U.S. financial market’s “Weimar phase” impact to your fiat and digital assets

Stock-Markets / HyperInflation Feb 29, 2024 - 10:02 PM GMTBy: Raymond_Matison

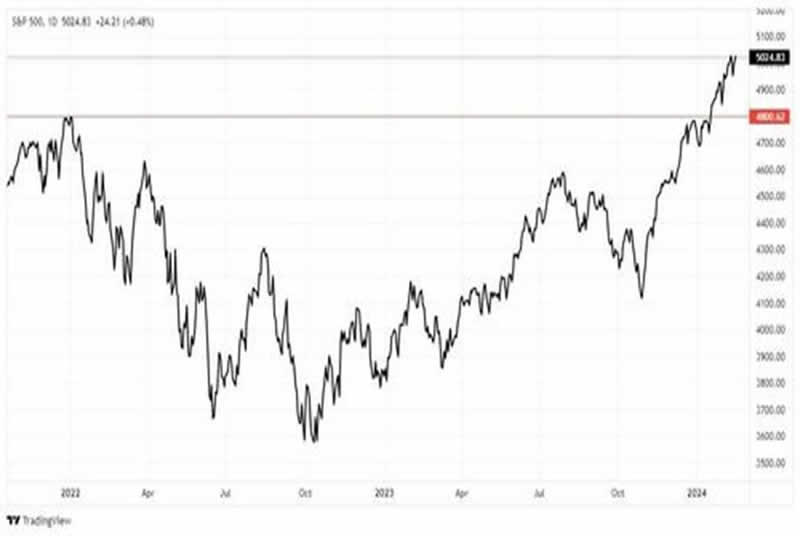

U.S. equities market was strong in 2023, and after a decline in 2022, rose by 20% last year as measured by the S&P 500 Index. In addition, that index rose above 5,000 for the first time ever in the early part of the 2024 year. Surely, it must be because our economy is strong - as key government officials including our president have assured us. Or maybe not?! You can decide for yourself as key issues are evaluated

U.S. equities market was strong in 2023, and after a decline in 2022, rose by 20% last year as measured by the S&P 500 Index. In addition, that index rose above 5,000 for the first time ever in the early part of the 2024 year. Surely, it must be because our economy is strong - as key government officials including our president have assured us. Or maybe not?! You can decide for yourself as key issues are evaluated

herein. We will compare our current equity market performance with a period 100 years ago with its implications for our future financial markets. We will look at the concept of self-custody for assets from gold to bank money deposits, to a securities stock and bond account and the custody of digital assets. We examine how America’s proxy war efforts are affecting our budget deficit, and the dire need for additional debt/money issueance promoting product price inflation, and asset inflation. We examine America’s profligate spending challenging a growing BRICS coalition promoting global de-dollarization, and its effects on our fiat currency’s value, alternative currencies and implications for adoption and value of Web 3 digital assets.

The following chart shows performance of equities as measured by the S&P 500 Index over the last two years. The 2022 year shows the frailty of our economy, while the 2023 portion demonstrates the power of our FED to move markets.

Is the incredible performance in 2023 seen on the preceding chart due to a strong economy, rapidly growing earnings, or previously depressed valuation of equity securities? Well, actually, no! Over recent years markets have simply been moved more significantly by comments from the FED Chairman regarding interest rates and QE or QT. Our stock market has been supported by our rapidly growing national debt, which enters our financial system as new fiat money and gets invested in the stock market because our economy is arguably too risky or weak for banks to lend it to businesses and industry – and therefore is channeled into financial markets. This money-creation induces a rise in prices which reflexively translates to increased revenues and earnings that in turn transforms into higher stock prices – but with little increase in actual inflation adjusted value.

