lying politicians and the MSM (Main stream morons) Propaganda networks. Understand this WE HAVE DONE NOTHING OVER THE PAST 25 YEARS TO PREVENT GLOBAL WARMING!

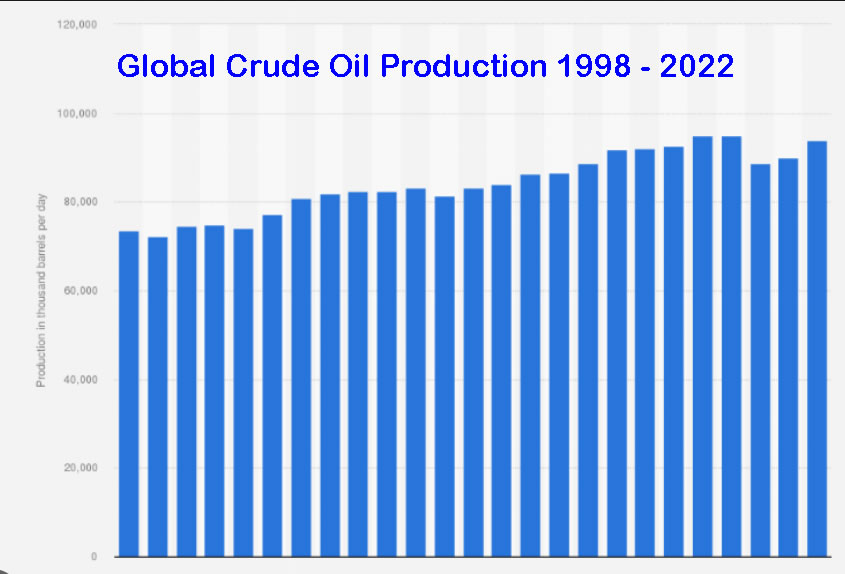

Look at the amount of barrels of oil produced per year where each barrel is pumping an addition 470kg of Co2 into the atmosphere of which a mere fraction is being captured.

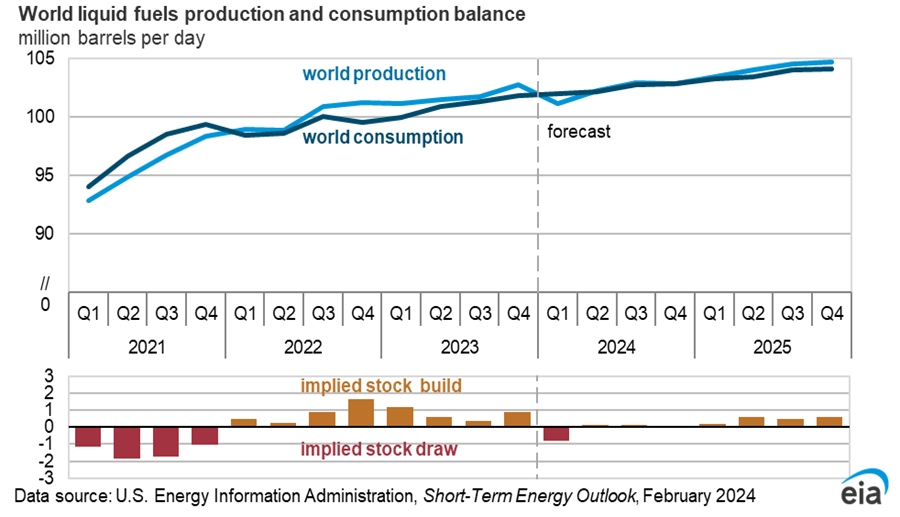

They keep saying that fossil fuels are dead, where are they dead? Back in 2000 when the world supposedly finally decided to do something about climate change global oil production was 74.5 million barrels per day, today it is 102 mbd and forecast to continue rising to over 104 mbd by the end of next year.

