Fed Crashes Financial Markets to Defend Against U.S. Dollar Collapse

Stock-Markets / Financial Markets 2013 Jun 22, 2013 - 03:52 PM GMTBy: Joseph_Russo

Let’s face the music people.

Let’s face the music people.

In a corrupt system, which imposes by force, unjust and unconstitutional laws, where a digital account entry creates monopoly-imposed legal tender out of thin air, it’s clear why global markets turn to the US dollar for safety.

Anyone with half a brain realizes the enormity of such insanity, but such is the corrupt reality imposed by our treasonous elite slave owners.

The control and monopoly of money creation is the most powerful weapon in the world.

Those harboring such power will use it as a weapon of mass destruction at worst, or as a tool of total control and enslavement at best. Such an ultimate monopoly inherently and inevitably engenders absolute corruption with reckless abandon and breakneck speed.

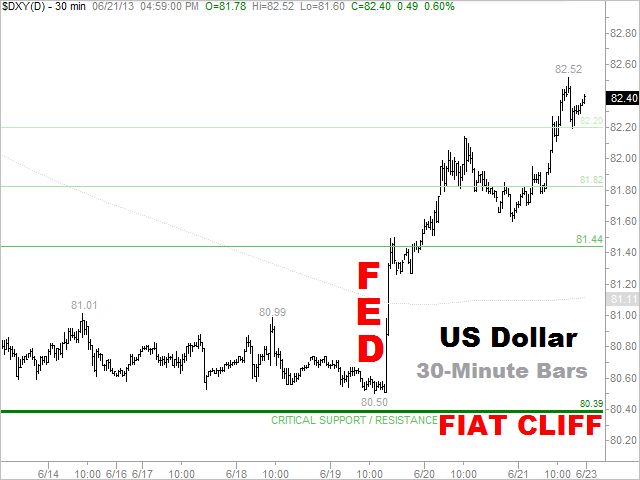

For years we have been monitoring the 80.00 level as a critical line in the sand, which in our view, defines the proverbial fiat cliff. In short, if the powers-that-be cannot defend the 80.00 level, they risk losing their greatest monopoly on full-spectrum power and control.

Just prior to the recent FOMC meeting, the dollar was falling sharply from its last pivot high, and was threatening an encounter with testing the 80.00 level, that ever-important line in the sand.

I don’t know, say for the sake of “national security,” which would more aptly be rephrased in most instances as “monopoly control,” just say that the dollar needed emergency rescuing from the existential threat of crashing decisively beneath the 80.00 handle.

What might those holding the control levers decide it necessary to engineer at any cost? A deceptive and ill-conceived flight to safety toward the US fiat currency would be my first guess.

Given the gargantuan monopoly power and concerted control capabilities rendered over the whole of the financial markets, engineering a crash in equities, metals, and bond prices leaves every enslaved participant with nowhere to run for safety but to the dirty hands of the imposed fiat dollar.

In a world of law, truth, and justice, anyone with the slightest level of survival instinct would turn to gold and silver as the ultimate safe haven.

Sadly, we do not live in such a world. We live in a world of fiction where legions of good-hearted people have allowed compartmentalized puppet masters to deceive them to such a degree, that most remain completely oblivious.

Likely, because of what has gone on behind closed doors in meetings of the all-powerful, above-the-law slave masters, we must realize there is an abundance of shocks waiting in destiny’s queue that will affect everyone’s immediate and longer-term future.

As such, if you have yet to do so, there is no time like the present to take essential precautions.

10 Things you can do right now to buffer inevitable shocks of all shapes and sizes:

- Get out of debt (100% debt free is the ultimate goal)

- Covet and protect your cash flows

- Maintain physical cash on hand (6-12 months of living expenses)

- Maintain physical possession of Gold and Silver (re-balance annually at 15% of net worth)

- Maintain a 3-12 month supply of non-perishable food reserves and water

- Protect your stock investments from broker bankruptcy & theft

- Learn about the safe use of firearms for personal security

- Hedge all bets using separate brokerages accounts that enable true strategic diversification

- Use timeframe specific strategies to manage like accounts

- Maintain prudent unbiased disciplines in executing and managing your strategic plans

Additional Resources:

For the average long-term investor self-directing exposure to the S&P 500, Gold, and Silver, the Guardian Revere Trend Monitor is an excellent long-term market timing and alert-service with an outstanding record of accomplishment in keeping its members on the right side of long-term trends.For active traders and investors, the Chart Cast Pilot takes it up several notches in sharing its programmed trades across all three time-frames in the major indices and among a basket of the most widely held stocks.

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2011 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.