Rebuild Me a Financial Crisis, One Dollar at a Time

Stock-Markets / Financial Markets 2013 Jan 14, 2013 - 12:35 PM GMTBy: Brady_Willett

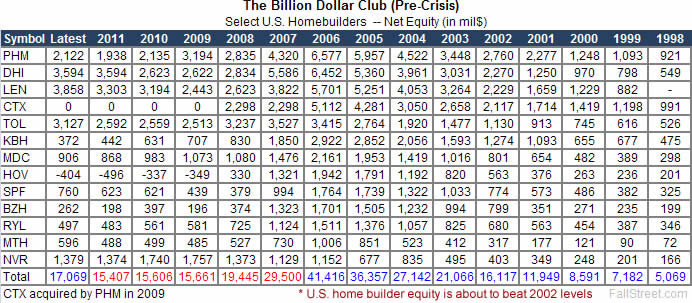

For the first time since 2007 the book value of the largest U.S. home builders is set to post an annual increase. This suggests that after a lost decade*, the worst is finally over.

For the first time since 2007 the book value of the largest U.S. home builders is set to post an annual increase. This suggests that after a lost decade*, the worst is finally over.

Unfortunately, with the Federal Reserve actively suppressing interest rates and purchasing MBS and the U.S. government now in year four of $1 trillion+ deficits, potentially unstable footings have provided the framework for the recovery in U.S. housing market. For that matter, with home builders having grown their outstanding share count from approximately 1.2 billion shares in 2007 to more than 1.6 billion today, the sad reality is that there has been no book value increase on a per share basis. Put another way, a 142% increase is required for the above U.S. home builders to reach 2006 book value levels, but a 218% increase would be needed to do so on a per share basis (using an unfathomable 10% perpetual annual growth rate, U.S. homebuilders are 19-years away from matching the book value levels seen in 2006).

A distant cousin to 'kick the can down the road', the influx of cash generated from a successful stock dilution does not increase shareholder value. Rather, other things being equal the net benefit to shareholders from dilution, on a per share basis, is always nil. In a similar spirit, money out of thin air and/or running massive fiscal deficits does not increase economic output or jobs per se (Granted, more money and cheap debt can rouse phantasms of economic vigor over the near-term, but there is no precedent of a printing press or government debt issuance producing lasting economic benefit). In fact, grand printing schemes have historically, without exception, always failed miserably, and government debt accumulation has a tendency to produce slower growth relative to less indebted countries (See Reinhart and Rogoff).

All this said, the beguiling questions churning into focus today are as follows: what if money printing and excessive government borrowing no longer have a negative impact on exchange rates and government interest rates? What if a new paradigm of infinite fiat has somehow cured the tribulations that have accompanied government debt explosions in the past? Confused? Welcome to the outrageous contradiction that is 2013...

After The Booms and Busts, Rebuilding A Bubble

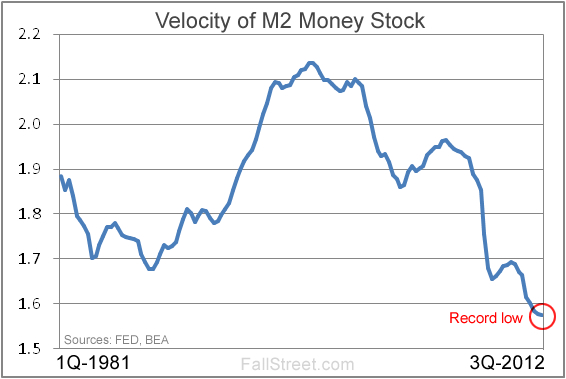

At the end of 1980 the Fed's M2 reading was just over $1.6 trillion. When compared to U.S. nominal GDP of $3 trillion this meant that for every dollar (in this measure of the money supply) there was $1.88 in economic output. At or near record lows leading into 2013, it is clear that new dollars are having a diminishing effect on the economy, or that the Fed, as it prints, is diluting the dollars already in cicrulation.

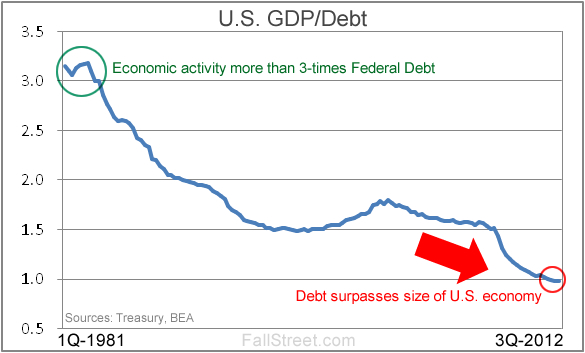

Not to be outdone, the U.S. government has done its best to dilute the amount of economic output represented by each outstanding dollar of debt. In 1980 for every dollar in economic output (nominal) there was 31 cents in debt while today there is more Federal debt than there is economic output (and don't even get us started on unfunded liabilities). Commonly observed as 'debt/GDP', a different twist here is GDP/Debt.

If an individual continually earned less with every new dollar borrowed they would quickly go bankrupt. This is not the case with the U.S. government. Over the last 112 years the U.S. government has run annual deficits 72% of the time and since 1980 deficits have occurred 88% of time. That the U.S. government has only managed to log 4 surpluses since 1980 and the baby boomer generation is just starting to place serious pressure on Social Security and Medicare does not bode well for the fiscal future of the United States.

If left unchecked the above trends alone are enough to worry that either a U.S. dollar and/or sovereign crisis is around the corner.

Why Bother Turning The Corner?

With the conclusion that fiscal and monetary machinations are past the point of the return - or that the Keynesians will not suddenly find a new religion - the only question regarding the brewing sovereign/currency crisis(es) is when. Here the crystal ball turns murky. After all, the Federal Reserve has been awarded a temporary reprieve from traditional monetary constraints thanks to two interrelated themes.