Commercial real estate is in process of collapsing, credit card and student debt are at record highs as all payments are delayed and defaults rise (despite partial student loan forgiveness). Fake jobs numbers represent adjustments, as major companies have instituted major job reductions, and major office building space is alarmingly vacant. Price inflation purported to be declining, is still increasing – even if in some months it is increasing at a lower rate than in a previous month. In a recent and revealing "60 Minutes" interview, Federal Reserve Chair Jerome Powell highlighted the precarious fiscal trajectory of the United States, stating that the nation's debt is expanding at a rate outpacing its economy, and it is unsustainable! Our U.S. national debt reached a historic high of over $34 trillion in early January, escalating rapidly from the $33 trillion mark hit just three months prior. For more on our unsustainable debt see https://www.marketoracle.co.uk/Article71099.htm

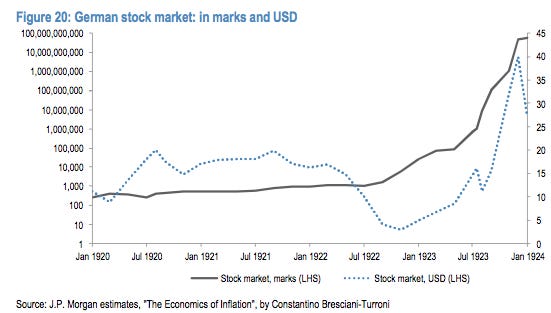

In short, we are economically and financially at the beginning of a period that is comparable to a period a century ago when Germany had printed currency to help finance its WWI war effort. More money printing was necessary when England and France, with the help of the U.S., won the war and imposed draconian war reparations payments designed to forever keep Weimar Germany from reemerging again as an industrial leader or viable global competitor. Additional debt (money printing) was necessary to restart their war-torn economy. This money printing had the effect of increasing the mark-dollar exchange rate from 4.2 marks per dollar in 1914 to 4.2 trillion marks to the dollar in 1923. For several years it also had an amazing positive effect on its stock market which defied sound economics.

Let us now review the Weimar stock performance chart from a century ago.

The preceding chart demonstrates how stock prices can rise for some time even in the face of an economic apocalypse. Note that the Y-axis of this chart is logarithmic due to the incredible level of money and price inflation – were this not so, the chart would need to be hundreds of feet long! So, the Weimar stock market rose exponentially – as investor wealth was actually being destroyed.

History is said not to repeat, but rhyme. Over the last fifty years the U.S. has amassed the largest debt of any country in the history of the world, principally related to military expenditures associated with its politically selected and initiated wars. Wars are very expensive, and the U.S. cannot repay its presently accumulated, and still rapidly accelerating debt to its lenders. One might ask, what are the global consequences of our government not being able to repay its debt? Our national debt, owned by foreign governments will be resold or repatriated to our central bank which will cause increased interest rates, rapid price inflation and decrease in its purchasing value - such that it destroys the confidence in our currency and ultimately completely destroys it. With such debasement of the USD, the value of debt owed by developing nations reduces or even evaporates.

The U.S. Treasury must refinance $8.9 trillion of existing debt this year. We will also need an additional $1.4 trillion to finance our current budget deficit. Corporations have over $100 billion coming due over the next year which will also need to be refinanced – if the companies involved are able to accommodate such refinancing at the now higher interest rates. Certainly, our government will find it ever more challenging just to service the interest on this debt, creating an ugly non-virtuous cycle. Increasingly, as foreign countries are willing to hold less US debt, it is our U.S. banks and Social Security System that have to buy or hold it – but Social Security’s cash flow no longer allows it to buy additional debt. Since our national debt cannot, under any circumstances, be repaid – the nation’s citizens will suffer from this financial Armageddon manifested by many bank failures and dramatic Social Security payments reductions together with general bank credit collapse.

Since central banks employ hundreds, if not thousands of America’s smartest economist PhD’s, the FED surely understands, the consequences of their present continuing rapidly expansionary monetary policies. It results in the ultimate destruction in the value of our currency, and therefore people’s total fiat savings. The original 1913 fiat dollar has already lost 99% of its value, as confirmed by the fact that a one-ounce dollar gold coin, then valued at $20 now costs over $2100 of paper currency. There is little merit in castigating our government agencies for lying to its citizens – for were they to tell the truth, they would be blamed for starting a riot.