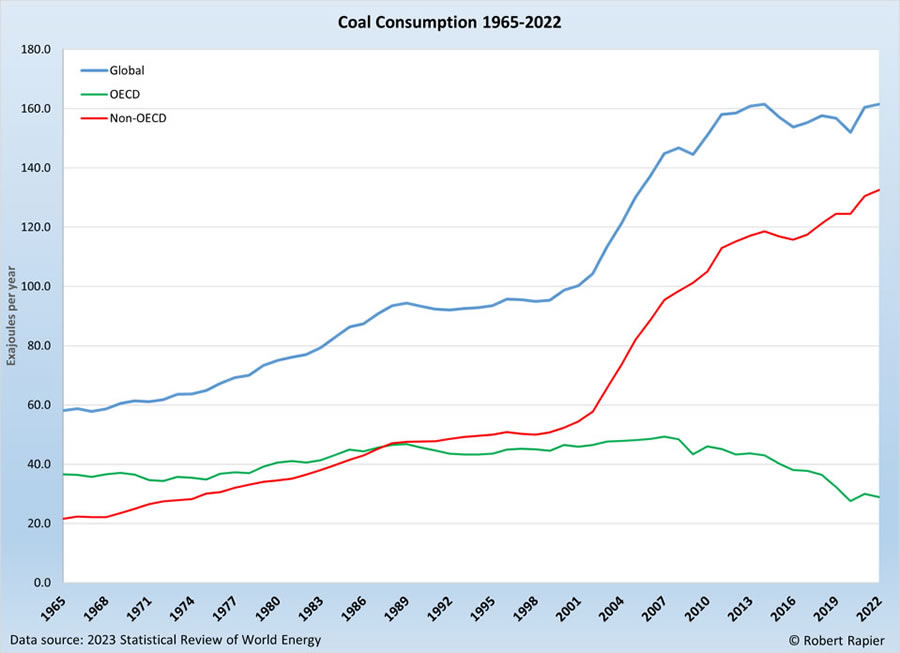

Even worse in terms of carbon emissions is COAL where all that the West has done in reducing coal consumption over the past 20 years has been more than offset by China and India. Just look at the graph! We may as well have not bothered! All that pain in western coal mining communities was for NOTHING!

In practical terms, humanity collectively has done absolutely NOTHING to cut back on carbon emissions so it's no wonder that that rate of increase in co2 in the atmosphere remains on an exponential trend trajectory. Back in 1999 the suits were aiming to cap co2 at 400 parts per million, today it is now over 425 ppm. in 25 years time it will probably be approaching 500ppm as in reality nothing will be done given that people want to have better lives, they want to eat meat every day not once a month or even once a year as used to be the case in centuries past. So we are a long way from even stabilising the system let alone reversing damage that is being done, look at the graph, what has been done since 2000 to prevent climate change? The answer is NOTHING! Instead the exact opposite has transpired!

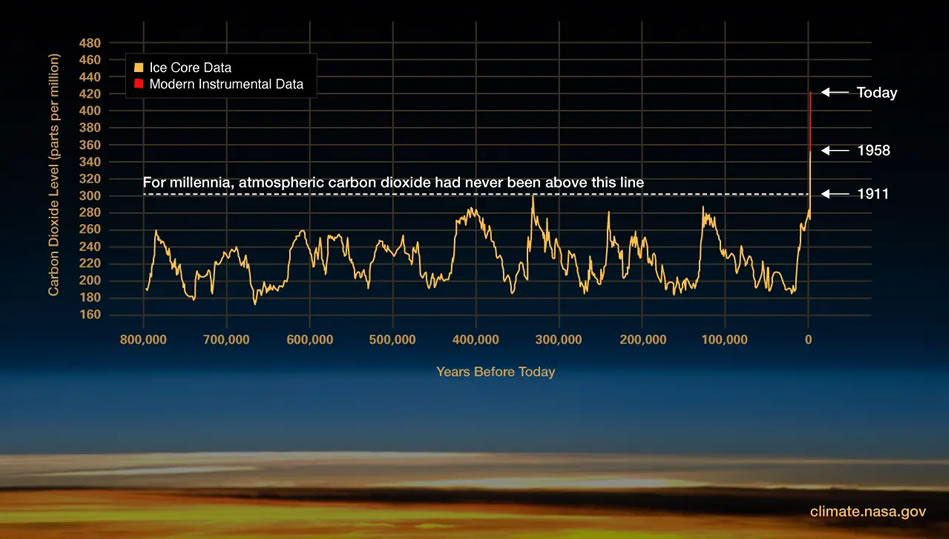

Here's what the co2 means in terms of the past 1 million years as sourced from ice core samples. We are on a rocket ship to probably a worse fate then a mass extinction!

. (Credit: Luthi, D., et al.. 2008; Etheridge, D.M., et al. 2010; Vostok ice core data/J.R. Petit et al.; NOAA Mauna Loa CO2 record.)

So how does this translate into rising temps?

This article is an excerpt from my latest in-depth analysis on how to capitalise on the Global Warming Climate Change mega-trend - How to Profit from the Global Warming ClImate Change Mega Death Trend Which was first been made available to patrons who support my So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, this is your last chance to lock it in now at $5 before it rises to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

And gain access to my exclusive to patron's only content such as the How to Really Get Rich series.

Change the Way You THINK! How to Really Get RICH - Part 1

Part 2 was HUGE! >

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

Part 3 Is Huger! And Gets the Job Done! >

Here's what you get access to for just $5 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's this month, so your last chance!

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst locked and loaded for another bull year.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.