#1 The Competition Stinks

In 2007 reports of the dollar's reserve currency demise were ripe as the Euro gained traction in central bank coffers. Today there are mainstream analysts forecasting the death of the Euro. These and other tails readily tell us that there is currently no serious challenge to the U.S. dollar! Moreover, the two greatest contenders - the Euro and Yen - are faced with problems far more serious and immediate than those aligned against the dollar. Thus, thanks to the sheer size of its markets and its relatively attractive fundamentals, the dollar is not so much the cleanest dirty shirt, but, at times, the only shirt large swaths of capital can wear.

#2 Fear of Breaking The Norm

Be it dreams of a gold dinar and pricing oil in Euros, or harsh words from countries like Brazil and Russia, a bevy of anti-dollar sentiments have taken shape in recent years. However, beyond central banks slowly pecking away at gold, not much has really changed: The vast majority of central banks carry more dollars than any other currency, the vast majority of institutional money prefers to run in the Treasury market, and key countries like China are loath to stop using the dollar and/or purchasing Treasuries due to the negative shock that doing so would wrought on their economies. With so many actors terrified of rocking the boat, grotesque debt is permitted to grow unfettered thanks to the nearly universal conclusion that ending USD hegemony now would cause a global crisis of unthinkable proportions.

In short, each new dollar and Treasury issue fortify the speculation that the day of reckoning is drawing near, even as pinpointing potential crisis' catalysts remain elusive.

Another Year Of Crooked Door Frames

Japan recently adopted the Fed's anti-inflation/print-forever slant and the ECB came around to the idea of 'unlimited' printing last year. This lends to the speculation that a major policy turnaround is no longer an option (i.e. I'll print and buy your debt if you print and buy mine...forever). Tyrannical central bankers now stand ready to print money to combat any major systemic hazard, the threat (real or not) of deflation, falling asset prices, high unemployment, undesirable exchange rates, etc. Whatever the problem, someplace in the world more fiat money is contended the answer.

Under this canopy of growing central bank control sits both great optimism and grave uncertainty. To be sure, on the one hand certain asset prices simply cannot move in an undesirable direction for very long unless a currency moves in an undesirable direction first. For example, U.S. interest rates are not going to spike dramatically higher so long as the U.S. dollar doesn't move dramatically lower. This correlation and caging of market expectations allows central bankers to (unofficially of course) efficiently pull on the strings of the global financial markets.

But below the surface sits the ominous prospect of uncontrollable inflation or money printing itself being recognized as the main problem. Quite frankly, there is the budding notion, even if years early, that if the next major crisis arrives before the Fed can raise interest rates and/or purge its balance sheet of some toxicity, USD hegemony will be no more. Already temporarily monetizing U.S. debt, once the Fed adopts a more permanent plan to purchase Treasuries in an attempt to keep interest rates low the dollar will enter its end game.

A Bond Bubble or USD Bust?

Some ignore the crucial importance of USD hegemony and attempt to focus instead on the coming U.S., Japan, or Euro debt collapse. These individuals would do well to remember that, despite all the bluster, the threat of a traditional default in America is nonexistent given that all U.S. debt is denominated in U.S. dollars.

Yes, it is with this point that contradiction and confusion take root. After all, wouldn't the rest of world be upset if the U.S. simply monetized a debt load it could no longer pay back? Wouldn't this be deeply unfair and put at risk the U.S.'s ability to play in global financial markets? Yes, it certainly would. And?...

Suffice to say, the easy-money, non-regulatory 'edifice' Greenspan mentioned when he admitted his entire tenure was an experiment gone wrong, is not only alive and well, it is running amuck. As sovereign default/restructure realities begin to boil to the surface, flashes of austerity will not be capable of blunting the fact that policy makers have based their reconstruction efforts on three tenets: borrow, print, and pray. And as these three tenets are challenged, the 40-year old fiat currency experiment will meet its demise...

Conclusions

It is not uncommon for CEOs and CFOs to mention positive balance sheet trends while completely ignoring their share count. It is up to the investor to discover if dilution is being used to lower debt/equity readings. It is also not uncommon for central bankers to extol the wonders their printin presses have unfurled (i.e. Mr. Bernanke has heralded his actions as being stock market and home price positive). But tell a central banker his policies caused a market bubble and they will protest until the end. The point is not that stock dilution and quantitative easing are inherently bad, only that each, in its own way, changes the way investors must view the world.

Just because there is no imminent threat to USD superiority today doesn't mean one cannot arise without much warning tomorrow. After all, currency crisis' have a funny way of not being on the radar screen one day and a loaf bread costs a wheelbarrow of money the next. How successful and quickly China can internationalize the renminbi is the theme worth monitoring on this point, as is the future actions of Bernanke or his successor.

2013, not unlike most years since 2000, is all about hedging your portfolio against the ongoing fiat-mania (gold and silver will suffice), and purchasing undervalued equities lest you portfolio be smothered by inflation (in this year's Wish List we added 3-individual non-U.S. companies). The only notable exception to this outlook may be that after rising in each of the last 12-years gold could be set to take an annual breather one year soon. As central bankers and politicians will become profoundly aware of in the future, nothing lasts forever.

By Brady Willett

FallStreet.com

FallStreet.com was launched in January of 2000 with the mandate of providing an alternative opinion on the U.S. equity markets. In the context of an uncritical herd euphoria that characterizes the mainstream media, Fallstreet strives to provide investors with the information they need to make informed investment decisions. To that end, we provide a clearinghouse for bearish and value-oriented investment information, independent research, and an investment newsletter containing specific company selections.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.