Another recent narrative from FED Chairman Mr. Powell proposes that he would like to have price inflation temporarily rise above 2%. Price inflation means that consumer prices will rise, yet money inflation means the purchasing value of the currency declines. The FED claims that it is trying to stimulate our economy, in order to accelerate economic growth. However, such goals are clearly incompatible, deceitful and contain a huge lie! After all, less purchasing power of a currency, and higher prices cannot possibly stimulate an economy! Technology-driven lower prices and increasing purchasing power of one’s money naturally allows a consumer to stimulate an economy. So, the question is, what have been the real goals of the FED over the last century?

Senator Rand Paul in a February filibuster delivered in Congress said that he “cares about the bankrupting of our country”. He sees it and would like it to stop, but politicians both democrats and republicans just keep spending money that we don’t have, money that has to be borrowed. Should we not do something to stop the destruction of our own currency? In response, Congress approved and is sending $90 billion to Ukraine for its our continuing proxy war effort to maintain our hegemony over Europe, and weaken Russia to it keep from becoming a viable challenger to us. Tucker Carlson’s recent famous interview of Russian president Putin captures this situation perfectly when he says “you are killing your currency with your own hand”.

Our stock market has been defying economic reality now for several years. But despite that, be mindful that this stock market could still rise further from a continuing decline in the value of our fiat currency. All of this rhymes with historic events experienced in the Weimar republic. Because America is not a physically invaded or a war-devastated country, we are unlikely to experience the mind-blowing hyperinflation of Weimar Germany, and any reduction in the value of the dollar may take longer to take place.

But wait, we do have an invasion taking place on our Southern border, and it has been going on for over forty years. We have been invaded by over thirty million people, mostly men of military age. But our cities have not been destroyed; oh wait, some of our most beautiful and largest and important cities have experienced burning, violence, and mayhem, to the extent that there are now thousands of “refugees” who have fled these cities for their own safety to another state. In major wars the belligerents will print fake money as a means to destroy their enemy’s currency thereby undermining their ability to finance/wage war – well, at least that has not happened. Oh wait, there seems to be a race between over one hundred nations trying to eliminate the dollar as a global centralized trade currency, and our own central bank printing money with abandon such that international concerns are being raised about the value of our dollar. But at least our form of republican government has not been taken over. But wait, it seems that local, state and our federal government is not executing the will of its people, but imposing rules and regulations that erode guaranteed freedoms in our constitution, including the right of people to speak freely, maintain their privacy, practice their religion, and criticize its government.

Civilian Asset Custody Dilemma

When gold was commonly used as money, citizens were responsible to safeguard or custody their own savings and wealth. As banks saw opportunities to earn higher earnings from providing more services to increasingly more prosperous clients, bank custody services expanded. When a veritable gold hoard was piled up in the banks, our government, in collusion with the privately owned controlling banks of the FED, issued convenient paper money called gold and silver certificates, which initially could be exchanged back into precious metal coins at banks.

Excessive printing of paper money in the U.S. started initially to finance WWI (at the time our Federal Reserve System was founded) and continued in the 1920s, supported by low interest rates which fostered great market speculation and a persistent rise in equity valuation. In order to curb the expansion of credit and market speculation, the FED rose interest rates in early 1928. But in order to continue to provide support for Britain’s economy, and prevent their loss of gold, our FED in late 1928 caused interest rates to once more decline, which caused the stock market to explode upwards, which after peaking resulted in a rapid and substantial decline resulting in America being faced with a long and virulent depression. In an attempt to recapitalize the banking industry it had revalue gold, and therefore, our government simply outlawed public ownership and seized their citizen’s gold, and then raised its price.

In 1971, when President Nixon announced the closing of the Federal Reserve’s window for gold exchange to foreign nations, the U.S. defaulted on its gold-backed currency convention, and gold was seized to the exclusive ownership of the U.S. Treasury. So, the lesson for individuals and foreign countries was clear - if you don’t custody your gold assets you eventually will lose them. That is, “if you don’t own your keys” to your gold safety deposit box, “you don’t own the asset.”

People have always thought that fiat money they deposit in a bank is their asset; but over decades banking laws have changed, and clarified this misconception. When you deposit cash into a bank, it becomes a junior liability of the bank, which in case of its default is required by law to first repay all the more senior liabilities, and in case your deposits may also be used to recapitalize the bank, it may leave you without any returnable funds. Government bank insurance funds are insufficient to cover significant failures – which are coming. So, is your money safe in any bank? Who is the custodian of your cash, you or a bank?

When this author/analyst was a stock broker in the 1970s, long term buyers of stock were issued physical and identifiable stock certificates, who could then self-custody as proof of their asset ownership. Today in a move resembling the transition of gold assets becoming custodied by banks, physical stock certificates seem to be a thing of the past. Today your monthly statement shows the ownership of your certificates, but the certificates are custodied by the securities firm or by its custodian firm, leaving you at risk.

Author David Rogers Webb, has recently published a book online entitled “The Great Taking” which suggests that financial assets including stocks and bonds – which today are held by a custodian firm are at risk to the real asset holder. Considering the huge portfolio losses of all banks holding “the safest asset in the world” – Treasury securities, and the unrealized losses stemming from a huge rise in interest rates driven by the Federal Reserve Bank over the last two years - all banks are affected if not debilitated.

Due to low interest rates credited to bank deposit accounts, bank depositors have already withdrawn $1 trillion from banks and moved them to money market accounts which when invested in U.S. treasury securities yields substantially more income. It now only requires for depositors to continue to rapidly withdraw funds from their banks to start a bank run becoming a stampede on the banks which will make the 1930s bank closures and depression look tame.

In these previous examples we have shown that giving up self-custody of your assets, allowing a single or several large custodians to hold your assets has historically proven to be very risky, as citizens trusting large centralized organizations time and again have lost a large portion of their assets. The larger issue to understand is that custodianship is a form of centralization, and centralization has proven not to be safe. Centralization of anything, be that money or political power is corruptive and subject to manipulation and eventual failure.

BRICS acceleration of fiat currency demise

In 2023, when the BRICS nations approved applications of six countries desiring to become members, it thereby brought in major energy resource and agricultural goods producers. It is no longer fresh news to note that the GDP of this now expanded group exceeds that of the powerful G7 countries. In addition, at present there are over thirty-five additional countries which are eager to join the BRICS coalition. Also, Operation Sandman, a group comprised of over one hundred countries are eager to jointly dethrone the U.S. dollar as a global reserve currency. If BRICS and other countries are dropping the dollar on trade, these countries will also not be buying U.S. debt, constraining its debt issuance and steeply raising borrowing costs.

One can only speculate as to what U.S. historical geopolitical policies or financial practices by the World Bank or IMF over the last fifty years have prompted these countries to join such a coalition and disavow the formerly esteemed United States. One may presume that unilateral regime changes, active military forays or engagements by the U.S. to maintain global hegemony, and strident monetary lending policies have been contributors. In addition, it may have been the liberal use of sanctions and their extra-territorial applications, including the weaponization of America’s global reserve currency leading to the seizure of about $300 billion of Russia’s assets that bought into focus for the rest of the world, that displeasing the United States with ill-advised political choices or any stated opposition could expose them to become victims to America’s displeasure and financial ruin.

It was over two decades ago when President Bush responding to the 9/11/2002 attack on Manhattan’s World Trade Center called out to the world to be identified as “you are either with us, or against us”. It was an extremely successful media event, but it has become a dangerous and visible failure as geo-political policy. It left no room for a country being neutral, uncommitted, or even dis-interested.

When the official war started in Ukraine in 2022, the U.S. was eager in getting countries to condemn Russia as an unprovoked aggressor. When Pakistan’s president Imran Khan persistently chose to stay neutral, the country was soon faced with a regime change, as its president was jailed on trumped up corruption charges. Two decades after President Bush’s ultimatum, the global answer appears to be in as the world is being split between the U.K., U.S. and its “allies”, and BRICS together with 100 other countries who declare their desire to end the global dollar and English-speaking nations’ hegemony.

It is well to recall that America fought bravely against Communism in the last century, with countries it calls its allies. But eighty years later with our military bases still in these countries, and fear mongering over military aggression endangering Europe, and the destruction of cheap energy supplies which are now deindustrializing these allies, this arrangement is now starting to appear more as a permanent conquest of its allies. One can anticipate that the deception of England’s and America’s divide and rule policies in the Middle East, Europe, and elsewhere may soon be over.

A declining or failing dollar will result in a significant decline in U.S. global influence – perhaps in part, because it will require America closing many of its military outposts around the world. Similar to the way the Bretton Woods conference in 1944 reduced the influence of Britain as a world hegemon, the BRICS movement to de-dollarize trade is reducing the influence of America as the current world hegemon. It is already visible that instead of one global leader there will be a coalition many countries, sharing the new world order crown. For more information on BRICS see https://www.marketoracle.co.uk/Article70911.html

The world’s old outdated and crumbling traditional financial system which uses centralized debt- based currency and fractional reserve banking is failing, and is being replaced by a modern blockchain driven asset based immediate payment settlement architecture which disintermediates banks and the monopoly of government issued currency.

New financial market’s investment considerations

It has been more than three decades since people have been able to send emails to each other efficiently, quickly, and without direct cost. We have been able to search the global web and locate obscure information in seconds. All of this derives from the benefits of what is called Web2, the internet of information. This internet, contrary to the expectations of its accredited founder, Tim Berners-Lee, instead of being decentralized soon became controlled by a small group of gigantic companies such as Microsoft, Amazon and Google.

In his genial book, “Life After Google” (published in 2018), author George Gilder notes, “Google digitized nearly all of the available books in the world (2005), the entire tapestry of the world’s languages and translations (2010), the topography of the planet (Google Maps and Google Earth, 2007), down to the surface and structures on individual streets (Street View) and their traffic (Waze, 2016). It digitized even the physiognomies of the world’s faces and its digital facial recognition software (2006, now upgraded massively and part of Google Photos). With the capture of TouTube in 2006, Google commanded an explosively digital rendition of much of the world’s imagery, music, and talk.” Google founders’ daring to imagine projects of such magnitude, and ability to accomplish them even today seems incredible – but it explains the reason for their great power and success.

Mr. Gilder understood the premise of Google’s success in providing its service to customers seemingly for free, which used their search histories to promote merchandise. Google succeeded in building massive storage facilities, promoted big data, cloud computing, artificial intelligence, and other technological advances. Yet given the title of Mr. Gilder’s book, he believes that the arrival of Web3 - the internet of value – which with the use of blockchain technology, allowing the permissionless transfer of value between individuals will require improved security, and decentralization, that necessarily will ultimately free its customers from these Web2 walled garden corporations of centralized control.

Web3 infrastructure allows individuals to earn, purchase and own digital assets. Unlike in the Web2 internet, individuals using and supporting the platform were only users rather than owners of their contribution to Web2. Hence their adoption of these platforms enhanced profits for the big data firms, but denied any profits to the adopters. It is well to remember that any analysis or information submitted to the internet became property of your web provider. In Web3, the adopters, by simply owning some digital assets will also profit from the coming global mass adoption of this new technology that will also drive token prices.

Blockchain technology is making it possible to tokenize assets such as stocks, bonds, real estate, while also issuing tokens representing digitized money. An ability to send value directly from person to person, business to business without a permissioned banking intermediary makes banking enterprises partially redundant. Similarly, tokenization of financial assets and decentralized exchanges will seriously disintermediate Wall Street firms. Therefore, there is a dramatic race going on for the world financial control of the future, which explains the SEC’s attempt to kill of the digital asset industry, delay clear regulations, and coopt Bitcoin by issuing futures which were used to control price, and ETFs which shift ownership and custody of this digital asset from the individual to centralized custody and control. Regulation and licensing, arguably a process to protect the unwary from unsafe products and practices, is being crafted by government such that it is also a method to obtain and enforce control and monopoly. It is always worthwhile to remember, while this battle is going on, the sage advice related to digital assets: “not your (cryptographic) keys, not your assets”.

In this furtive race is a central bank seeking to issue centralized CBDCs (Central Bank Digital Currency), which would forever and irrevocably control citizens through its programable money - and the opposition which uses individual custody of tokenized assets, secured on a blockchain which can be used privately in a permissionless manner, and without need of an intermediary, or risk of government confiscation. The central bank will do what their large owner commercial banks (owners of the central bank) want, therefore, stablecoin issues are more probable than CBDCs, unless the large banks actually desire to destroy the multitude of medium and smaller sized banks. For reference, such destruction did happen once before in the 1930s, when depositors lost all their cash from the permanently closed banks and selectively reopened banks, while scandalously the debts of the permanently closed were not cancelled.

Stablecoins, can be the on and off ramps to digital currencies because they are tokens on the internet, and can be used to move money or value across borders which otherwise can be/are restricted by individual nation’s capital controls or sanctions. Such cross-border transfers, which settle within a few seconds, eliminates a need for, or could become a substitute for, a global reserve currency.

The FED’s accelerated printing of fiat money, and practical elimination of interest rates during the 2020-2022 period, and creation of bubble markets, now requires the adoption of substantially different rules for prudent investing and capital preservation than those which existed previously. For example, an increasing number of money managers and hedge funds are adding gold to their portfolios. In addition, some investment hedge fund managers are now also allocating funds to cryptocurrencies such as Bitcoin.

Market pundits are now recommending that investors diversify their investments by including a 1-2% allocation to a legally approved Bitcoin ETF. Some analysts and promoters are suggesting that Bitcoin could rise to more than $200,000 per coin within two years, and over $1 million by 2030. How reasonable or likely is such a meteoric rise? Understand that such target prices can be achieved either from an increase in the value of BTC, driven by the imbalance of supply/demand coming from an avalanche of global adoption to digital assets, or a decline in the value of our dollar, or both. To reach a $200,000 price for BTC (currently, say priced at about $50,000) would require only that the USD loses another ¾ of its value in the next two years. In order to reach a $2 million target, it would require the USD lose 95% of its value in six years. You can decide if such dynamics, reflecting both global adoption of crypto and BRICS and Operation Sandman intentions, makes it is reasonable or possible.

Consider in physics the second law of thermodynamics, called entropy, which states that a closed system will tend to disorder – which, if applicable and extended to a system such as finance, provides expectations that the whole financial construct of a fractional reserve system of debt-based fiat money will ultimately be destroyed (decentralized) as it tends to ever greater disorder destroying with it global financial colonialization and debt peonage. Currency and financial markets are to decline in value, while digital asset values will rise. Indeed, if this concept can be applied to other systems – such as governance – humanity can remain hopeful that the present forces which include globalist organizations, fascism, and all the other “isms” seeking complete control over mankind will similarly ultimately become decentralized, resulting in the sovereignty of civilizations, countries, and individuals, broadening freedom and elevate humankind. Unfortunately, to arrive at this better state we must first survive the transition from our current economic state of affairs – beyond that, our future is bright.

Raymond Matison

Mr. Matison was an Institutional Investor magazine top ten financial analyst of the insurance industry, founded Kidder Peabody’s investment banking activities in the insurance industry, and was a Director, Investment Banking in Merrill Lynch Capital Markets. He can be e-mailed at rmatison@msn.com

Copyright © 2024 Raymond Matison - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.